Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Linda starts trading on 1 June 2015 and ceases trading on 31 July 2020. She has adjusted trading profits as follows: 1 June 2015

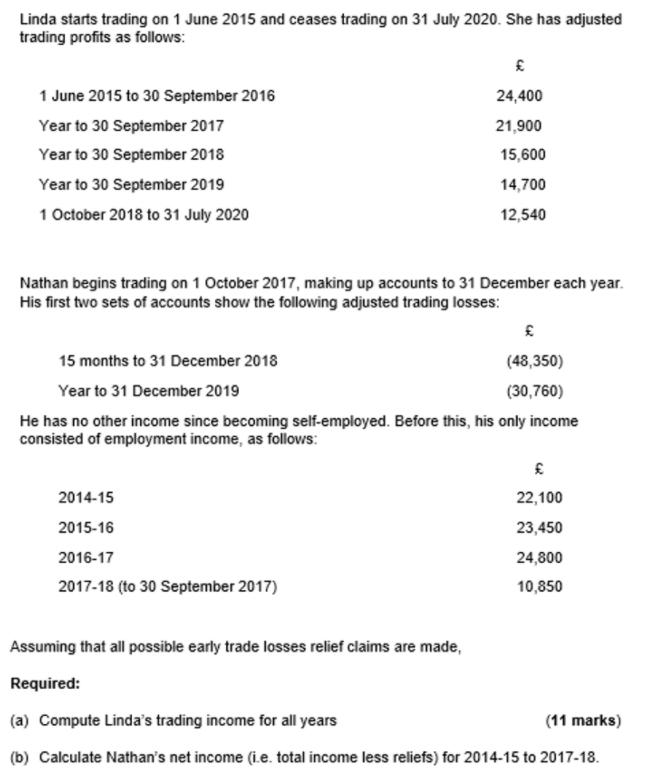

Linda starts trading on 1 June 2015 and ceases trading on 31 July 2020. She has adjusted trading profits as follows: 1 June 2015 to 30 September 2016 24,400 Year to 30 September 2017 21,900 Year to 30 September 2018 15,600 Year to 30 September 2019 14,700 1 October 2018 to 31 July 2020 12,540 Nathan begins trading on 1 October 2017, making up accounts to 31 December each year. His first two sets of accounts show the following adjusted trading losses: 15 months to 31 December 2018 (48,350) Year to 31 December 2019 (30,760) He has no other income since becoming self-employed. Before this, his only income consisted of employment income, as follows: 2014-15 22,100 2015-16 23,450 2016-17 24,800 2017-18 (to 30 September 2017) 10,850 Assuming that all possible early trade losses relief claims are made, Required: (a) Compute Linda's trading income for all years (11 marks) (b) Calculate Nathan's net income (i.e. total income less reliefs) for 2014-15 to 2017-18.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solu tion Trading psofit refers to the poofit foom opesa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started