Question

Linda Williams, M.D., maintains the accounting records of Williams Clinic on a cash basis. During 2020, Dr. Williams collected $134,269 from her patients and paid

Linda Williams, M.D., maintains the accounting records of Williams Clinic on a cash basis. During 2020, Dr. Williams collected $134,269 from her patients and paid $50,926 in expenses. At January 1, 2020, and December 31, 2020, she had accounts receivable, unearned service revenue, accrued expenses, and prepaid expenses as follows. (All long-lived assets are rented.)

| January 1, 2020 | December 31, 2020 | |||

|---|---|---|---|---|

| Accounts receivable | $8,768 | $14,914 | ||

| Unearned service revenue | 2,908 | 3,733 | ||

| Accrued expenses | 3,444 | 2,049 | ||

| Prepaid expenses | 1,835 | 3,239 |

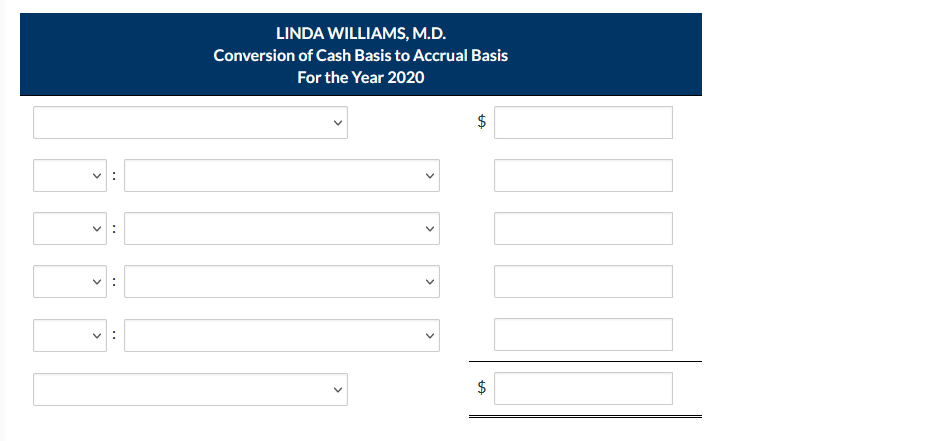

Prepare a schedule that converts Dr. Williamss "excess of cash collected over cash disbursed" for the year 2020 to net income on an accrual basis for the year 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started