Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lina, age 32, has a high-deductible health plan (HDHP) at her work. She is single and contributes $3,000 each what would the tax outcome be?

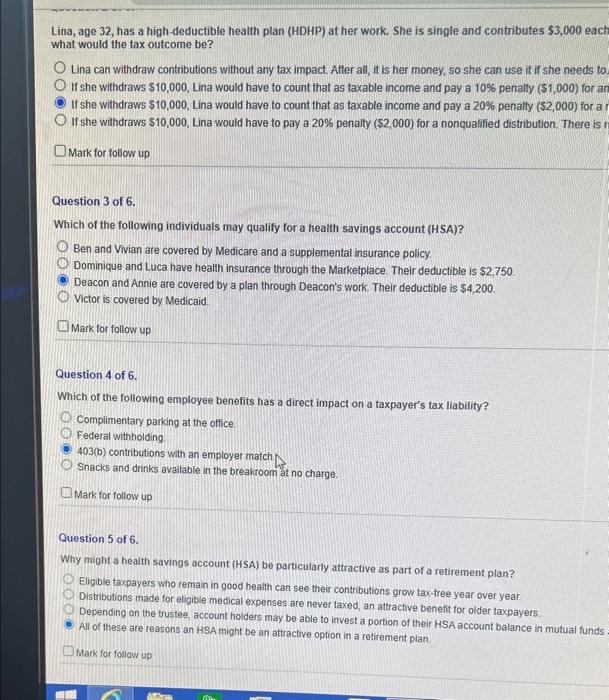

Lina, age 32, has a high-deductible health plan (HDHP) at her work. She is single and contributes $3,000 each what would the tax outcome be? Lina can withdraw contributions without any tax impact. After all, it is her money, so she can use it if she needs to If she withdraws $10,000, Lina would have to count that as taxable income and pay a 10% penalty ($1,000) for an If she withdraws $10,000, Lina would have to count that as taxable income and pay a 20% penalty ($2,000) for ar If she withdraws $10,000, Lina would have to pay a 20% penalty ($2,000) for a nonqualified distribution. There is n Mark for follow up Question 3 of 6. Which of the following individuals may qualify for a health savings account (HSA)? Ben and Vivian are covered by Medicare and a supplemental insurance policy. Dominique and Luca have health insurance through the Marketplace. Their deductible is $2,750. Deacon and Annie are covered by a plan through Deacon's work. Their deductible is $4,200. Victor is covered by Medicaid. Mark for follow up Question 4 of 6. Which of the following employee benefits has a direct impact on a taxpayer's tax liability? Complimentary parking at the office. Federal withholding. 403(b) contributions with an employer match. 10 Snacks and drinks available in the breakroom at no charge. Mark for follow up Question 5 of 6. Why might a health savings account (HSA) be particularly attractive as part of a retirement plan? Eligible taxpayers who remain in good health can see their contributions grow tax-free year over year. Distributions made for eligible medical expenses are never taxed, an attractive benefit for older taxpayers. Depending on the trustee, account holders may be able to invest a portion of their HSA account balance in mutual funds All of these are reasons an HSA might be an attractive option in a retirement plan. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started