Question

Linda's Lights balance sheet info for the beginning of 2020: Owners' Equity 27 million Bank Loan 10 million, 4.5% interest rate Fixed Assets 10

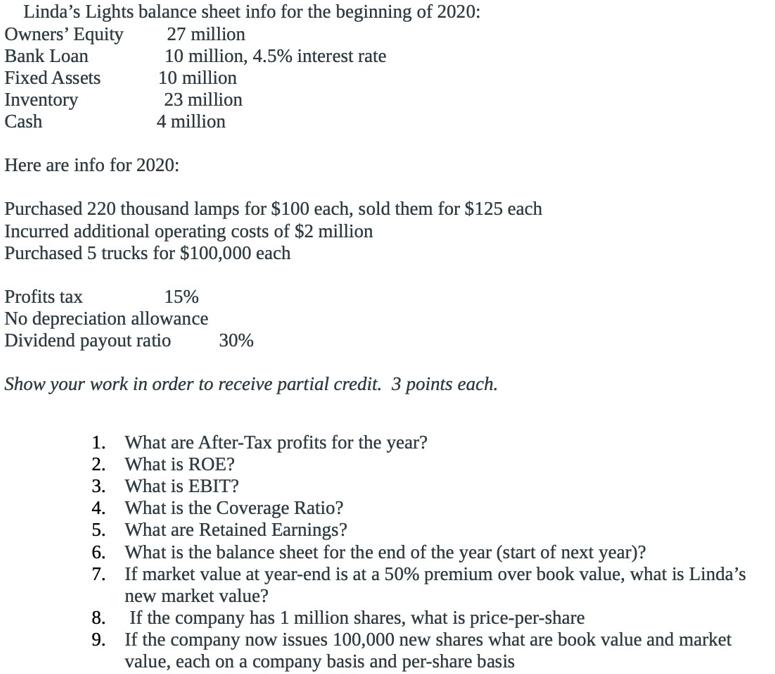

Linda's Lights balance sheet info for the beginning of 2020: Owners' Equity 27 million Bank Loan 10 million, 4.5% interest rate Fixed Assets 10 million 23 million Inventory Cash Here are info for 2020: Purchased 220 thousand lamps for $100 each, sold them for $125 each Incurred additional operating costs of $2 million Purchased 5 trucks for $100,000 each 4 million Profits tax 15% No depreciation allowance Dividend payout ratio Show your work in order to receive partial credit. 3 points each. 30% 1. What are After-Tax profits for the year? 2. What is ROE? 8. 9. 3. What is EBIT? 4. What is the Coverage Ratio? 5. What are Retained Earnings? 6. What is the balance sheet for the end of the year (start of next year)? 7. If market value at year-end is at a 50% premium over book value, what is Linda's new market value? If the company has 1 million shares, what is price-per-share If the company now issues 100,000 new shares what are book value and market value, each on a company basis and per-share basis

Step by Step Solution

3.33 Rating (135 Votes )

There are 3 Steps involved in it

Step: 1

AfterTax Profits for the Year Revenue from lamp sales Number of lamps sold Selling price per lamp Revenue from lamp sales 220000 lamps 125 per lamp Revenue from lamp sales 27500000 Cost of lamps purch...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started