Answered step by step

Verified Expert Solution

Question

1 Approved Answer

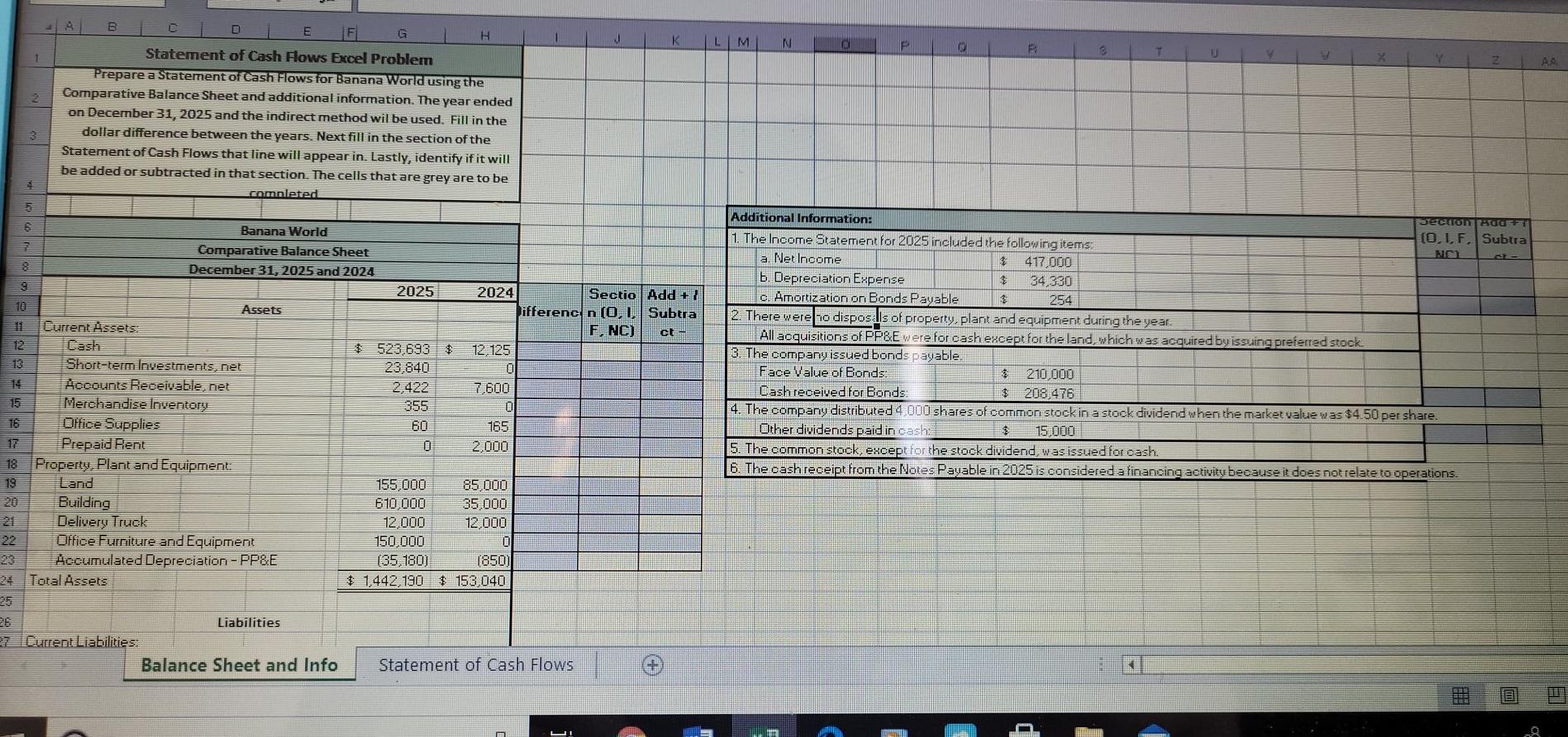

LIM N 0 F T 1 2 BCT E G H Statement of Cash Flows Excel Problem Prepare a Statement of Cash Flows for Banana

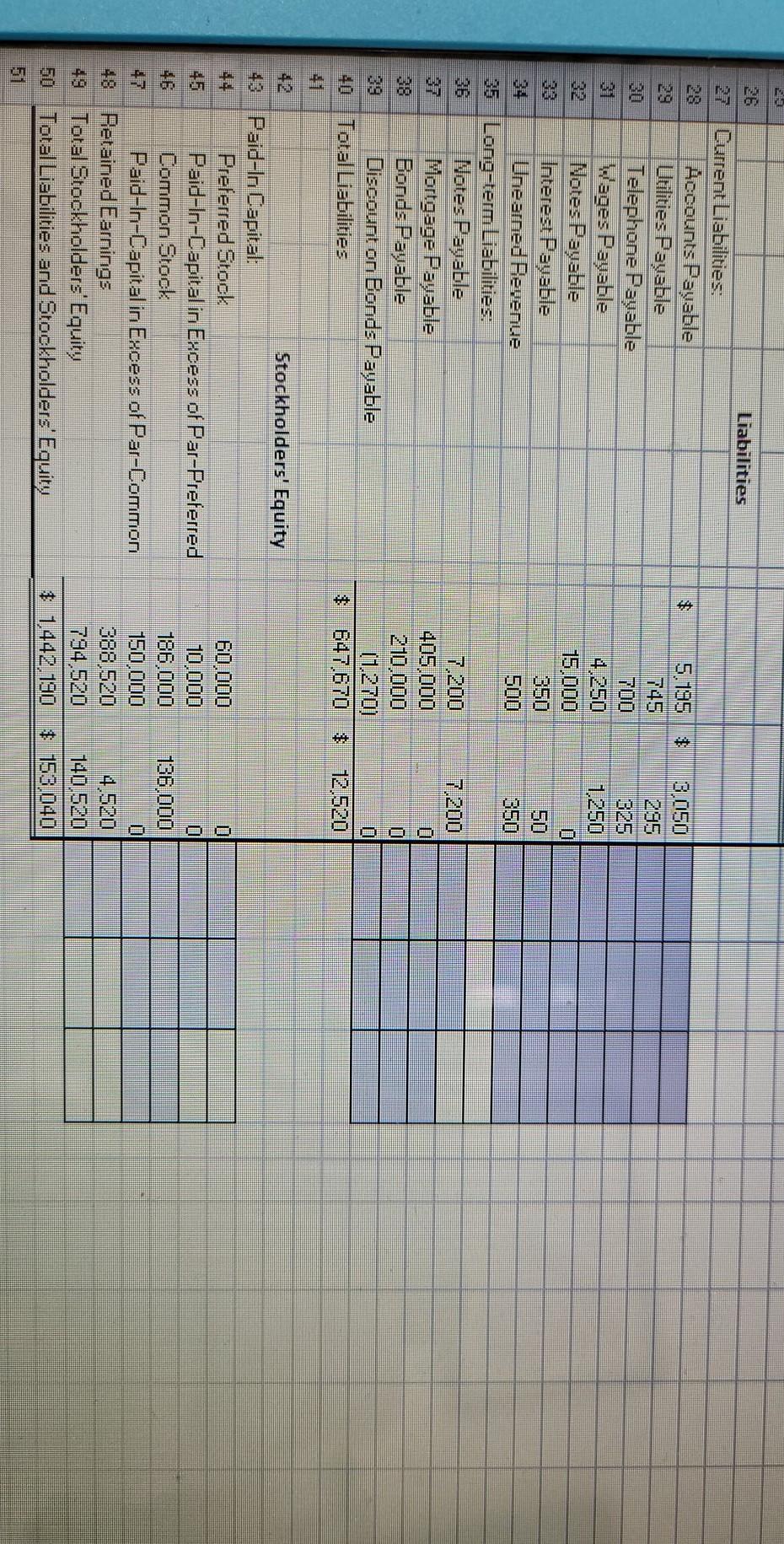

LIM N 0 F T 1 2 BCT E G H Statement of Cash Flows Excel Problem Prepare a Statement of Cash Flows for Banana World using the Comparative Balance Sheet and additional information. The year ended on December 31, 2025 and the indirect method wil be used. Fill in the dollar difference between the years. Next fill in the section of the Statement of Cash Flows that line will appear in. Lastly, identify if it will be added or subtracted in that section. The cells that are grey are to be completed 3 5 recue 6 7 Banana World Comparative Balance Sheet December 31, 2025 and 2024 8 2025 2024 Sectio Add + ifferenc n (0, 1, Subtra F, NC) ct 12 13 12,125 $ 523,693 $ 23,840 2.422 355 60 Additional Information: 1. The Income Statement for 2025 included the following items: (0.1, F. Subtra a. Net Income $ 417 000 b. Depreciation Expense 3 34.330 c. Amortization on Bonds Payable $ 254 2. There were no disposals of property, plant and equipment during the year. All acquisitions of PP&E were for cash except for the land, which was acquired by issuing preferred stock 3. The company issued bonds payable. Face Value of Bonds: $ 210,000 Cashreceived for Bonds: $ 208,476 4. The company distributed 4 000 shares of common stock in a stock dividend when the market value was $4.50 per share. Other dividends paid in cash. $ 15 000 5. The common stock, except for the stock dividend, was issued for cash. 6. The cash receipt from the Notes Payable in 2025 is considered a financing activity because it does notrelate to operations. 7,600 n Assets Current Assets: Cash Short-term Investments, net Accounts Receivable.net Merchandise Inventory Office Supplies Prepaid Rent Property, Plant and Equipment: Land Building Delivery Truck Office Furniture and Equipment Accumulated Depreciation - PP&E Total Assets 17 165 2.000 18 19 20 155,000 85 000 610 000 35 000 12 000 12,000 150.000 (35,180) 1850) $ 1442,190 $ 153,040 Liabilities 27 Current Liabilities: Balance Sheet and Info Statement of Cash Flows - $ 3.050 295 745 700 1.250 15,000 Liabilities Current Liabilities: Accounts Payable Utilities Payable Telephone Payable Wages Payable Notes Payable Interest Payable Unearned Revenue 35 Long-term Liabilities: Notes Payable Mortgage Payable Bonds Payable Discount on Bonds Payable Total Liabilities 500 350 7,200 405,000 210.000 (1.270) 647.670 Stockholders' Equity 43 Paid-In Capital: Preferred Stock Paid-In-Capital in Excess of Par-Preferred 46 Common Stook Paid-In-Capitalin Excess of Par-Common 48 Retained Earnings 49 Total Stockholders' Equity 50 Total Liabilities and Stockholders' Equity 60.000 10,000 186.000 136.000 150,000 388,520 4,520 140.520 $ 1,442,190 $ 158,040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started