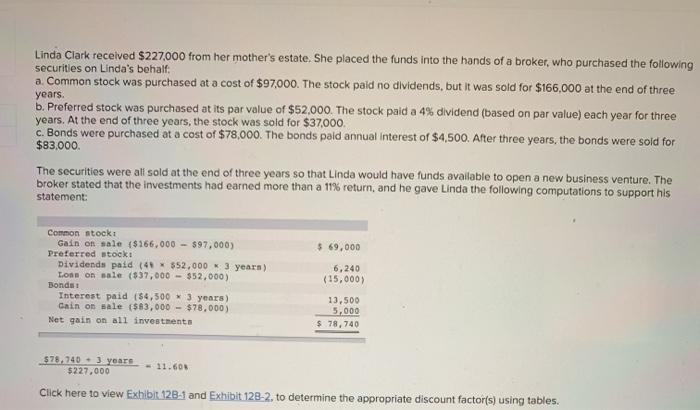

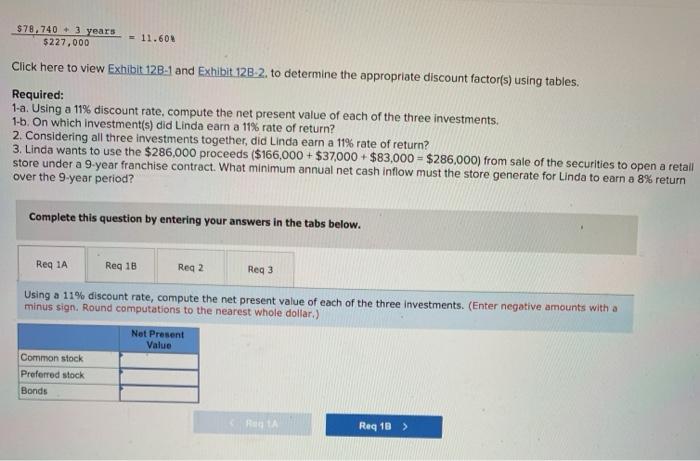

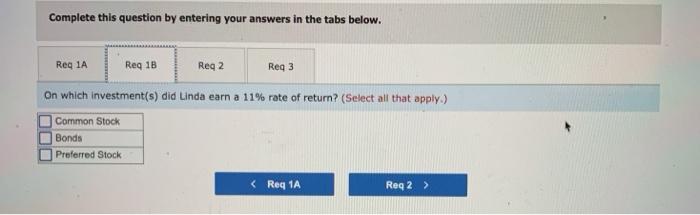

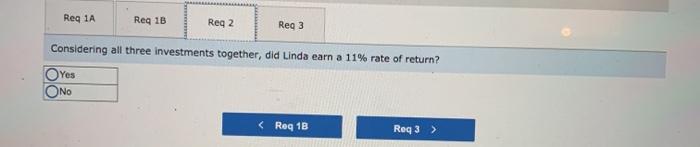

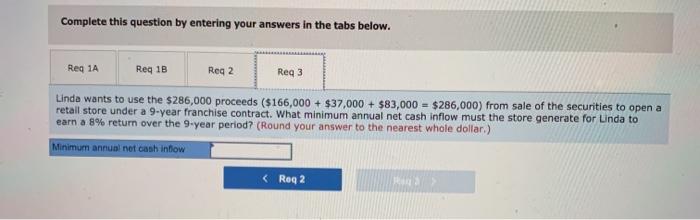

Linda Clark received $227,000 from her mother's estate. She placed the funds into the hands of a broker, who purchased the following securities on Linda's behalf a common stock was purchased at a cost of $97,000. The stock paid no dividends, but it was sold for $166,000 at the end of three years. 6. Preferred stock was purchased at its par value of $52.000. The stock paid a 4% dividend (based on par value) each year for three years. At the end of three years, the stock was sold for $37,000 c. Bonds were purchased at a cost of $78,000. The bonds paid annual Interest of $4,500. After three years, the bonds were sold for $83.000 The securities were all sold at the end of three years so that Linda would have funds available to open a new business venture. The broker stated that the investments had earned more than a 11% return, and he gave Linda the following computations to support his statement: $ 69,000 Common stock Gain on sale ($166,000 - $97,000) Preferred stock Dividends paid (41 * $52.000 * 3 yearn) Lots on sale ($37,000 - 352,000) Bonds: Interest paid $4,500 * 3 years) Cain on sale ($83,000 - $78,000) Net gain on all investments 6,240 (15,000) 13,500 5,000 $78,740 $78,740 3 years $227,000 * 11.600 Click here to view Exhibit 128-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using tables. $78,740 + 3 years 5227,000 = 11.600 Click here to view Exhibit 12B-1 and Exhibit 12B 2. to determine the appropriate discount factor(s) using tables. Required: 1-a. Using a 11% discount rate, compute the net present value of each of the three investments, 1-5. On which investment(s) did Linda earn a 11% rate of return? 2. Considering all three investments together, did Linda earn a 11% rate of return? 3. Linda wants to use the $286,000 proceeds ($166,000+ $37,000$83,000 = $286,000) from sale of the securities to open a retail store under a 9-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 8% return over the 9-year period? Complete this question by entering your answers in the tabs below. Req 1A Reg 18 Reg 2 Reg 3 Using a 11% discount rate, compute the net present value of each of the three investments. (Enter negative amounts with a minus sign. Round computations to the nearest whole dollar.) Net Present Value Common stock Preferred stock Bonds Reg 10 > Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 2 Reg 3 On which investment(s) did Linda earn a 11% rate of return? (Select all that apply.) . Common Stock Bonds Preferred Stock Reg 1A Reg 1B Reg 2 Reg 3 Considering all three investments together, did Linda earn a 11% rate of return? Yes ONO Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Req3 Linda wants to use the $286,000 proceeds ($166,000 + $37,000 + $83,000 = $286,000) from sale of the securities to open a retail store under a 9-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 8% return over the 9-year period? (Round your answer to the nearest whole dollar.) Minimum annual net cash inflow