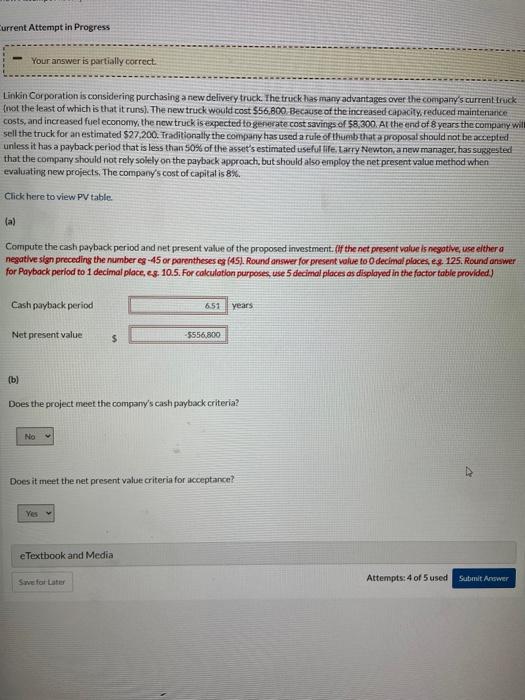

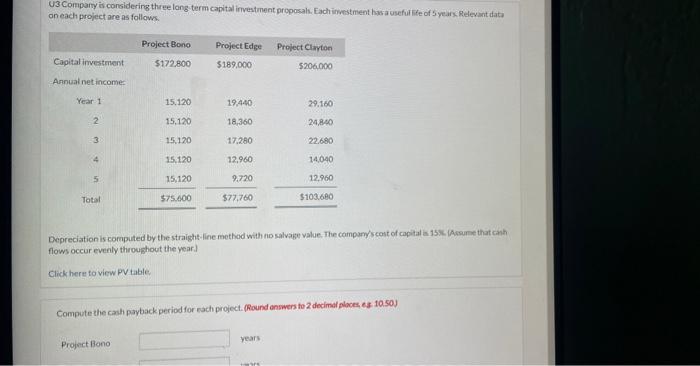

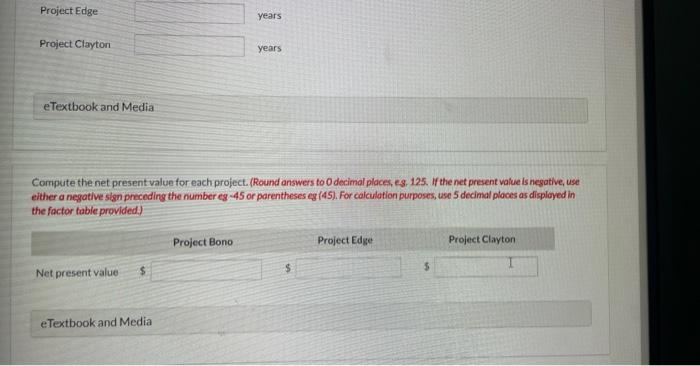

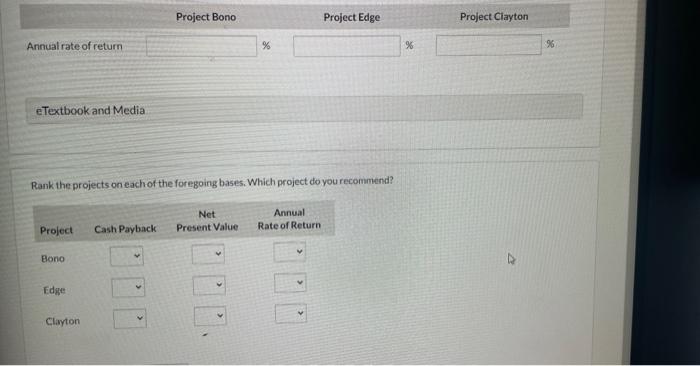

Linkin Cor poration is considering purchasing a new delivery truck. The truck dlas many advantages over the compamy's current Lruck (not the least of which is that it runs). The new truck woutd cost $56,800 Because of the increased capacity, reduced maintenaice costs, and increased fuel conomy, the now truck is expected to 8 enerate cost savings of 58300 . At the end of 8 years the comparty will sell the truck for an estimated $27,200. Traditionally the company has uscd a rule of thumbthat aropocai should not be accepted unless it has a payback period that is less than 508 of the asset's estimated useful tife, Larry Newton, ancw manager, has suegested that the compary should not rely solely on the payback approach, but should also emptoy the net present value method when evaluating new projects. The company's cost of capital is 8% Click here to view PV table. (a) Compute the cash payback period and net present value of the proposed investment. (ff the net present value is nesotive, use either a negative sian preceding the number e8 - 45 or parentheses es (45). Round answer for present valie to 0 decimal places; es. 125. Round answer for Payback period to 1 decimal place, es. 10.5. For cakulation purposes, use 5 decimal places as displayed in the foctor table provided) Cash payback period Net present value (b) Does the project meet the company's cash paryback criteria? Does it meet the net present value criteria for acceptance? eTextbook and Media U3 Compary is considerirg three long term capital investment groposals. Each irvestment hisa usefur lie of 5 years Redevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The campum/scost of capital is 15 ik- ABsume that canh flows occur evenly throughout the year. Click here to view PV table. Compute the cath payback period for each project. (Round enswers to 2 decimal ploces, es 10.50 ) Compute the net present value for each project. (Round answers to 0 decimal places, es. 125. If the net present value is negative, use either a negative sign preceding the number eg - 45 or parentheses eg (45). For calculotion purposes, use 5 decimal ploces as disployed in the factor fable provided.) Rank the projects on each of the for egoing bases. Which project do you recommend? Linkin Cor poration is considering purchasing a new delivery truck. The truck dlas many advantages over the compamy's current Lruck (not the least of which is that it runs). The new truck woutd cost $56,800 Because of the increased capacity, reduced maintenaice costs, and increased fuel conomy, the now truck is expected to 8 enerate cost savings of 58300 . At the end of 8 years the comparty will sell the truck for an estimated $27,200. Traditionally the company has uscd a rule of thumbthat aropocai should not be accepted unless it has a payback period that is less than 508 of the asset's estimated useful tife, Larry Newton, ancw manager, has suegested that the compary should not rely solely on the payback approach, but should also emptoy the net present value method when evaluating new projects. The company's cost of capital is 8% Click here to view PV table. (a) Compute the cash payback period and net present value of the proposed investment. (ff the net present value is nesotive, use either a negative sian preceding the number e8 - 45 or parentheses es (45). Round answer for present valie to 0 decimal places; es. 125. Round answer for Payback period to 1 decimal place, es. 10.5. For cakulation purposes, use 5 decimal places as displayed in the foctor table provided) Cash payback period Net present value (b) Does the project meet the company's cash paryback criteria? Does it meet the net present value criteria for acceptance? eTextbook and Media U3 Compary is considerirg three long term capital investment groposals. Each irvestment hisa usefur lie of 5 years Redevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The campum/scost of capital is 15 ik- ABsume that canh flows occur evenly throughout the year. Click here to view PV table. Compute the cath payback period for each project. (Round enswers to 2 decimal ploces, es 10.50 ) Compute the net present value for each project. (Round answers to 0 decimal places, es. 125. If the net present value is negative, use either a negative sign preceding the number eg - 45 or parentheses eg (45). For calculotion purposes, use 5 decimal ploces as disployed in the factor fable provided.) Rank the projects on each of the for egoing bases. Which project do you recommend