Question

Lin Corporation has a single product, whose selling price is $200 and whose variable cost is 60% of sales price. The company's monthly fixed

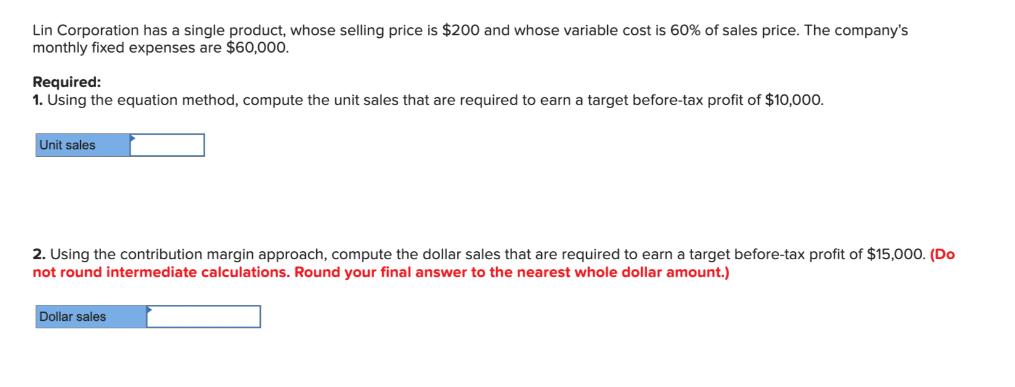

Lin Corporation has a single product, whose selling price is $200 and whose variable cost is 60% of sales price. The company's monthly fixed expenses are $60,000. Required: 1. Using the equation method, compute the unit sales that are required to earn a target before-tax profit of $10,000. Unit sales 2. Using the contribution margin approach, compute the dollar sales that are required to earn a target before-tax profit of $15,000. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Dollar sales

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Flexible Budget Performance Report for July Flights Revenue Expenses Net Income Actual Results 56 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Managerial Accounting

Authors: Peter Brewer, Ray Garrison, Eric Noreen

5th edition

73527076, 978-0077386214, 77386213, 978-0073527079

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App