Answered step by step

Verified Expert Solution

Question

1 Approved Answer

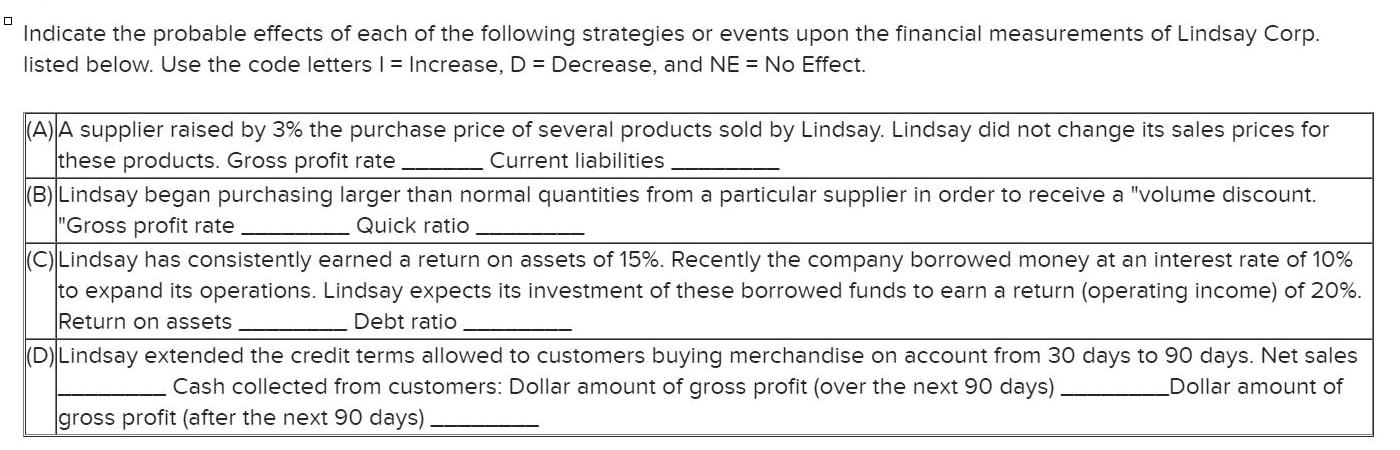

Indicate the probable effects of each of the following strategies or events upon the financial measurements of Lindsay Corp. listed below. Use the code

Indicate the probable effects of each of the following strategies or events upon the financial measurements of Lindsay Corp. listed below. Use the code letters I = Increase, D = Decrease, and NE = No Effect. (A)A supplier raised by 3% the purchase price of several products sold by Lindsay. Lindsay did not change its sales prices for these products. Gross profit rate (B) Lindsay began purchasing larger than normal quantities from a particular supplier in order to receive a "volume discount. "Gross profit rate Current liabilities Quick ratio (C)Lindsay has consistently earned a return on assets of 15%. Recently the company borrowed money at an interest rate of 10% to expand its operations. Lindsay expects its investment of these borrowed funds to earn a return (operating income) of 20%. Return on assets Debt ratio (D)Lindsay extended the credit terms allowed to customers buying merchandise on account from 30 days to 90 days. Net sales Cash collected from customers: Dollar amount of gross profit (over the next 90 days) Dollar amount of gross profit (after the next 90 days)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Req A Gross Profit rate Decrease Current liabilities Increase This is due to the fact that cost of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started