Question

Lilys savings habits are far from perfect. She does not pay herself first and very rarely puts money into her savings account. Currently, she has

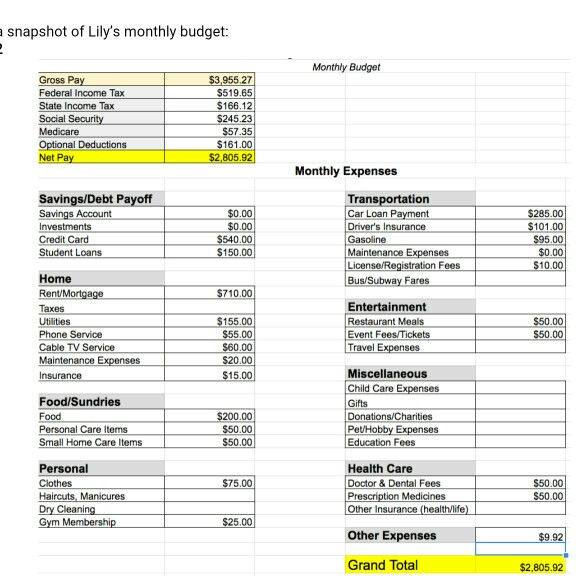

Lilys savings habits are far from perfect. She does not pay herself first and very rarely puts money into her savings account. Currently, she has $79.54 in her account. She lives paycheck to paycheck. Because her salary is lower than she expected, she tries to manage her money each month by keeping a budget.

Here is a snapshot of Lilys monthly budget: Exhibit 2

Answer This: 4. In what areas of Lilys budget do you think she is overspending? Explain.

5. Is there any category that is left out of Lilys budget that should be included?

Lily decides to visit a local Payday Lender, and they were happy to give her a two-week loan. The Payday Lender is requesting the following information from Lily: a paycheck stub, her next paycheck date, and a current bank statement. She was told that the total fee to borrow the $500.00 would only be $75.00, so she would owe $575.00 on her next payday (this lender charges $15.00 for every $100.00 borrowed). All she would have to do is sign some paperwork and bring a post-dated check for her paycheck date to cover the cost of the loan and fee.

Answer This: 7. What would be the financial impact of Lily taking out this Payday Loan? How do borrowers get trapped in an inescapable cycle of borrowing money when using this type of loan?

snapshot of Lily's monthly budget: Monthly Budget Gross Pay Federal Income Tax State Income Tax Social Security Medicare Optional Deductions Net Pay $3,955.27 $519.65 $166.12 $245.23 $57.35 $161.00 $2,805.92 Monthly Expenses Savings/Debt Payoff Savings Account Investments Credit Card Student Loans $0.00 $0.00 $540.00 $150.00 Transportation Car Loan Payment Driver's Insurance Gasoline Maintenance Expenses License/Registration Fees Bus/Subway Fares $285.00 $101.00 $95.00 $0.00 $10.00 $710.00 Home Rent/Mortgage Taxes Utilities Phone Service Cable TV Service Maintenance Expenses Insurance Entertainment Restaurant Meals Event Fees/Tickets Travel Expenses $155.00 $55.00 $60.00 $20.00 $15.00 $50.00 $50.00 Food/Sundries Food Personal Care Items Small Home Care Items Miscellaneous Child Care Expenses Gifts Donations/Charities Pet Hobby Expenses Education Fees $200.00 $50.00 $50.00 $75.00 Personal Clothes Haircuts, Manicures Dry Cleaning Gym Membership $50.00 $50.00 Health Care Doctor & Dental Fees Prescription Medicines Other Insurance (healthlife) Other Expenses $25.00 $9.92 Grand Total $2,805.92 snapshot of Lily's monthly budget: Monthly Budget Gross Pay Federal Income Tax State Income Tax Social Security Medicare Optional Deductions Net Pay $3,955.27 $519.65 $166.12 $245.23 $57.35 $161.00 $2,805.92 Monthly Expenses Savings/Debt Payoff Savings Account Investments Credit Card Student Loans $0.00 $0.00 $540.00 $150.00 Transportation Car Loan Payment Driver's Insurance Gasoline Maintenance Expenses License/Registration Fees Bus/Subway Fares $285.00 $101.00 $95.00 $0.00 $10.00 $710.00 Home Rent/Mortgage Taxes Utilities Phone Service Cable TV Service Maintenance Expenses Insurance Entertainment Restaurant Meals Event Fees/Tickets Travel Expenses $155.00 $55.00 $60.00 $20.00 $15.00 $50.00 $50.00 Food/Sundries Food Personal Care Items Small Home Care Items Miscellaneous Child Care Expenses Gifts Donations/Charities Pet Hobby Expenses Education Fees $200.00 $50.00 $50.00 $75.00 Personal Clothes Haircuts, Manicures Dry Cleaning Gym Membership $50.00 $50.00 Health Care Doctor & Dental Fees Prescription Medicines Other Insurance (healthlife) Other Expenses $25.00 $9.92 Grand Total $2,805.92Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started