Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lincoln Research, a nonprofit organization, estimates that it can save $25,000 a year in cash operating costs for the next 9 years if it

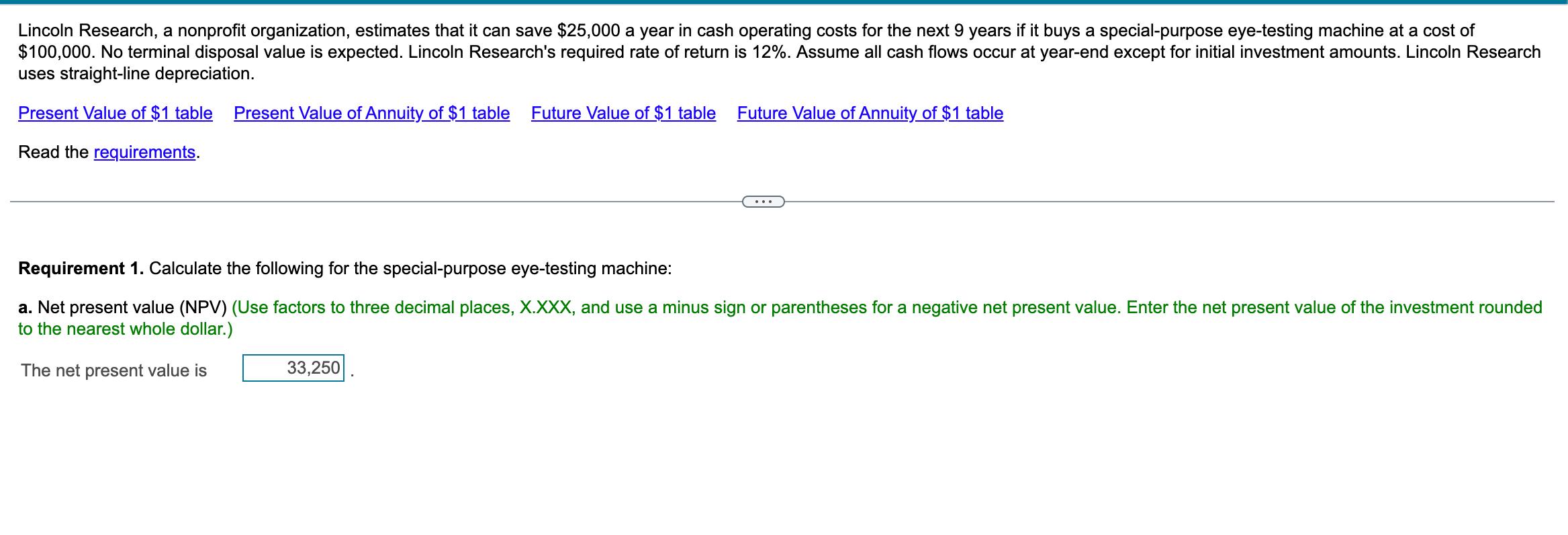

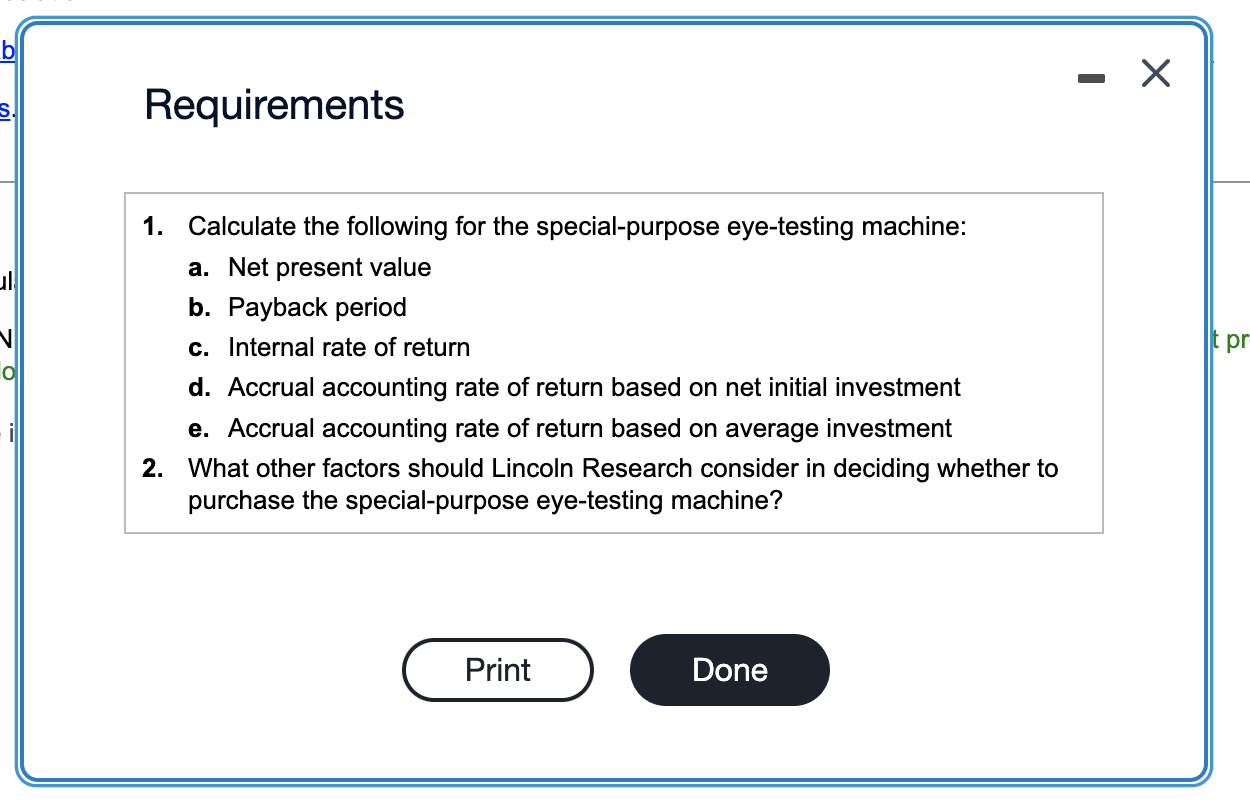

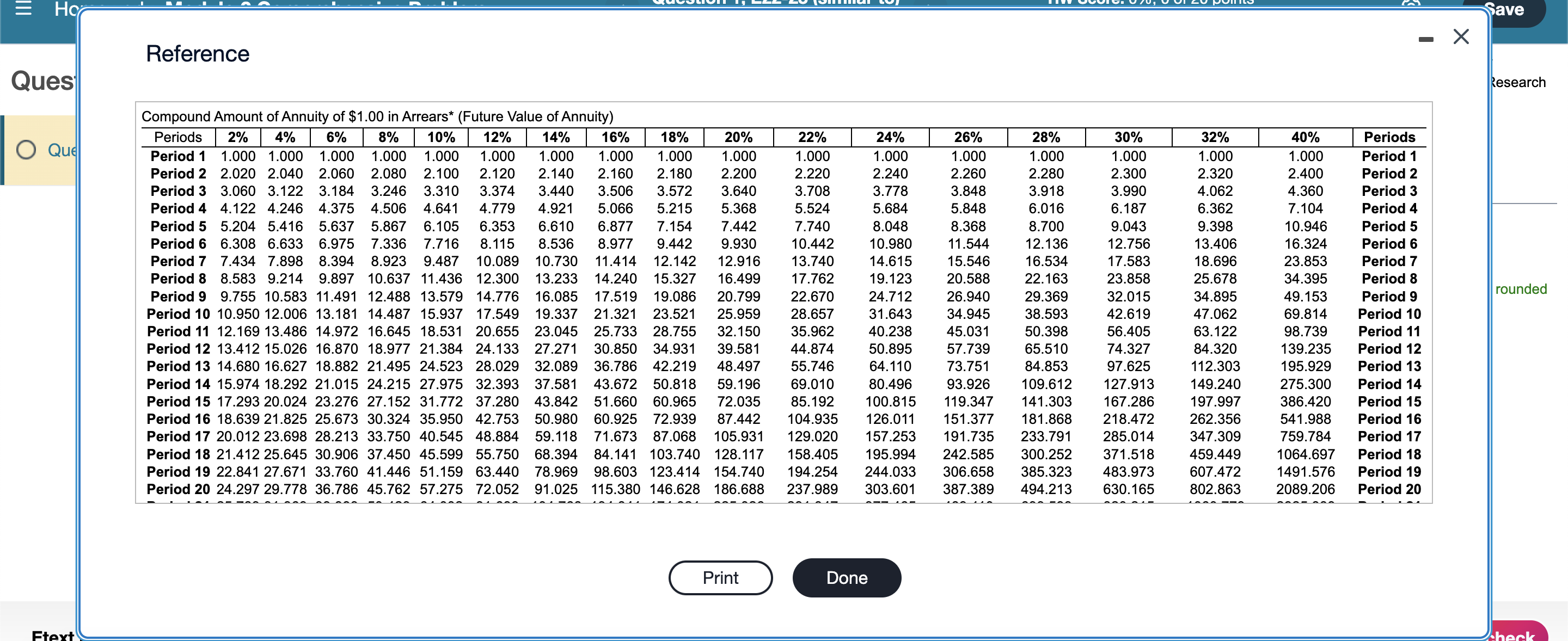

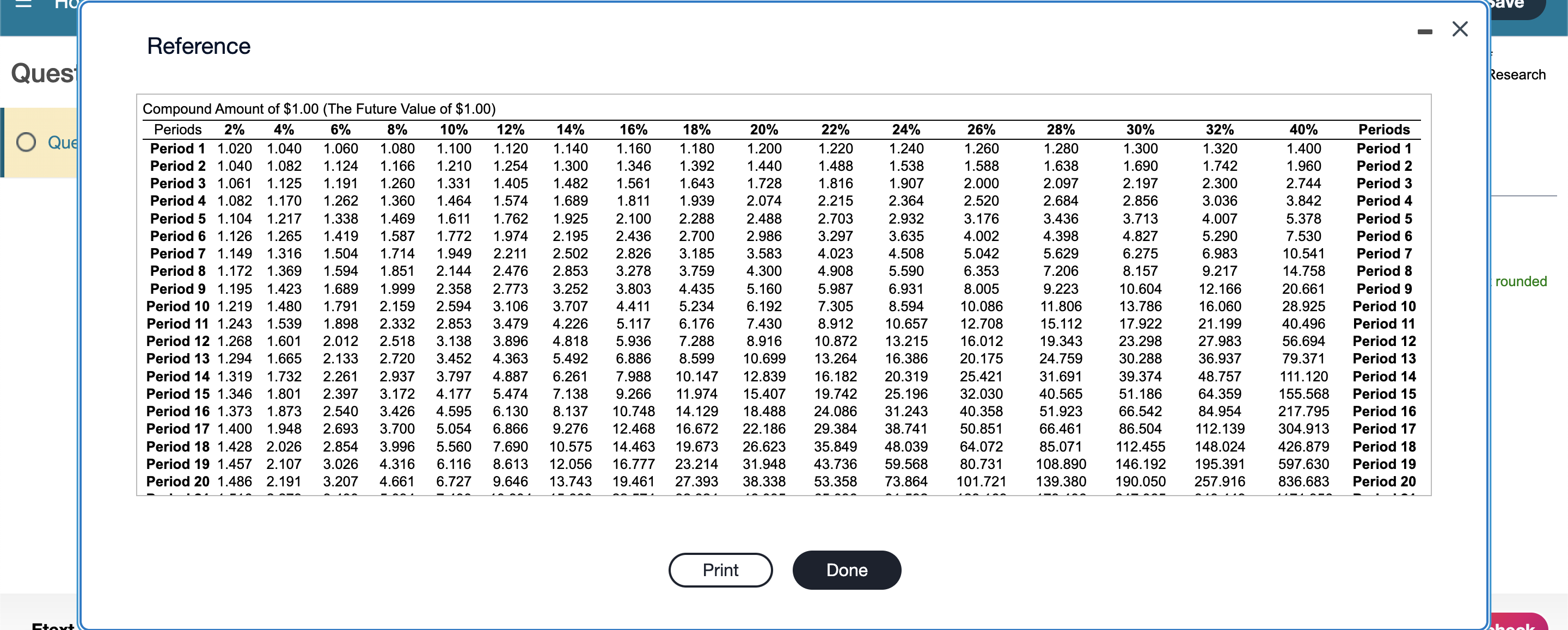

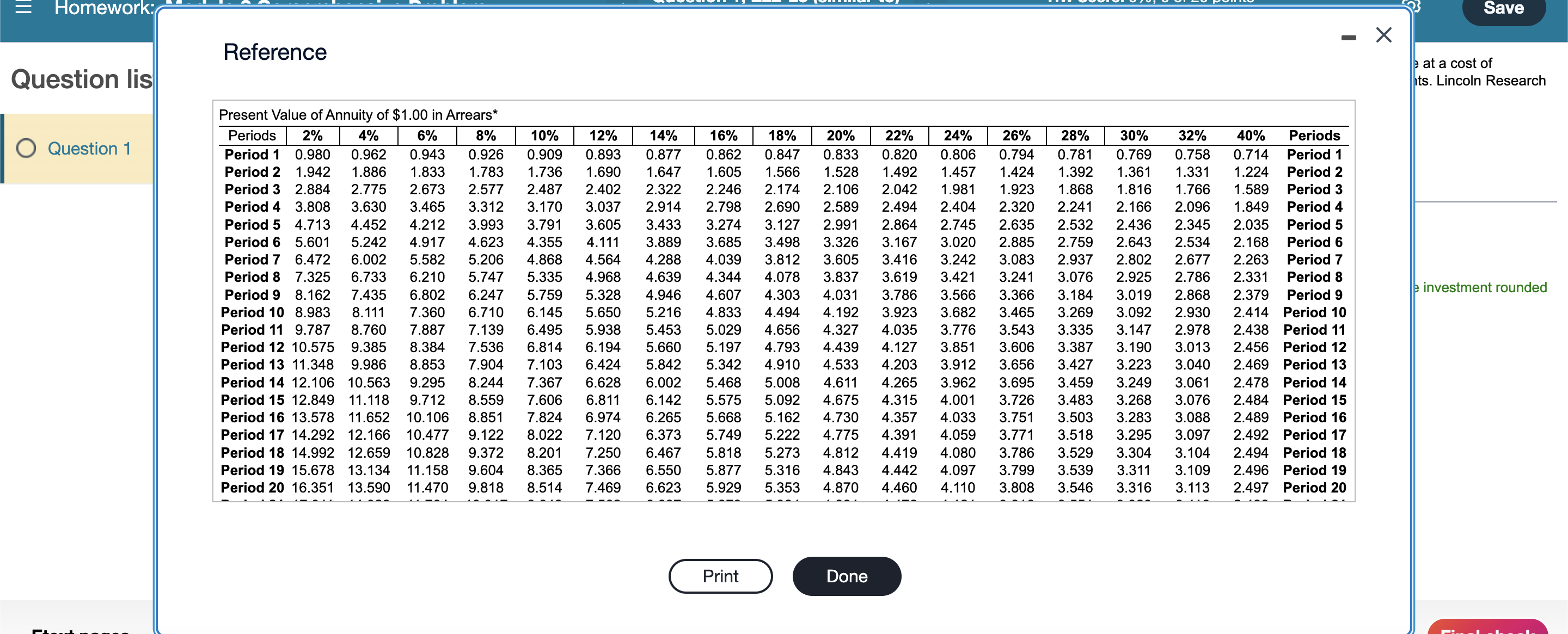

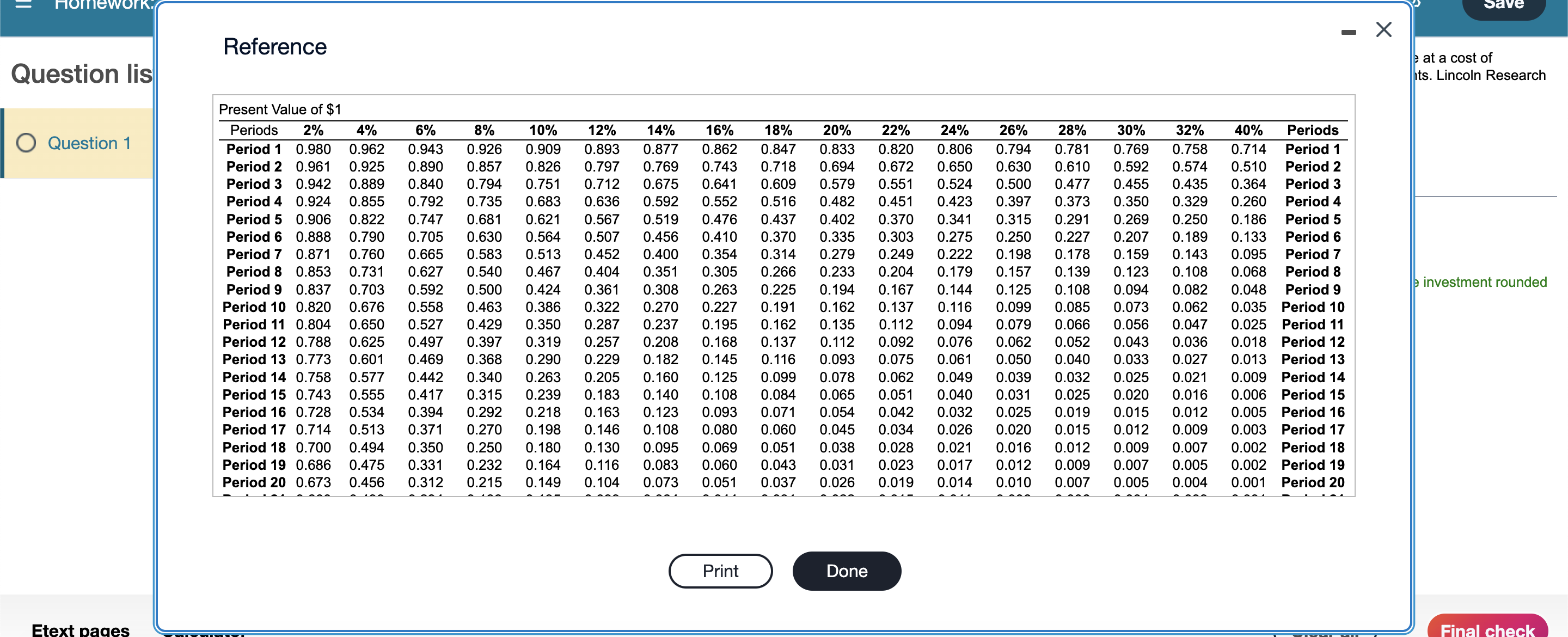

Lincoln Research, a nonprofit organization, estimates that it can save $25,000 a year in cash operating costs for the next 9 years if it buys a special-purpose eye-testing machine at a cost of $100,000. No terminal disposal value is expected. Lincoln Research's required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts. Lincoln Research uses straight-line depreciation. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Requirement 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value (NPV) (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is 33,250 Requirements 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value b. Payback period c. Internal rate of return d. Accrual accounting rate of return based on net initial investment e. Accrual accounting rate of return based on average investment 2. What other factors should Lincoln Research consider in deciding whether to purchase the special-purpose eye-testing machine? Print Done X pr ||| Ho Ques O Que Ftext Reference 18% 22% Period 1 24% 1.000 2.240 Compound Amount of Annuity of $1.00 in Arrears* (Future Value of Annuity) Periods 2% 4% 6% 8% 10% 12% 14% 16% 20% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Period 2 2.020 2.040 2.060 2.080 2.100 2.120 2.140 2.160 2.180 2.200 2.220 Period 3 3.060 3.122 3.184 3.246 3.310 3.374 3.440 3.506 3.572 3.640 3.708 Period 4 4.122 4.246 4.375 4.506 4.641 4.779 4.921 5.066 5.215 5.368 5.524 Period 5 5.204 5.416 5.637 5.867 6.105 6.353 6.610 6.877 7.154 7.442 7.740 Period 6 6.308 6.633 6.975 7.336 7.716 8.115 8.536 8.977 9.442 9.930 10.442 Period 7 7.434 7.898 8.394 8.923 9.487 10.089 10.730 11.414 12.142 12.916 13.740 Period 8 8.583 9.214 9.897 10.637 11.436 12.300 13.233 14.240 15.327 16.499 17.762 Period 9 9.755 10.583 11.491 12.488 13.579 14.776 16.085 17.519 19.086 20.799 22.670 Period 10 10.950 12.006 13.181 14.487 15.937 17.549 19.337 21.321 23.521 25.959 28.657 42.619 Period 11 12.169 13.486 14.972 16.645 18.531 20.655 23.045 25.733 28.755 32.150 35.962 45.031 56.405 Period 12 13.412 15.026 16.870 18.977 21.384 24.133 27.271 30.850 34.931 39.581 44.874 57.739 65.510 74.327 Period 13 14.680 16.627 18.882 21.495 24.523 28.029 32.089 36.786 42.219 48.497 55.746 73.751 84.853 97.625 Period 14 15.974 18.292 21.015 24.215 27.975 32.393 37.581 43.672 50.818 59.196 69.010 80.496 93.926 109.612 127.913 Period 15 17.293 20.024 23.276 27.152 31.772 37.280 43.842 51.660 60.965 72.035 85.192 100.815 119.347 141.303 167.286 Period 16 18.639 21.825 25.673 30.324 35.950 42.753 50.980 60.925 72.939 87.442 104.935 126.011 151.377 181.868 218.472 Period 17 20.012 23.698 28.213 33.750 40.545 48.884 59.118 71.673 87.068 105.931 129.020 157.253 191.735 233.791 285.014 Period 18 21.412 25.645 30.906 37.450 45.599 55.750 68.394 84.141 103.740 128.117 158.405 195.994 242.585 300.252 371.518 Period 19 22.841 27.671 33.760 41.446 51.159 63.440 78.969 98.603 123.414 154.740 194.254 244.033 306.658 385.323 483.973 Period 20 24.297 29.778 36.786 45.762 57.275 72.052 91.025 115.380 146.628 186.688 237.989 303.601 387.389 494.213 630.165 3.778 5.684 8.048 10.980 14.615 19.123 24.712 31.643 40.238 26% 1.000 2.260 3.848 5.848 8.368 11.544 15.546 20.588 26.940 34.945 28% 1.000 2.280 3.918 6.016 8.700 12.136 16.534 22.163 29.369 38.593 50.398 30% 1.000 2.300 3.990 6.187 9.043 12.756 17.583 23.858 32.015 50.895 64.110 Print Done 32% 1.000 2.320 4.062 6.362 9.398 13.406 18.696 25.678 34.895 47.062 63.122 84.320 112.303 149.240 197.997 262.356 347.309 459.449 607.472 802.863 40% 1.000 2.400 4.360 7.104 10.946 16.324 23.853 34.395 49.153 69.814 98.739 139.235 195.929 275.300 386.420 541.988 759.784 1064.697 1491.576 2089.206 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Save Research rounded check || Ques O Que Stort Reference 22% 1.220 1.488 24% 1.240 1.538 1.907 2.364 26% 1.260 1.588 2.000 2.520 1.816 2.215 2.703 2.932 3.297 3.635 3.176 4.002 5.042 4.023 4.508 5.590 4.908 6.353 Compound Amount of $1.00 (The Future Value of $1.00) Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 1.020 1.040 1.060 1.080 1.100 1.120 1.140 1.160 1.180 1.200 Period 2 1.040 1.082 1.124 1.166 1.210 1.254 1.300 1.346 1.392 1.440 Period 3 1.061 1.125 1.191 1.260 1.331 1.405 1.482 1.561 1.643 1.728 Period 4 1.082 1.170 1.262 1.360 1.464 1.574 1.689 1.811 1.939 2.074 Period 5 1.104 1.217 1.338 1.469 1.611 1.762 1.925 2.100 2.288 2.488 Period 6 1.126 1.265 1.419 1.587 1.772 1.974 2.195 2.436 2.700 2.986 Period 7 1.149 1.316 1.504 1.714 1.949 2.211 2.502 2.826 3.185 3.583 Period 8 1.172 1.369 1.594 1.851 2.144 2.476 2.853 3.278 3.759 4.300 Period 9 1.195 1.423 1.689 1.999 2.358 2.773 3.252 3.803 4.435 5.160 Period 10 1.219 1.480 1.791 2.159 2.594 3.106 3.707 4.411 5.234 6.192 7.305 8.594 10.086 Period 11 1.243 1.539 1.898 2.332 2.853 3.479 4.226 5.117 6.176 7.430 8.912 10.657 12.708 Period 12 1.268 1.601 2.012 2.518 3.138 3.896 4.818 5.936 7.288 8.916 10.872 13.215 16.012 Period 13 1.294 1.665 2.133 2.720 3.452 4.363 5.492 6.886 8.599 10.699 13.264 16.386 20.175 Period 14 1.319 1.732 2.261 2.937 3.797 4.887 6.261 7.988 10.147 12.839 16.182 20.319 25.421 Period 15 1.346 1.801 2.397 3.172 4.177 5.474 7.138 9.266 11.974 15.407 19.742 25.196 32.030 Period 16 1.373 1.873 2.540 3.426 4.595 6.130 8.137 10.748 14.129 18.488 24.086 31.243 40.358 Period 17 1.400 1.948 2.693 3.700 5.054 6.866 9.276 12.468 16.672 22.186 29.384 38.741 50.851 Period 18 1.428 2.026 2.854 3.996 5.560 7.690 10.575 14.463 19.673 26.623 35.849 48.039 64.072 Period 19 1.457 2.107 3.026 4.316 6.116 8.613 12.056 16.777 23.214 31.948 43.736 59.568 80.731 Period 20 1.486 2.191 3.207 4.661 6.727 9.646 13.743 19.461 27.393 38.338 53.358 73.864 101.721 5.987 6.931 8.005 Print Done 28% 1.280 1.638 2.097 30% 1.300 1.690 2.197 2.856 3.713 2.684 3.436 4.398 5.629 32% 1.320 1.742 2.300 3.036 4.007 5.290 6.983 9.217 12.166 16.060 21.199 27.983 40% 1.400 1.960 2.744 3.842 5.378 7.530 10.541 14.758 20.661 28.925 40.496 56.694 36.937 79.371 31.691 48.757 111.120 40.565 64.359 155.568 51.923 66.542 84.954 217.795 66.461 86.504 112.139 304.913 85.071 112.455 148.024 426.879 108.890 146.192 195.391 597.630 139.380 190.050 257.916 836.683 7.206 9.223 4.827 6.275 8.157 10.604 13.786 17.922 11.806 15.112 19.343 23.298 24.759 30.288 39.374 51.186 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 - X Research rounded abook Homework: Question lis L Question 1 Reference 1.942 1.886 Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Present Value of Annuity of $1.00 in Arrears* Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% Periods 0.980 0.962 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.794 0.781 0.769 0.758 0.714 Period 1 1.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 1.492 1.457 1.424 1.392 1.361 1.331 1.224 Period 2 2.884 2.775 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106 2.042 1.981 1.923 1.868 1.816 1.766 1.589 Period 3 3.808 3.630 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 2.494 2.404 2.320 2.241 2.166 2.096 1.849 Period 4 4.713 4.452 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 2.864 2.745 2.635 2.532 2.436 2.345 2.035 Period 5 5.601 5.242 4.917 4.623 4.355 4.111 3.889 3.685 3.498 3.326 3.167 3.020 2.885 2.759 2.643 2.534 2.168 Period 6 Period 7 6.472 6.002 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 3.416 3.242 3.083 2.937 2.802 2.677 2.263 Period 7 Period 8 7.325 6.733 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 3.619 3.421 3.241 3.076 2.925 2.786 2.331 Period 8 Period 9 8.162 7.435 6.802 6.247 5.759 5.328 4.946 4.607 4.303 4.031 3.786 3.566 3.366 3.184 3.019 2.868 2.379 Period 9 Period 10 8.983 8.111 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 3.923 3.682 3.465 3.269 3.092 2.930 2.414 Period 10 Period 11 9.787 8.760 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 4.035 3.776 3.543 3.335 3.147 2.978 2.438 Period 11 Period 12 10.575 9.385 8.384 7.536 6.814 6.194 5.660 5.197 4.793 4.439 4.127 3.851 3.606 3.387 3.190 3.013 2.456 Period 12 Period 13 11.348 9.986 8.853 7.904 7.103 6.424 5.842 5.342 4.910 4.533 4.203 3.912 3.656 3.427 3.223 3.040 2.469 Period 13 Period 14 12.106 10.563 9.295 8.244 7.367 6.628 6.002 5.468 5.008 4.611 4.265 3.962 3.695 3.459 3.249 3.061 2.478 Period 14 Period 15 12.849 11.118 9.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 4.315 4.001 3.726 3.483 3.268 3.076 2.484 Period 15 Period 16 13.578 11.652 10.106 8.851 7.824 6.974 6.265 5.668 5.162 4.730 4.357 4.033 3.751 3.503 3.283 3.088 2.489 Period 16 Period 17 14.292 12.166 10.477 9.122 8.022 7.120 6.373 5.749 5.222 4.775 4.391 4.059 3.771 3.518 3.295 3.097 2.492 Period 17 Period 18 14.992 12.659 10.828 9.372 8.201 7.250 6.467 5.818 5.273 4.812 4.419 4.080 3.786 3.529 3.304 3.104 2.494 Period 18 Period 19 15.678 13.134 11.158 9.604 8.365 7.366 6.550 5.877 5.316 4.843 4.442 4.097 3.799 3.539 3.311 3.109 2.496 Period 19 Period 20 16.351 13.590 11.470 9.818 8.514 7.469 6.623 5.929 5.353 4.870 4.460 4.110 3.808 3.546 3.316 3.113 2.497 Period 20 Print Done X Save e at a cost of ts. Lincoln Research le investment rounded Question lis O Question 1 Etext pages Reference Present Value of $1 Periods 2% 4% 0.980 0.962 0.961 0.925 Period 1 Period 2 Period 3 Period 4 6% 0.943 0.890 0.942 0.889 0.840 0.924 0.855 0.792 0.906 0.822 0.747 0.888 0.790 0.705 0.665 0.627 0.592 Period 5 Period 6 Period 7 0.871 0.760 Period 8 0.853 0.731 0.703 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% Periods 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.794 0.781 0.769 0.758 0.714 Period 1 0.857 0.826 0.797 0.769 0.743 0.718 0.694 0.672 0.650 0.630 0.610 0.592 0.574 0.510 Period 2 0.794 0.751 0.712 0.675 0.641 0.609 0.579 0.551 0.524 0.500 0.477 0.455 0.435 0.364 Period 3 0.735 0.683 0.636 0.592 0.552 0.516 0.482 0.451 0.423 0.397 0.373 0.350 0.329 0.260 Period 4 0.681 0.621 0.567 0.519 0.476 0.437 0.402 0.370 0.341 0.315 0.291 0.269 0.250 0.186 Period 5 0.630 0.564 0.507 0.456 0.410 0.370 0.335 0.303 0.275 0.250 0.227 0.207 0.189 0.133 Period 6 0.583 0.513 0.452 0.400 0.354 0.314 0.279 0.249 0.222 0.198 0.178 0.159 0.143 0.095 Period 7 0.540 0.467 0.404 0.351 0.305 0.266 0.233 0.204 0.179 0.157 0.139 0.123 0.108 0.068 Period 8 Period 9 0.837 0.500 0.424 0.361 0.308 0.263 0.225 0.194 0.167 0.144 0.125 0.108 0.094 0.082 0.048 Period 9 Period 10 0.820 0.463 0.386 0.322 0.270 0.227 0.191 0.162 0.137 0.116 0.099 0.085 0.073 0.062 0.035 Period 10 Period 11 0.804 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 0.112 0.094 0.079 0.066 0.056 0.047 0.025 Period 11 Period 12 0.788 0.625 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 0.092 0.076 0.062 0.052 0.043 0.036 0.018 Period 12 Period 13 0.773 0.601 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093 0.075 0.061 0.050 0.040 0.033 0.027 0.013 Period 13 Period 14 0.758 0.577 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 0.062 0.049 0.039 0.032 0.025 0.021 Period 15 0.743 0.555 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.065 0.051 0.040 0.031 0.025 0.020 0.016 Period 16 0.728 0.534 0.394 0.292 0.218 0.163 0.123 0.093 0.071 0.054 0.042 0.032 0.025 0.019 0.015 0.012 Period 17 0.714 0.513 0.371 0.270 0.198 0.146 0.108 0.080 0.060 0.045 0.034 0.026 0.020 0.015 0.012 0.009 Period 18 0.700 0.494 0.350 0.250 0.180 0.130 0.095 0.069 0.051 0.038 0.028 0.021 0.016 0.012 0.009 0.007 Period 19 0.686 0.475 0.331 0.232 0.164 0.116 0.083 0.060 0.043 0.031 0.023 0.017 0.012 0.009 0.007 0.005 Period 20 0.673 0.456 0.312 0.215 0.149 0.104 0.073 0.051 0.037 0.026 0.019 0.014 0.010 0.007 0.005 0.004 0.676 0.558 0.650 0.009 Period 14 0.006 Period 15 0.005 Period 16 0.003 Period 17 0.002 Period 18 0.002 Period 19 0.001 Period 20 Print Done X Save e at a cost of ts. Lincoln Research le investment rounded Final check

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The calculations are as follows a Net present value Year Cost Savingsa DiscFactor12 Total PV 0 100000 1 100000 1 25000 1112893 22325 2 25000 11122797 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started