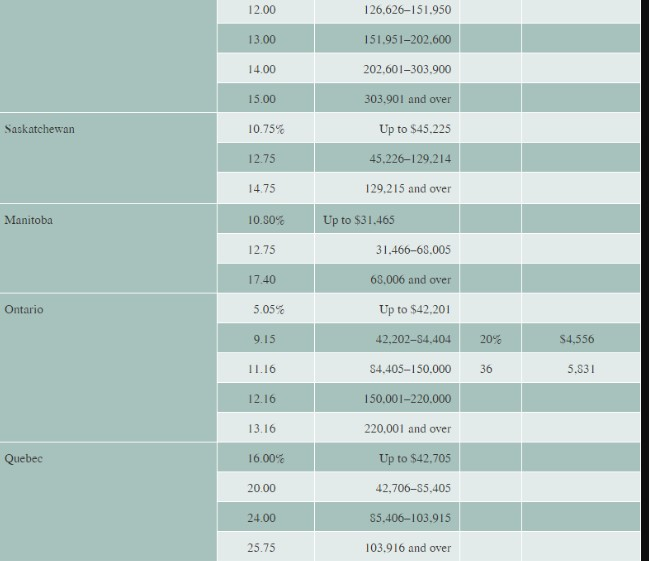

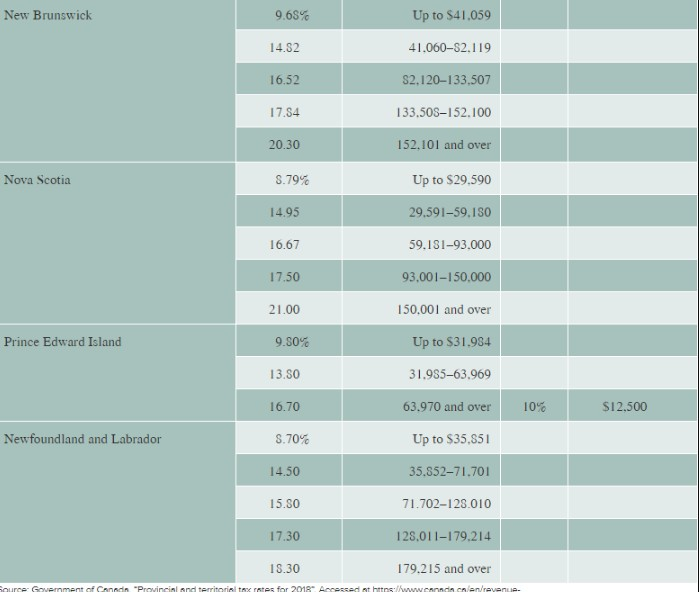

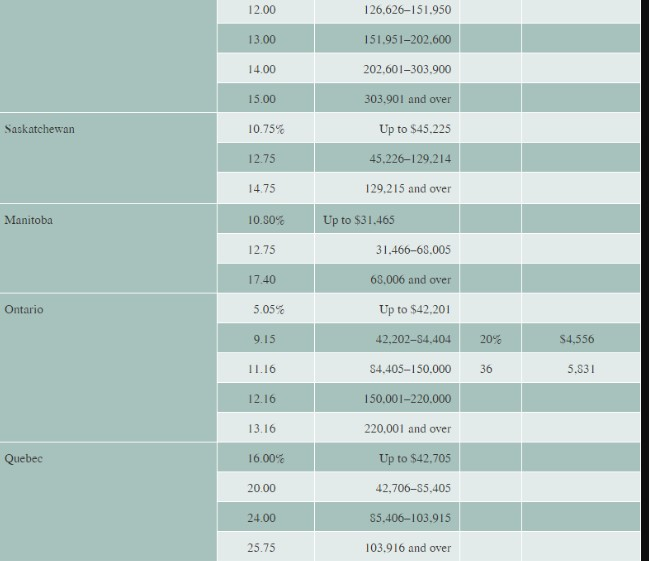

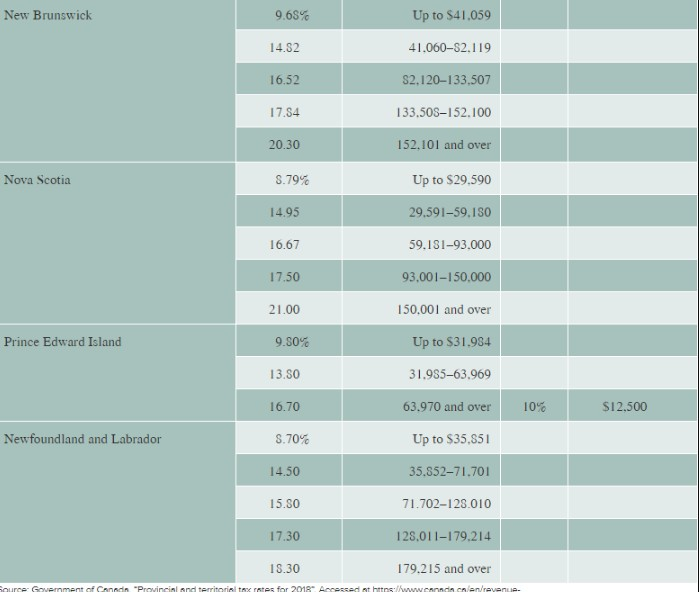

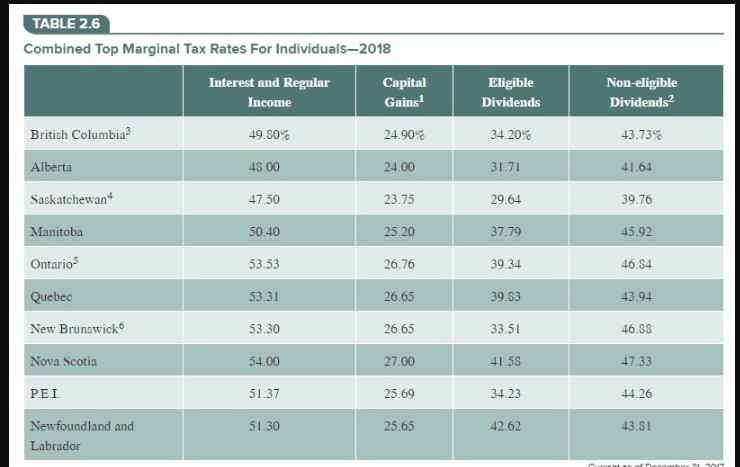

Linda Milner, an Alberta investor, receives $40,000 in dividends from Okotoks Forest Products shares, $20,000 in interest from a deposit in a chartered bank, and a $20,000 capital gain from Cremona Mines shares. Ms. Milner's federal tax rate is 29%. Assume that Ms. Milner's cash flows are from equal investments of $75,000 each. Use the information in Table 2.5 and Table 2.6 to find her after-tax rate of return on each investment. (Round the final answers to 2 decimal places.) After Tax Rate of Return on Dividends After Tax Rate of Return on Interest After Tax Rate of Return on Capital Gains 12.00 126.626-151.950 13.00 151.951-202.600 14.00 202.601-303.900 15.00 303.901 and over Saskatchewan 10.75% Up to $45.225 12.75 45.226-129.214 14.75 129.215 and over Manitoba 10.50% Up to $31.465 12.75 31.466-68.005 17.40 68.006 and over Ontario 5.05% Up to $42,201 9.15 42,202-84.404 20% S4,556 11.16 S4.405-150.000 36 5.831 12.16 150.001-220.000 13.16 220.001 and over Quebec 16.00% Up to $42.705 20.00 42,706-85,405 24.00 85.406-103.915 25.75 103.916 and over New Brunswick 9.68% Up to $41.059 14.52 41.060-82.119 16.52 82.120-133.507 17.54 133.508-152.100 20.30 152.101 and over Nova Scotia 8.79% Up to $29.590 14.95 29.591-59.180 16.67 59.181-93.000 17.50 93,001150,000 21.00 150.001 and over Prince Edward Island 9.50% Up to $31.984 13.50 31.985-63.969 16.70 63.970 and over 10% $12,500 Newfoundland and Labrador 8.70% Up to $35.851 14.50 35.552-71.701 15.50 71.702128.010 125.011-179.214 17.30 30 15.30 179.215 and over Source Government of Canada Provincial and territorial tax rates for 2018 Accessed attos www cenu revenue. TABLE 2.6 Combined Top Marginal Tax Rates For Individuals-2018 Interest and Regular Income Capital Gains Eligible Dividends Non-eligible Dividends British Columbia 49.80% 24.90% 34.20% 43.73% Alberta 45.00 24.00 31.71 41.64 Saskatchewan 47.50 23.75 39.76 45.92 Manitoba 50.40 29.64 37.79 39.34 25.20 Ontarios 53.53 26.76 46.54 Quebec 53.31 39.53 43.94 26.65 26.65 New Brunswick 53.30 33.51 46.SS Nova Scotia 54.00 27.00 27.00 41.55 47.33 PEI 25.69 34.23 44.26 51.37 51.30 Newfoundland and Labrador 25.65 42.62 42.62 43.51 Linda Milner, an Alberta investor, receives $40,000 in dividends from Okotoks Forest Products shares, $20,000 in interest from a deposit in a chartered bank, and a $20,000 capital gain from Cremona Mines shares. Ms. Milner's federal tax rate is 29%. Assume that Ms. Milner's cash flows are from equal investments of $75,000 each. Use the information in Table 2.5 and Table 2.6 to find her after-tax rate of return on each investment. (Round the final answers to 2 decimal places.) After Tax Rate of Return on Dividends After Tax Rate of Return on Interest After Tax Rate of Return on Capital Gains 12.00 126.626-151.950 13.00 151.951-202.600 14.00 202.601-303.900 15.00 303.901 and over Saskatchewan 10.75% Up to $45.225 12.75 45.226-129.214 14.75 129.215 and over Manitoba 10.50% Up to $31.465 12.75 31.466-68.005 17.40 68.006 and over Ontario 5.05% Up to $42,201 9.15 42,202-84.404 20% S4,556 11.16 S4.405-150.000 36 5.831 12.16 150.001-220.000 13.16 220.001 and over Quebec 16.00% Up to $42.705 20.00 42,706-85,405 24.00 85.406-103.915 25.75 103.916 and over New Brunswick 9.68% Up to $41.059 14.52 41.060-82.119 16.52 82.120-133.507 17.54 133.508-152.100 20.30 152.101 and over Nova Scotia 8.79% Up to $29.590 14.95 29.591-59.180 16.67 59.181-93.000 17.50 93,001150,000 21.00 150.001 and over Prince Edward Island 9.50% Up to $31.984 13.50 31.985-63.969 16.70 63.970 and over 10% $12,500 Newfoundland and Labrador 8.70% Up to $35.851 14.50 35.552-71.701 15.50 71.702128.010 125.011-179.214 17.30 30 15.30 179.215 and over Source Government of Canada Provincial and territorial tax rates for 2018 Accessed attos www cenu revenue. TABLE 2.6 Combined Top Marginal Tax Rates For Individuals-2018 Interest and Regular Income Capital Gains Eligible Dividends Non-eligible Dividends British Columbia 49.80% 24.90% 34.20% 43.73% Alberta 45.00 24.00 31.71 41.64 Saskatchewan 47.50 23.75 39.76 45.92 Manitoba 50.40 29.64 37.79 39.34 25.20 Ontarios 53.53 26.76 46.54 Quebec 53.31 39.53 43.94 26.65 26.65 New Brunswick 53.30 33.51 46.SS Nova Scotia 54.00 27.00 27.00 41.55 47.33 PEI 25.69 34.23 44.26 51.37 51.30 Newfoundland and Labrador 25.65 42.62 42.62 43.51