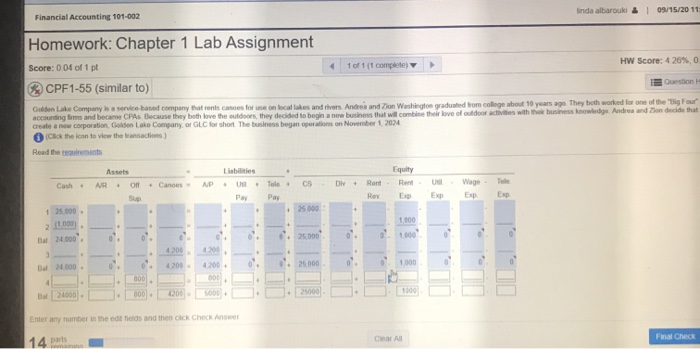

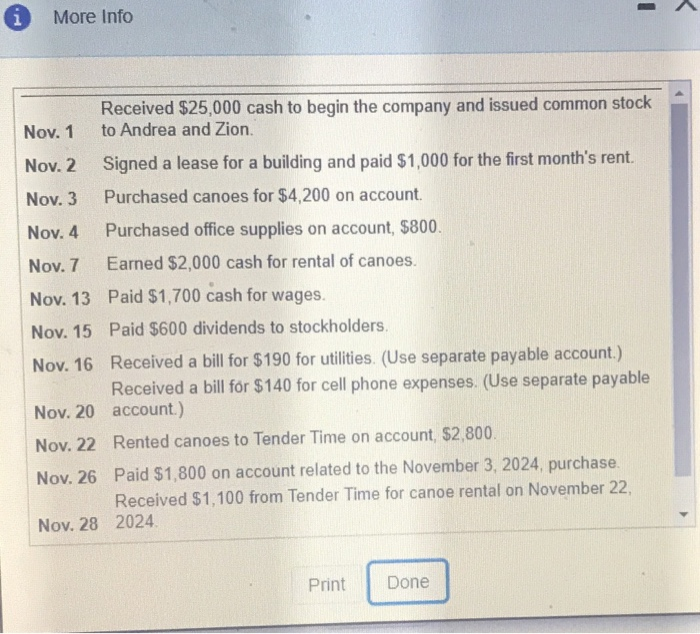

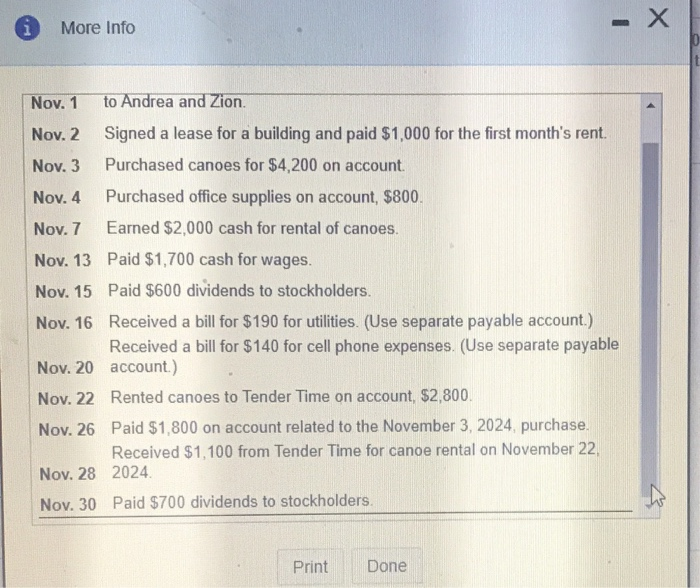

linda albarouki 09/15/2011 Financial Accounting 101-002 Homework: Chapter 1 Lab Assignment Question Score: 0.01 of 1 pt 1 of 1 (1 complete) HW Score: 4 26% CPF1-55 (similar to) Golden Lake Company is a service based company that renscanoes forte on local lakes and rivers. Andrea and Zion Washington graduated from college about 10 years ago They both worked for one of the Big Four accounting firm and became CPAS Because they both love the outdoors, they decided to begin a new business that will combine their love of outdoor activities with business knowledge Andrea and Zion decide that create a new corporation, Golden Lake Company, or GLC for short. The business began operations on November 2024 Click the icon to view the transactions) Read the recent Cash Assets AR Of - Canoes Sup Liabilities APU Pay CS U DH Equity Rent Rent Rex EX Tole Pay Wage Exp Exp Exp + . . 1 25.000 2 1.000 Bal 24.000 1800 100 0 0 0 25.000 0. 4200 200 BalM000 0 25000 300 BOL 4 B24000) 000 WOOL 25000 1000 Enter any number in the edt helds and then click Check 14 parte Fal Check Clear All More Info Received $25,000 cash to begin the company and issued common stock Nov. 1 to Andrea and Zion. Nov. 2 Signed a lease for a building and paid $1,000 for the first month's rent. Nov. 3 Purchased canoes for $4,200 on account. Nov. 4 Purchased office supplies on account, $800. Nov. 7 Earned $2,000 cash for rental of canoes. Nov. 13 Paid $1,700 cash for wages. Nov. 15 Paid $600 dividends to stockholders. Nov. 16 Received a bill for $190 for utilities. (Use separate payable account.) Received a bill for $140 for cell phone expenses. (Use separate payable Nov. 20 account.) Nov. 22 Rented canoes to Tender Time on account, $2,800. Nov. 26 Paid $1,800 on account related to the November 3, 2024, purchase. Received $1,100 from Tender Time for canoe rental on November 22, Nov. 28 2024 Print Done More Info Nov. 1 to Andrea and Zion. Nov. 2 Signed a lease for a building and paid $1,000 for the first month's rent. Nov. 3 Purchased canoes for $4,200 on account. Nov. 4 Purchased office supplies on account, $800. Nov. 7 Earned $2,000 cash for rental of canoes. Nov. 13 Paid $1,700 cash for wages. Nov. 15 Paid $600 dividends to stockholders. Nov. 16 Received a bill for $190 for utilities. (Use separate payable account.) Received a bill for $140 for cell phone expenses. (Use separate payable Nov. 20 account) Nov. 22 Rented canoes to Tender Time on account, $2,800. Nov. 26 Paid $1,800 on account related to the November 3, 2024, purchase. Received $1,100 from Tender Time for canoe rental on November 22, Nov. 28 2024 Nov. 30 Paid $700 dividends to stockholders. Print Done