Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Linda James is an employee of a Canadian controlled private corporation (CCPC). Required: For the 2020 taxation year, calculate the following for Linda: Net Income

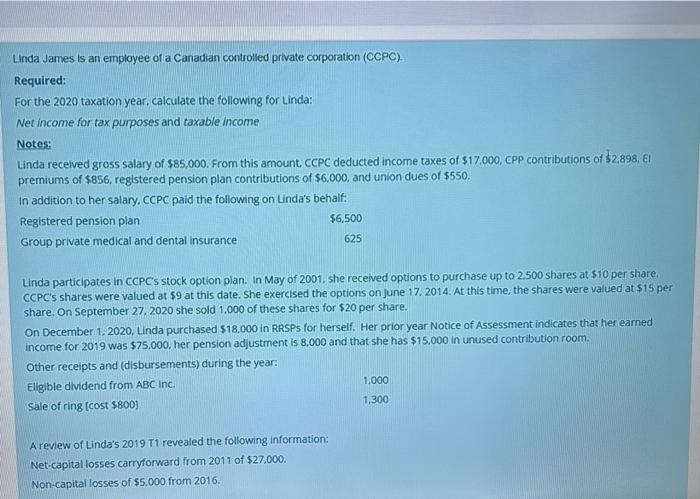

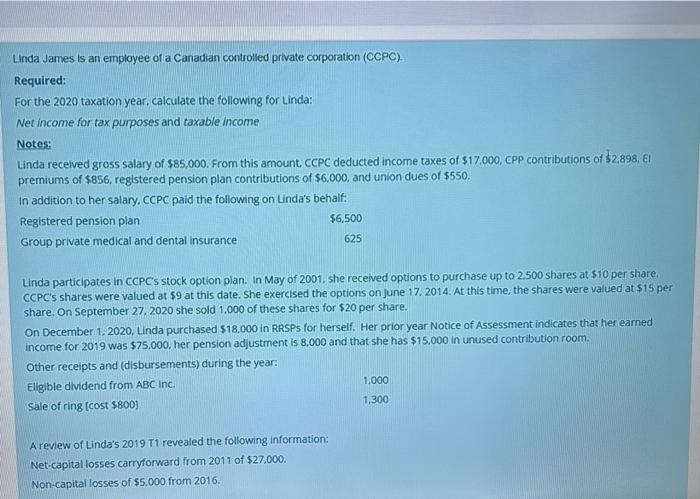

Linda James is an employee of a Canadian controlled private corporation (CCPC). Required: For the 2020 taxation year, calculate the following for Linda: Net Income for tax purposes and taxable income Notes: Linda received gross salary of $85,000. From this amount CCPC deducted income taxes of $17,000, CPP contributions of $2,898, El premiums of $856. registered pension plan contributions of $6,000, and union dues of $550. In addition to her salary. CCPC paid the following on Linda's behalf. Registered pension plan $6,500 Group private medical and dental Insurance 625 Linda participates in CCPC's stock option plan. In May of 2001. she received options to purchase up to 2.500 shares at $10 per share, CCPC's shares were valued at $9 at this date. She exercised the options on June 17, 2014. At this time, the shares were valued at $15 per share. On September 27, 2020 she sold 1.000 of these shares for $20 per share. On December 1, 2020, Linda purchased $18,000 in RRSPs for herself. Her prior year Notice of Assessment indicates that her earned income for 2019 was $75.000,her pension adjustment is 8,000 and that she has $15.000 in unused contribution room. Other receipts and (disbursements) during the year: Eligible dividend from ABC Inc. 1.000 Sale of ring (cost $800) 1.300 A review of Linda's 2019 T1 revealed the following information: Net-capital losses carryforward from 2011 of $27,000 Non-capital losses of $5,000 from 2016

Linda James is an employee of a Canadian controlled private corporation (CCPC). Required: For the 2020 taxation year, calculate the following for Linda: Net Income for tax purposes and taxable income Notes: Linda received gross salary of $85,000. From this amount CCPC deducted income taxes of $17,000, CPP contributions of $2,898, El premiums of $856. registered pension plan contributions of $6,000, and union dues of $550. In addition to her salary. CCPC paid the following on Linda's behalf. Registered pension plan $6,500 Group private medical and dental Insurance 625 Linda participates in CCPC's stock option plan. In May of 2001. she received options to purchase up to 2.500 shares at $10 per share, CCPC's shares were valued at $9 at this date. She exercised the options on June 17, 2014. At this time, the shares were valued at $15 per share. On September 27, 2020 she sold 1.000 of these shares for $20 per share. On December 1, 2020, Linda purchased $18,000 in RRSPs for herself. Her prior year Notice of Assessment indicates that her earned income for 2019 was $75.000,her pension adjustment is 8,000 and that she has $15.000 in unused contribution room. Other receipts and (disbursements) during the year: Eligible dividend from ABC Inc. 1.000 Sale of ring (cost $800) 1.300 A review of Linda's 2019 T1 revealed the following information: Net-capital losses carryforward from 2011 of $27,000 Non-capital losses of $5,000 from 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started