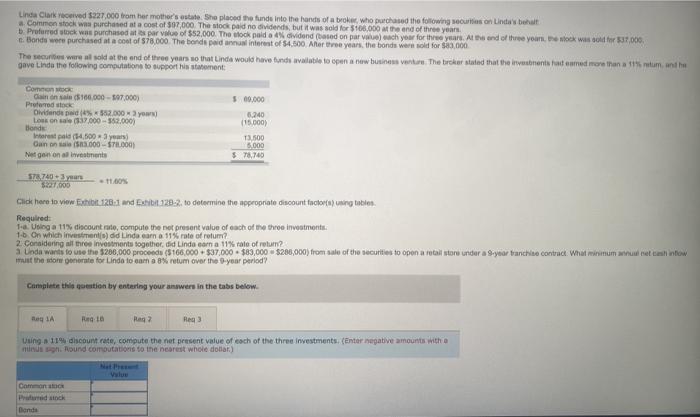

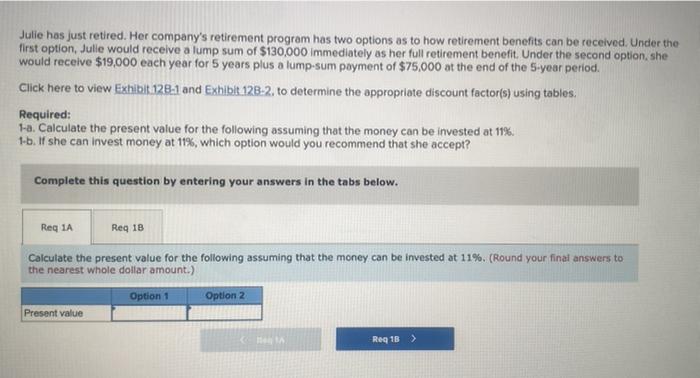

Linda Clarkeerved 227,000 from her mother's estate. She placed the funds into the hands of a broker who purchased the following is on Lindahl a common stock was purchased at a cost of 507,000 The stock paid no dividends, but it was sold for $106.000 at the end of three years Proferred stock was purchased its par value of $52,000. The lock palda dividend (based on parvou) ach your for three years. At the end of three your work is sold for 37.000 Bonds were purchased at a cost of 78.000 The bonds perd annual interest of $4.500 Alor tree years, the bonds were sold for 30.000 The securities were at sold at the end of three years to thot Linda would have funds walible to open a new business venture. The broker stated that the inventa font med more than 15 tum and he gave Lindo the following computations to support his statement Como Gainonsa (100.000 - 97.000) Preferred stock Dividende ped552.000 3 you Los on sale 2.000 - 552.000) Bonde Interest paid (14,500 years) Canon (53.000 -SPIL Nedge on a investments 500.000 5.240 115.000) 13,500 3.000 $ 78,740 578740 + 3 years Click here to view Ext. 128.1 and 32:2, to determine the appropriate discount factors using tobies Required: 1. Using a 11% discount rate, compute the not present value of each of the three investments 1. On which investment(s) did Linda carn a 11% rate of retur? 2. Considering all three investments together, did Linda carn a 11% rate of retum? a Unda wants to use the $206,000 proceeds (5166,000 $37.000 $83,000 $286,000) from sale of the securities to open a retail store under a year tranchise contract. What einum et into must the store generate for Undato com a 8% return over the year period? Complete this question by entering your answers in the tabs below. Reg 1 Reto Raga Reg Using a 11 discount rate, compute the net present value of each of the three investments (Enter negative amounts with a ns. Round commutations to the nearest whole dolar) Commons Julie has just retired. Her company's retirement program has two options as to how retirement benefits can be received. Under the first option, Julle would receive a lump sum of $130,000 immediately as her full retirement benefit. Under the second option, she would receive $19,000 each year for 5 years plus a lump-sum payment of $75,000 at the end of the 5-year period. Click here to view Exhibit 128-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables, Required: 1-a. Calculate the present value for the following assuming that the money can be invested at 11% 1-b. If she can invest money at 11%, which option would you recommend that she accept? Complete this question by entering your answers in the tabs below. Req 1A Req 18 Calculate the present value for the following assuming that the money can be invested at 11%. (Round your final answers to the nearest whole dollar amount.) Option 1 Option 2 Present value