Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Linfei Ltd. has a 31 December year-end, and a tax rate of 25%. Management has asked you to respond to the following situations: 1. The

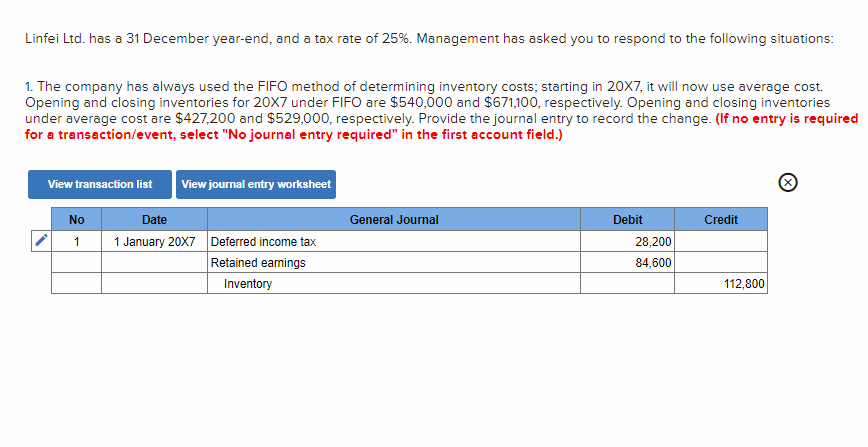

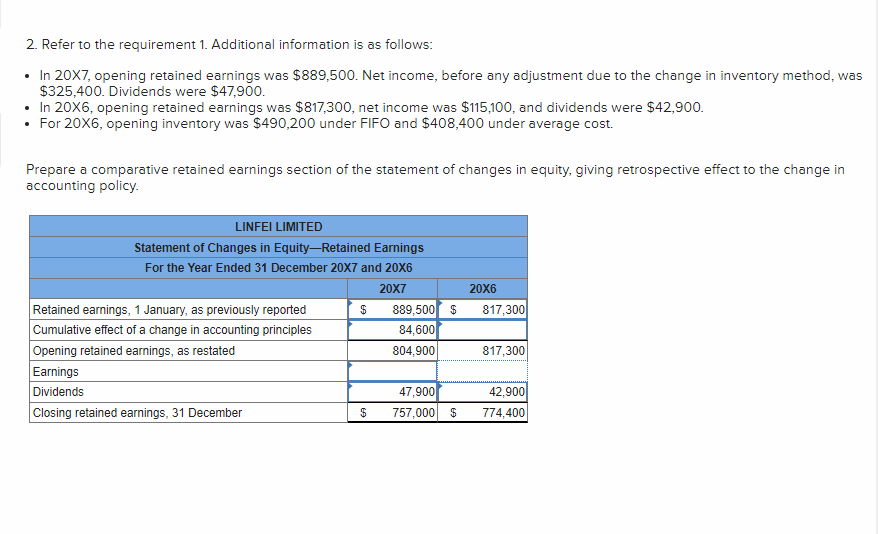

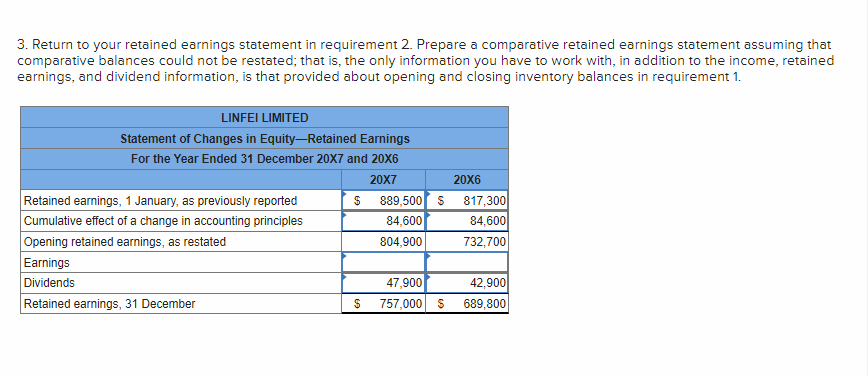

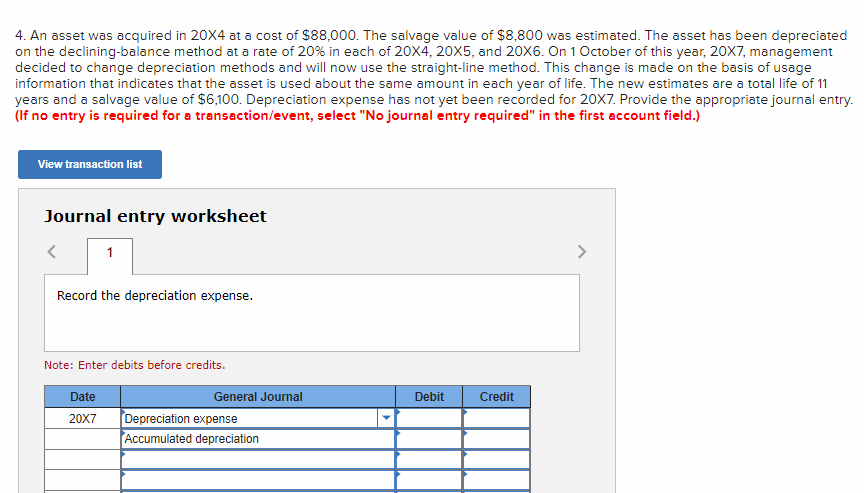

Linfei Ltd. has a 31 December year-end, and a tax rate of 25%. Management has asked you to respond to the following situations: 1. The company has always used the FIFO method of determining inventory costs; starting in 207, it will now use average cost. Opening and closing inventories for 207 under FIFO are $540,000 and $671,100, respectively. Opening and closing inventories under average cost are $427,200 and $529,000, respectively. Provide the journal entry to record the change. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Refer to the requirement 1. Additional information is as follows: - In 20X7, opening retained earnings was $889,500. Net income, before any adjustment due to the change in inventory method, was $325,400. Dividends were $47,900. - In 20X6, opening retained earnings was $817,300, net income was $115,100, and dividends were $42,900. - For 206, opening inventory was $490,200 under FIFO and $408,400 under average cost. Prepare a comparative retained earnings section of the statement of changes in equity, giving retrospective effect to the change in accounting policy. 3. Return to your retained earnings statement in requirement 2. Prepare a comparative retained earnings statement assuming that comparative balances could not be restated; that is, the only information you have to work with, in addition to the income, retained earnings, and dividend information, is that provided about opening and closing inventory balances in requirement 1. 4. An asset was acquired in 204 at a cost of $88,000. The salvage value of $8,800 was estimated. The asset has been depreciated on the declining-balance method at a rate of 20% in each of 204,205, and 206. On 1 October of this year, 20X7, management decided to change depreciation methods and will now use the straight-line method. This change is made on the basis of usage information that indicates that the asset is used about the same amount in each year of life. The new estimates are a total life of 11 years and a salvage value of $6,100. Depreciation expense has not yet been recorded for 207. Provide the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits betore credits. Linfei Ltd. has a 31 December year-end, and a tax rate of 25%. Management has asked you to respond to the following situations: 1. The company has always used the FIFO method of determining inventory costs; starting in 207, it will now use average cost. Opening and closing inventories for 207 under FIFO are $540,000 and $671,100, respectively. Opening and closing inventories under average cost are $427,200 and $529,000, respectively. Provide the journal entry to record the change. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Refer to the requirement 1. Additional information is as follows: - In 20X7, opening retained earnings was $889,500. Net income, before any adjustment due to the change in inventory method, was $325,400. Dividends were $47,900. - In 20X6, opening retained earnings was $817,300, net income was $115,100, and dividends were $42,900. - For 206, opening inventory was $490,200 under FIFO and $408,400 under average cost. Prepare a comparative retained earnings section of the statement of changes in equity, giving retrospective effect to the change in accounting policy. 3. Return to your retained earnings statement in requirement 2. Prepare a comparative retained earnings statement assuming that comparative balances could not be restated; that is, the only information you have to work with, in addition to the income, retained earnings, and dividend information, is that provided about opening and closing inventory balances in requirement 1. 4. An asset was acquired in 204 at a cost of $88,000. The salvage value of $8,800 was estimated. The asset has been depreciated on the declining-balance method at a rate of 20% in each of 204,205, and 206. On 1 October of this year, 20X7, management decided to change depreciation methods and will now use the straight-line method. This change is made on the basis of usage information that indicates that the asset is used about the same amount in each year of life. The new estimates are a total life of 11 years and a salvage value of $6,100. Depreciation expense has not yet been recorded for 207. Provide the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits betore credits

Linfei Ltd. has a 31 December year-end, and a tax rate of 25%. Management has asked you to respond to the following situations: 1. The company has always used the FIFO method of determining inventory costs; starting in 207, it will now use average cost. Opening and closing inventories for 207 under FIFO are $540,000 and $671,100, respectively. Opening and closing inventories under average cost are $427,200 and $529,000, respectively. Provide the journal entry to record the change. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Refer to the requirement 1. Additional information is as follows: - In 20X7, opening retained earnings was $889,500. Net income, before any adjustment due to the change in inventory method, was $325,400. Dividends were $47,900. - In 20X6, opening retained earnings was $817,300, net income was $115,100, and dividends were $42,900. - For 206, opening inventory was $490,200 under FIFO and $408,400 under average cost. Prepare a comparative retained earnings section of the statement of changes in equity, giving retrospective effect to the change in accounting policy. 3. Return to your retained earnings statement in requirement 2. Prepare a comparative retained earnings statement assuming that comparative balances could not be restated; that is, the only information you have to work with, in addition to the income, retained earnings, and dividend information, is that provided about opening and closing inventory balances in requirement 1. 4. An asset was acquired in 204 at a cost of $88,000. The salvage value of $8,800 was estimated. The asset has been depreciated on the declining-balance method at a rate of 20% in each of 204,205, and 206. On 1 October of this year, 20X7, management decided to change depreciation methods and will now use the straight-line method. This change is made on the basis of usage information that indicates that the asset is used about the same amount in each year of life. The new estimates are a total life of 11 years and a salvage value of $6,100. Depreciation expense has not yet been recorded for 207. Provide the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits betore credits. Linfei Ltd. has a 31 December year-end, and a tax rate of 25%. Management has asked you to respond to the following situations: 1. The company has always used the FIFO method of determining inventory costs; starting in 207, it will now use average cost. Opening and closing inventories for 207 under FIFO are $540,000 and $671,100, respectively. Opening and closing inventories under average cost are $427,200 and $529,000, respectively. Provide the journal entry to record the change. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Refer to the requirement 1. Additional information is as follows: - In 20X7, opening retained earnings was $889,500. Net income, before any adjustment due to the change in inventory method, was $325,400. Dividends were $47,900. - In 20X6, opening retained earnings was $817,300, net income was $115,100, and dividends were $42,900. - For 206, opening inventory was $490,200 under FIFO and $408,400 under average cost. Prepare a comparative retained earnings section of the statement of changes in equity, giving retrospective effect to the change in accounting policy. 3. Return to your retained earnings statement in requirement 2. Prepare a comparative retained earnings statement assuming that comparative balances could not be restated; that is, the only information you have to work with, in addition to the income, retained earnings, and dividend information, is that provided about opening and closing inventory balances in requirement 1. 4. An asset was acquired in 204 at a cost of $88,000. The salvage value of $8,800 was estimated. The asset has been depreciated on the declining-balance method at a rate of 20% in each of 204,205, and 206. On 1 October of this year, 20X7, management decided to change depreciation methods and will now use the straight-line method. This change is made on the basis of usage information that indicates that the asset is used about the same amount in each year of life. The new estimates are a total life of 11 years and a salvage value of $6,100. Depreciation expense has not yet been recorded for 207. Provide the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits betore credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started