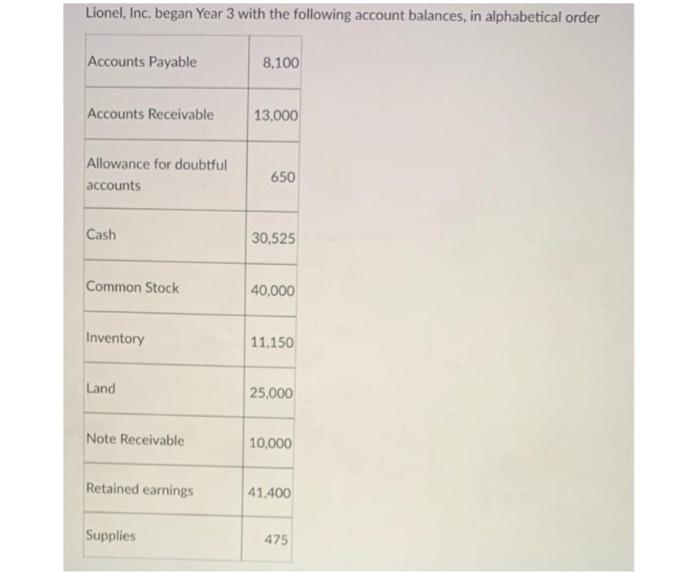

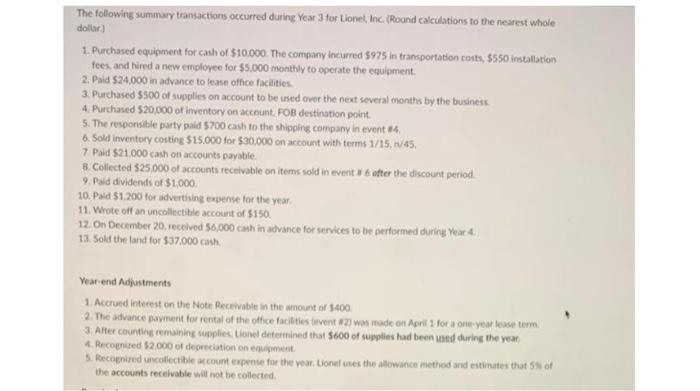

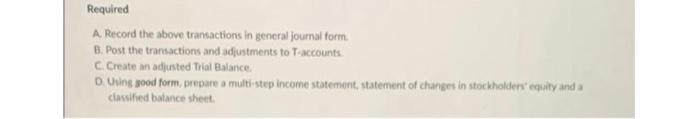

Lionel, Inc. began Year 3 with the following account balances, in alphabetical order Accounts Payable 8,100 Accounts Receivable 13,000 Allowance for doubtful accounts 650 Cash 30.525 Common Stock 40,000 Inventory 11.150 Land 25,000 Note Receivable 10,000 Retained earnings 41,400 Supplies 475 The following summary transactions occurred during Year 3 for Lionel, Inc. (Round calculations to the nearest whole dollar) 1. Purchased equipment for cash of $10.000. The company incurred 5975 in transportation costs, $550 installation fees and hired a new employee for $5.000 monthly to operate the equipment 2. Paid $24,000 in advance to bene office facilities 3. Purchased $500 of supplies on account to be used over the next several months by the business. 4. Purchased $20,000 of inventory on account. FOB destination point. 5. The responsible party paid $700 cash to the shipping company in event #4 6. Sold inventory costing $15.000 for $30.000 on account with terms 1/15, 1/45 7 Paid $21.000 cash on accounts payable. 8. Collected $25.000 of accounts receivable on items sold in event #6 ofter the discount period. 9. Paid dividends of $1,000 10. Paid $1.200 for advertising expense for the year 11. Wrote off an uncollectible account of $150. 12. On December 20, received $6.000 cash in advance for services to be performed during Year 4. 13. Sold the land for $37.900 cash Year-end Adjustments 1. Accrued interest on the Note Receivable in the mount of 5400 2. The advance payment for rental of the office facilities event #2) was made on April 1 for one year lease term 3. After counting remaining supplies, Lionel determined that $600 of supplies had been and during the year 4. Recognised $2.000 of depreciation on equipment 5. Recognized uncollectible account expense for the year. Lionel nes the allowance method and estimates that of the accounts receivable will not be collected Required A. Record the above transactions in general journal form B. Post the transactions and adjustments to accounts. Create an adjusted Trial Balance D. Using good form, prepare a multi-step income statement statement of changes in stockholders' equity and a classified balance sheet