Answered step by step

Verified Expert Solution

Question

1 Approved Answer

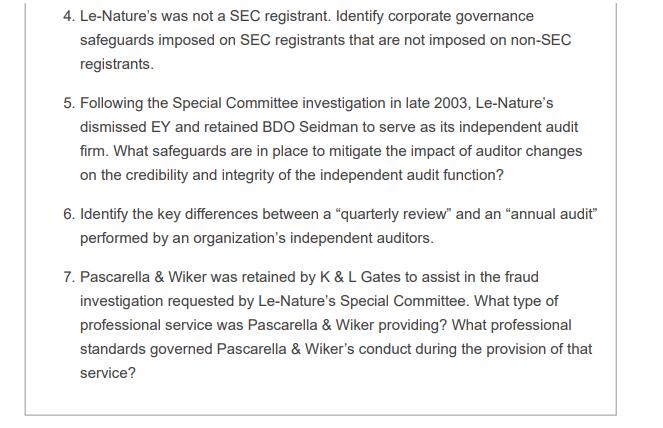

Le-Nature's Inc. After graduating from West Virginia University in 1984 with a degree in accounting and finance, Gregory Podlucky decided to work with his

Le-Nature's Inc. After graduating from West Virginia University in 1984 with a degree in accounting and finance, Gregory Podlucky decided to work with his father Gabriel, who had a small business empire in western Pennsylvania. * The senior Podlucky's business interests included a chain of auto parts stores, an ethanol fuel company, several real estate properties, and, most notably, the Jones Brewing Co., which is best known for its line of beers sold under the "Stoney's" brand name. In 1989, Gregory Podlucky decided to strike out on his own. Podlucky used the funds he obtained from cashing out his ownership interest in his father's businesses to establish a water bottling venture in LaTrobe, Pennsylvania, the hometown of golfing great Arnold Palmer. In 1992, the entrepreneur and former CPA expanded his product line to include a wide range of flavored water, fruit, and tea drinks. Despite competing in the hypercompetitive beverage industry, Podlucky's company, which he ultimately named Le-Nature's Inc., grew rapidly. By 2006, the company was the 33rd largest beverage producer in the United States with annual reported sales approaching $290 million and a workforce of several hundred employees. One year earlier, an investment group had offered Podlucky $1.2 billion for Le-Nature's, an offer he rejected. Instead of selling out, Podlucky decided to take his company public. Unfortunately for Podlucky, his fellow investors, and his company's many creditors, that dream was never realized. Strategic Financing Podlucky served as Le-Nature's chief executive officer (CEO) and relied principally on his family and wide circle of friends and business associates to staff the company's other key positions as it expanded over the years. He hired his brother, Jonathan, to serve as Le- Nature's chief operating officer (COO) and placed his 22-year-old son Jesse in charge of the day-to-day accounting for Le-Nature's large subsidiary that produced bottled tea products. Among the friends that he appointed to management positions at Le-Nature's was Robert Lynn, who had multiple titles over the years with the company including executive vice president of sales. Despite serving as Le-Nature's CEO, Gregory Podlucky was also heavily involved in the company's "routine accounting functions."* "Director of Accounting" was the title held by the organization's chief accountant, a position occupied by Tammy Andreycak, another close friend of Podlucky. Andreycak was a single mother who did not have a college degree or formal training in accounting. According to company insiders, her primary role within Le- Nature's was serving as Podlucky's confidante. When dealing with third parties, Podlucky often referred to Andreycak as his "secretary." A common nemesis of a rapidly growing small company is a shortage of capital. Gregory Podlucky relied on different strategies to finance his company's expanding operations. During the 14 years that he served as Le-Nature's CEO, the articulate and outgoing Podlucky raised almost $1 billion of debt and equity capital for the company. In 1999, Podlucky retained a financial consulting firm to identify potential investors for Le- Nature's. In 2000 and 2002, that consulting firm arranged for two investment funds to collectively purchase eight million shares of Le-Nature's preferred stock which they had the right to convert into the company's common stock. If the two funds had exercised the convertibility option, they would have controlled 45 percent of Le-Nature's outstanding common stock; Podlucky owned all of his company's outstanding common stock throughout its existence. The sales of preferred stock raised nearly $30 million for Le-Nature's. Those transactions directly impacted Le-Nature's corporate governance structure because each of the investment funds that purchased the preferred stock had the right to appoint an individual to the company's board of directors. The majority of the board consisted of "inside" directors including Podlucky, his brother, Jonathan, and other senior company executives. Another financing technique used by Podlucky was long-term equipment leasing. In one such transaction, Podlucky retained a North Carolina leasing agent to contract with a Wisconsin-based company that was a subsidiary of a German manufacturing firm. The German firm manufactured equipment Le-Nature's used in its bottling operations. With the North Carolina leasing agent serving as an intermediary, Le-Nature's leased the equipment from the Wisconsin subsidiary of the German firm. The leasing agreement required Le- Nature's to make a large escrow deposit with the leasing agent; Le-Nature's borrowed those funds from a U.S. lender. In total, Podlucky financed the acquisition of approximately $300 million of equipment in this manner. The primary method Podlucky used to raise funds for his company was conventional long- term borrowing arrangements. Wachovia, a diversified financial services firm based in North Carolina, arranged or underwrote approximately $500 million of long-term debt for Le- Nature's. In 2005, for example, Wachovia marketed a $150 million bond issue for the company. The high-yield or "junk" bonds were sold primarily to pension and retirement funds such as California Public Employees Retirement System (CalPERS), the nation's largest pension fund. Podlucky relied heavily on Le-Nature's' audited financial statements to borrow funds for his company. Take the case of the $150 million bond issue. Wachovia included Le-Nature's audited financial statements with the promotional materials for those bonds. Likewise, Moody's Investors Service accessed and relied on Le-Nature's financial statements to assign credit ratings to those bonds and the company's other outstanding debt obligations. Suspicions + Resignations Investigation In August 2003, Le-Nature's independent audit firm, Ernst & Young (EY), was completing its review of the company's financial statements for the second quarter of fiscal 2003. A standard procedure EY performed during the quarterly review was to ask a client's senior executives whether they were aware of, or suspected, any fraudulent activity within the organization. When Richard Lipovich, the EY audit engagement partner, posed that question to John Higbee, Le-Nature's CFO at the time, Higbee candidly replied that he had significant doubts regarding the reliability of his company's recorded sales figures. Lipovich received similar responses from Le-Nature's chief administrative officer (CAO) and its vice president of administration (VPA). The day after communicating their concerns to Lipovich, the three company officials submitted letters of resignation to Gregory Podlucky. In their resignation letters, the three former executives suggested that Podlucky was "engaging in improper conduct with Le-Nature's tea suppliers, equipment vendors, and certain customers."* Higbee-who had served for 20 years as an audit partner with Arthur Andersen & Co., including 16 years heading up the audit practice for that firm's Pittsburgh office-reported that Podlucky had repeatedly refused to provide him with documentation supporting key transactions reflected in Le-Nature's accounting records. He considered Podlucky's failure to provide such documentation "an astonishing and extremely improper restriction for any executive officer to impose upon a company's chief financial officer." Those restrictions made it impossible for Higbee to satisfy his CFO-related corporate governance responsibilities. Higbee also identified what he considered to be several material weaknesses in Le-Nature's internal controls. Those weaknesses included Podlucky's "absolute control" over the company's "detailed financial records" and the lack of "checks and balances" for key assets of the company such as the large escrow deposits for its long-term equipment leases and its product inventories. * The startling statements by Higbee and his two former colleagues in their resignation letters prompted Richard Lipovich to write a letter to Le-Nature's board of directors. In that letter, Lipovich requested that Le-Nature's retain an independent law firm to investigate and file a report regarding the allegations made by the three former company executives. Lipovich informed Le-Nature's board that EY would not be associated with any of the company's financial statements until 1) the external investigation was completed, 2) EY had reviewed the given report, and 3) the accounting firm had decided what other investigative procedures, if any, were necessary on its part. Le-Nature's board responded to Lipovich's letter by creating a Special Committee to investigate the allegations made by the three former executives. That committee was made up of the outside members of the company's board, which included the directors appointed by the investment funds that had purchased Le-Nature's preferred stock. The Special Committee retained an independent law firm, K & L Gates, one of the ten largest legal firms in the United States, to supervise that investigation. In turn, K & L Gates hired an independent accounting firm, Pascarella & Wiker, to assist in the investigation. In late November 2003, K & L Gates submitted a draft copy of its report to Podlucky, who was not a member of the Special Committee. The CEO provided feedback regarding the report to the law firm. One week later, K & L Gates provided a revised copy of the report to the members of the Special Committee. The report "found no evidence of fraud or malfeasance" although it did identify multiple internal control weaknesses. Among the suggestions made to remedy those internal control weaknesses were strengthening the segregation of duties for key transactions such as equipment leases and inventory purchases, adopting more rigorous documentation standards for those transactions, and establishing an audit committee consisting of outside directors. The outside directors on the Special Committee accepted the findings of the investigative report and indicated they would work with the other members of Le-Nature's board of directors to address the identified internal control problems. Shortly thereafter, Le-Nature's dismissed EY as its independent audit firm and retained BDO Seidman, which would ultimately audit the company's 2003 through 2005 financial statements. Fraud Allegations Resurface Following the 2003 investigation, Gregory Podlucky rededicated himself to enhancing his company's stature and size in the beverage industry. Le-Nature's impressive financial data caught the attention of several private equity funds in 2005 when Wachovia prepared and distributed a "confidential memorandum" to sell the company to the highest bidder. The initial bid received for the company was $1.2 billion. To the disappointment of the company's preferred stockholders, Podlucky rejected that offer. The preferred stockholders claimed that Podlucky intentionally sabotaged the sale of Le-Nature's by refusing to allow the potential buyer access to the company's accounting records. Podlucky dismissed that allegation and instead maintained he had rejected the buyout offer because the price had been too low. In May 2006, the preferred stockholders filed a lawsuit against Le-Nature's, Podlucky, and other top executives to force an outright sale of the company. Despite that lawsuit, Podlucky began preparing an initial public offering (IPO) for Le-Nature's with the assistance of K & L Gates. At the same time, Wachovia was in the process of arranging more than $300 million of additional long-term loans for Le-Nature's. Podlucky's plans for his company were disrupted when allegations of an accounting fraud within Le-Nature's resurfaced. The CEO refuted those allegations by pointing out that Le- Nature's independent auditors had issued unqualified opinions each year on the company's financial statements. Podlucky also insisted that "the financial stability of Le-Nature's has never been stronger" and boldly predicted that Le-Nature's sales would nearly quadruple over the next four years, increasing from approximately $290 million to more than $1 billion annually. In October 2006, Le-Nature's preferred stockholders requested a restraining order against the company in a petition they filed with a Delaware court. In the petition, the preferred stockholders referred the court to a fraudulent equipment leasing transaction arranged by Le-Nature's. One of the lenders that provided the financing for the company's long-term leases had determined, with the assistance of a handwriting expert, that certain documents for the given transaction had been forged. The forged documents had resulted in $20 million of the lease escrow deposit financed by the lender being improperly transferred to Le- Nature's. The Delaware court issued the requested restraining order, evicted Gregory Podlucky from the company's corporate headquarters, and appointed Steven Panagos of Kroll Zolfo Cooper, a consulting firm specializing in corporate turnarounds and restructuring, to serve as the custodian of Le-Nature's assets and operations. Less than one week later, Panagos filed an affidavit with the court that presented evidence of a massive accounting fraud within the company. He also reported that he had found evidence that Gregory Podlucky had "frantically shredded company documents" before he was forced to leave Le-Nature's corporate headquarters. Even more troubling was the custodian's discovery that the company had been maintaining two sets of accounting records. Panagos' affidavit spurred Le-Nature's creditors to file a petition to initiate involuntary bankruptcy proceedings against the company. A federal bankruptcy judge approved that petition and appointed a bankruptcy trustee to take control of Le-Nature's for the purpose of liquidating it and pursuing any viable legal claims against individuals or entities involved in undermining the company. Fraud on a Grand Scale Investigations of Le-Nature's accounting records by the company's court-appointed custodian, bankruptcy trustee, and law enforcement authorities revealed the sordid details of the brazen accounting hoax initiated by Gregory Podlucky in the late 1990s. The individual who would prove to be most helpful in unraveling the fraudulent scheme was Tammy Andrecyak, Le-Nature's Director of Accounting and Podlucky's most trusted associate. After pleading guilty to multiple criminal charges, Andrecyak agreed to cooperate with law enforcement authorities investigating the Le-Nature's scandal. A federal judge would subsequently note that Andrecyak and Podlucky were the only "two people aware of the magnitude of the [Le-Nature's] fraud." * James Garrett, a federal prosecutor with the U.S. Department of Justice (USDOJ) assigned to the Le-Nature's case, characterized the fraud masterminded by Podlucky as a "financial mirage the likes of which I could never even dreamt could have been created."* In 2002, the company had reported sales of more than $135 million when the company's actual sales were fewer than $2 million. Three years later, in 2005, the fiscal year before the fraud was uncovered, Le-Nature's audited financial statements reported revenues of $287 million when the company's actual revenues were fewer than $40 million. A large portion of the bogus revenues booked by Le-Nature's was cycled through its tea subsidiary. From 2000 through 2006, that subsidiary reported sales of $240 million while its actual sales during that period were fewer than $100,000. * Podlucky and his co-conspirators used Le-Nature's graphics department to prepare a slew of bogus purchase orders, sales invoices, and other fake documents to sustain the accounting fraud. The bogus documents allowed the conspirators to conceal Le-Nature's enormous volume of fictitious revenues from the company's lenders, independent auditors, and regulatory authorities. As determined by one of Le-Nature's lenders, the conspirators also used forged documents to improperly transfer deposits held in escrow by a leasing agent to Le-Nature's. In turn, that leasing agent provided confirmations to Le-Nature's independent auditors that intentionally overstated the dollar amount of deposits being held by his firm on behalf of the company. Le-Nature's maintained two completely separate accounting systems during the course of the massive accounting fraud. One system accumulated the company's actual transaction data, which only Podlucky and Andrecyak could access. The other accounting system contained primarily fraudulent financial data. The company's independent auditors were unaware of the former accounting system. Podlucky was also successful in concealing that accounting system from K & L Gates and Pascarella & Wiker, the law firm and accounting firm, respectively, that were involved in the Special Committee fraud investigation of 2003. Podlucky used Le-Nature's phony financial statements to convince third parties to loan funds to the company. He then siphoned off large amounts of those borrowed funds for his personal use. Because the stolen funds had to be repaid, it was necessary for Podlucky to continually borrow additional amounts. This cycle of repaying stolen funds with new loans caused law enforcement authorities to characterize his fraud as a Ponzi scheme. As pointed out by Le-Nature's court-appointed bankruptcy trustee, the 2003 Special Committee investigation tragically backfired on the company's preferred stockholders and creditors, who were the primary victims of Podlucky's scam. The "no fraud" conclusion included in the investigative report submitted to the Special Committee allowed Podlucky and his co-conspirators to continue "looting" the company "and wasting corporate funds on avoidable transactions" for three more years. * Federal law enforcement authorities placed a final price tag of nearly $700 million on the long-running scam masterminded by Gregory Podlucky. U.S. District Judge Alan Bloch, in a decision that was largely symbolic, imposed a $661 million restitution order on Podlucky. That figure included the huge losses suffered by Le-Nature's enormously unprofitable business operations and the funds embezzled and squandered by Podlucky and his family members. Podlucky used the embezzled funds to finance a lavish and ostentatious lifestyle. An audit of Podlucky's personal finances revealed that in one year he spent $45,000 on shoes; his corporate salary at the time was $50,000. When he lost control of Le-Nature's, Podlucky was building a palatial, 25,000-square-foot home near the company's headquarters that had a price tag approaching $20 million. Nearly $30 million of jewelry that had been purchased with Le-Nature's funds was discovered in a secret room within the company's corporate headquarters. Millions of dollars of additional jewelry were recovered years later when members of the Podlucky family attempted to sell the jewelry through the Sotheby's auction house. Other extravagant personal assets of Podlucky seized by law enforcement authorities included a small fleet of luxury automobiles and an immense model train collection that he had acquired at a cost of $1 million. The lynchpin of the Le-Nature's fraud was the fatal flaw in the company's corporate governance system that allowed Gregory Podlucky to single-handedly manipulate and distort the company's reported financial results. Outside of the company, Podlucky was perceived as a gregarious, well-meaning individual who was heavily involved in charitable, religious, and political organizations and activities. Internally, Podlucky, a physically large man, was known for his overbearing and volatile disposition. Podlucky used his domineering personality to control his subordinates. During their testimony in various court proceedings, Podlucky's former colleagues alluded to his "foul-mouthed, dictatorial style" that he used to "bully" them into submission. In one particularly revealing incident, Podlucky forced a fellow executive to take off his (Podlucky's) shoes, shine them, and then put them back on his feet. The executive was also forced to tie the shoes and adjust Podlucky's socks. Like his father and several other former Le-Nature's executives and employees, Jesse Podlucky would eventually face criminal charges for his role in the Le-Nature's fraud. A principal element of the defense strategy used by Jesse's attorneys was that the young accountant had been controlled and manipulated by his tyrannical father throughout his life which allegedly mitigated the degree to which he could be held responsible for his misdeeds. Jesse's attorneys reported that because of the senior Podlucky's "erratic" and "uncontrollable temper", his children had lived under a "reign of terror" in the Podlucky household. In one scene recalled by Jesse, his father hurled his own birthday cake against a wall and referred to his children with a derogatory epithet. In another incident, Jesse recalled that he was beaten so badly by his father that his face was "almost unrecognizable." * Epilogue In October 2011, Gregory Podlucky appeared before federal Judge Alan Bloch during his sentencing hearing after pleading guilty to mail fraud, income tax evasion, and conspiracy to commit money laundering. While addressing Judge Bloch, Podlucky stated, "I am appalled by my actions, Lord, I mean, your honor." * Later in the hearing, Podlucky referred to himself as a "filthy rag" and pleaded with the judge to give him a noncustodial sentence so he could create a charity to cater to the needs of federal prison inmates. Judge Bloch ignored Podlucky's tearful contrition and sentenced him to 20 years in federal prison for his egregious crimes. Seven of Podlucky's relatives and business associates also received prison sentences for their roles in the Le-Nature's fraud. Despite his attorneys' efforts to blame his criminal behavior on his overbearing father, Jesse Podlucky received a nine-year prison sentence after being convicted of money laundering. A similar conviction for Karla Podlucky, Gregory's wife and Jesse's mother, resulted in a four- year prison sentence. The money laundering charges against the two Podluckys stemmed from their involvement in covertly selling jewelry purchased with Le- Nature's corporate funds. The two had used the proceeds from the sale of the jewelry for improper expenditures including the payment of Gregory Podlucky's legal bills and, in the case of Jesse, the purchase of an $80,000 Mercedes Benz automobile. Podlucky's close associate Tammy Andrecyak received a five-year prison term despite her extensive cooperation with law enforcement authorities investigating the Le-Nature's fraud. After pleading guilty to one count of bank fraud, Jonathan Podlucky, Le-Nature's former COO, received a five-year sentence. Similar to Jesse and Karla Podlucky, Robert Lynn, Le-Nature's former executive vice president of sales, opted for a jury trial rather than pleading guilty to the criminal charges filed against him. Following his conviction on 10 fraud charges, Lynn received a 15-year prison sentence. Another former Le-Nature's executive received a prison sentence of 10 years after pleading guilty to bank fraud; a similar plea by one of Le-Nature's former leasing agents resulted in a five-year prison sentence. Multiple civil lawsuits were filed against several parties associated with Le-Nature's, including BDO Seidman. The plaintiffs in those lawsuits were Le-Nature's bondholders, other creditors, and Marc Kirschner, the company's court-appointed bankruptcy trustee. Kirschner negotiated out-of-court settlements of $12 million with BDO Seidman, $23.7 million with K & L Gates, and $895,000 with Pascarella & Wiker. The bankruptcy trustee's largest recovery was a $125 million collective payment made by two companies involved in the fraudulent equipment leasing transactions orchestrated by Gregory Podlucky. Kirschner agreed to a settlement of $38 million with Wells Fargo, the company that acquired Wachovia in 2008. Prior to that settlement, Kirschner had filed a federal racketeering lawsuit against Wachovia. Among other allegations, he maintained that Wachovia had continued to arrange financing for Le-Nature's despite "numerous red flags" that suggested the company's operating results were being embellished. * The huge loans arranged by Wachovia-but funded primarily by other lenders- reportedly earned the bank "tens of millions of dollars" in fees. * In 2006, Wachovia had taken the unusual measure of retaining PricewaterhouseCoopers (PwC) to investigate accounting decisions made by Le- Nature's. That decision was apparently prompted by Wachovia financial analysts who overtly challenged the authenticity of the company's financial data. One analyst questioned Le-Nature's reported sales figures since none of the company's products were being carried by major retailers, while another analyst for the bank characterized Le-Nature's reported financial data as "frankly worthless." * Questions 1. Identify the parties impacted by the quality and rigor of an organization's corporate governance. What responsibilities do corporate executives have to those parties? 2. Identify and describe the corporate governance-related responsibilities of corporate accountants, independent auditors, and external accountants hired by companies to perform forensic investigations. 3. Identify the apparent flaws in Le-Nature's corporate governance. Relate those flaws to the five components of the COSO internal control framework and the "fraud triangle." 4. Le-Nature's was not a SEC registrant. Identify corporate governance safeguards imposed on SEC registrants that are not imposed on non-SEC registrants. 5. Following the Special Committee investigation in late 2003, Le-Nature's dismissed EY and retained BDO Seidman to serve as its independent audit firm. What safeguards are in place to mitigate the impact of auditor changes on the credibility and integrity of the independent audit function? 6. Identify the key differences between a "quarterly review" and an "annual audit" performed by an organization's independent auditors. 7. Pascarella & Wiker was retained by K & L Gates to assist in the fraud investigation requested by Le-Nature's Special Committee. What type of professional service was Pascarella & Wiker providing? What professional standards governed Pascarella & Wiker's conduct during the provision of that service?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

KL Gates then hired the investigative firm Kroll Associates Inc to conduct the investigation Kroll was a leading international provider of investigative intelligence and risk consulting services Kroll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started