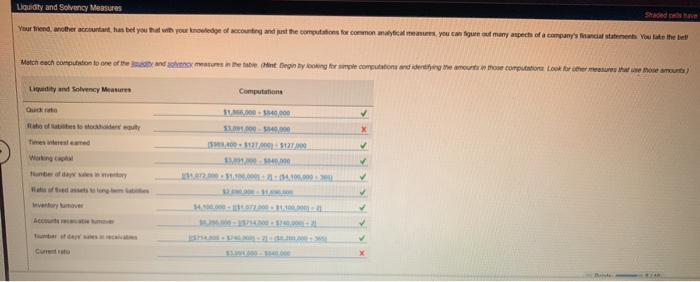

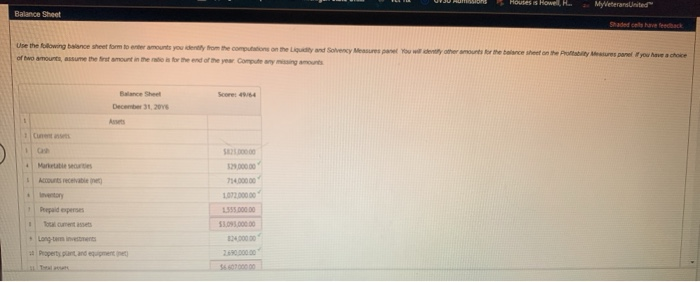

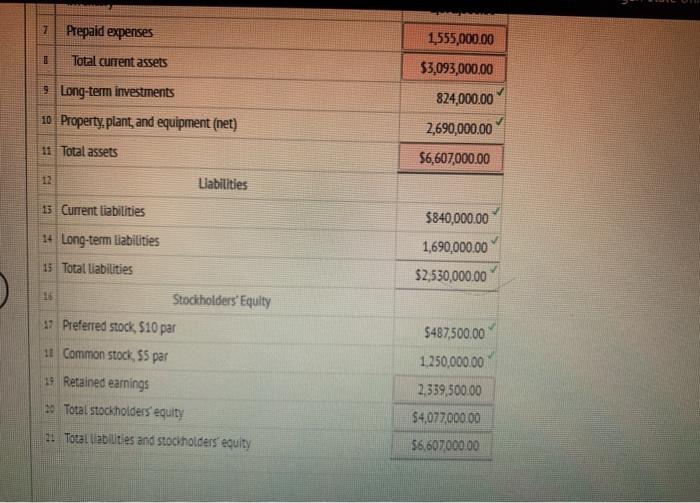

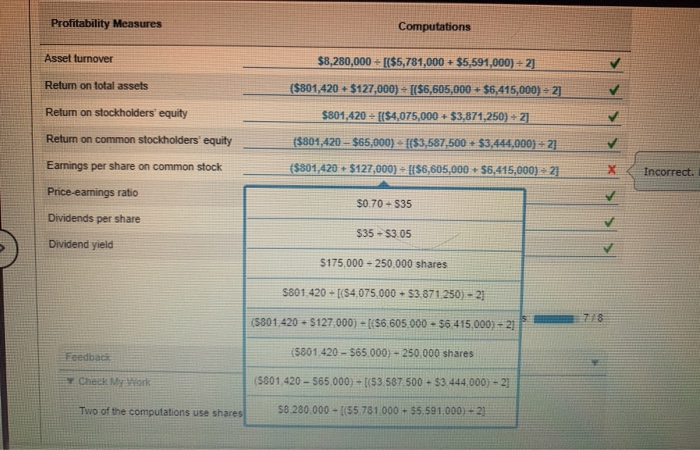

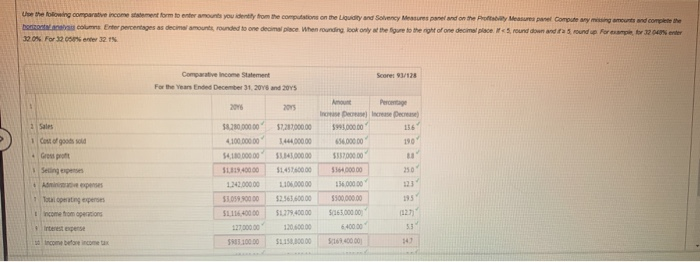

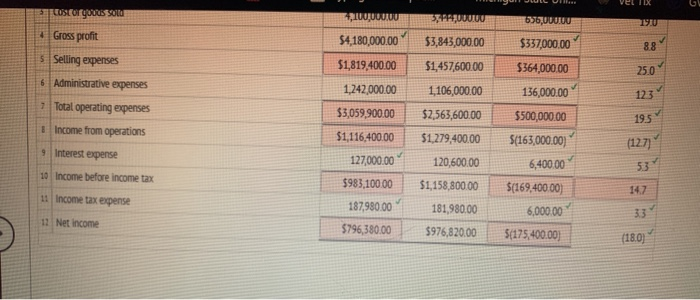

Liquidity and Solvency Measures Shaded ces have Your friend other accountant, has bed you that with your knowledge of accounting and just the computations for common analytical measures you can figure out many aspects of a company's financial statements you take the bell Match each computation to one of the suity and any measures in the table. (Hint Begin by looking for simple computations and identing the amounts in those computations Look for other measures that use the amount) Liquidity and Solvency Measures Computations Quick Ratio of testo stockholders' equity 31,000 - $340,000 33091000 - 540,000 (309.400 177.000) 5127.000 X Times werest earned 2.000 1.100.000 1.114.109,000 Ratio of free to long Inventory move 54,100,000.00 31.100.000 Accounts receiver umber of days since Currento Houses Howel H. My VeteransUnited Balance Sheet Shaded ca are feet Use the following balance sheet form to enter amounts you dently from the computations on the Land Solvency Measures are you will ently the amounts for the balance on the Potableres panel you nechoice of two amounts, assume the first amount in the main for the end of the year. Computery missing amounts Score: 49/64 Balance Sheet December 31, 2015 SED Martes Accounts receivable 120.000.00 754.000.00 17200000 Depudepes 1.555.000 DO 51.095.000.00 400000 Longo Property purtand equipment 566010000 1 Prepaid expenses 8 Total current assets 1,555,000.00 $3,093,000.00 9 Long-term investments 10 Property, plant, and equipment (net) 824,000.00 2,690,000.00 11 Total assets $6,607,000.00 12 Labilities 13 Current liabilities $840,000.00 14 Long-term Liabilities 15 Total Liabilities 1,690,000.00 $2,530,000.00 1 Stockholders' Equity 17 Preferred stock 510 par 11 Common stock, 55 par 19 Retained earnings 20 Total stockholders equity 11 Total liabilities and stockholders equity $487,500.00 1,250,000.00 2,359,500.00 $4,077,000.00 $6,607,000.00 Profitability Measures Computations Asset turnover $8,280,000 - [($5,781,000 + $5,591,000) + 2] Return on total assets ($801,420 +$127,000) = [($6,605,000+ $6,415,000) = 2] $801,420 - ($4,075,000 $3,871,250) + 2] Return on stockholders' equity Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio ($801,420 - $65,000) = [[$3,587,500 $3,444,000) + 2] (5801,420 + $127,000) = [($6,605,000 + $6,415,000) = 2] Incorrect. $0.70 - $35 Dividends per share $35 - $3.05 Dividend yield $175,000 - 250.000 shares $801.420 - [($4.075,000 - $3.871.250) - 2] (5801.420 - $127.000) = [($6,605.000 - $6 415,000) 21 Feedback (5801 420 - $65.000) - 250,000 shares Check My Work (5801 420-565000) - [(53.587.500 - $3 444,000) - 21 Two of the computations use shares $8.280,000 - (55 781 000 + $5.591.000) = 21 Use the following comparative income form to enter amounts you idently from the computations on the Liquidity and Solvency Measures and on the Profil Measures are computery i am ad complete the hotel com Enterpercentages as decimal amounts rounded to one decimal pace. When rounding look only the five to the right of one decimal places, round down and around up for 2018 300% For 2 arter 32.15 Score 93/128 Comparative Income Statement For the Year Ended December 31, 2018 and 2045 2016 2015 Amount Per In Decrease Decrease 599.000.00 Sales 1 Cost of goods sold Gross Selings 58.28000000 41000000 54.10000000 190 5111940000 144.000.00 141.000.00 $1.45760000 116.00000 $2.563,500.00 51279400.00 120.000 51.158,000.00 1.242.000.00 $3.059.90000 51.116.400.00 656.000 DO 5537,000.00 5564.000.00 156.000.00 5500.000.00 $165,000.00 6:40000 S1010000 Total operating pero Income from operations 185 Interest expense income before income 5985.100.00 VEL BX oscuroussu 1000000 SEPARUUUU 63UUUUU 19 Gross profit Selling expenses $4,180,000.00 $337,000.00 8.8 53,843,000.00 $1,457,600.00 25.0 6 Administrative expenses 123 2 Total operating expenses 1 Income from operations $1,819,400.00 1,242,000.00 $3,059,900.00 $1,116,400.00 1,106,000.00 $2,563,600.00 19.5 $1,279,400.00 (127) Interest expense $364,000.00 136,000.00 $500,000.00 $(163,000.00) 6,400.00 $(169,400.00 6,000.00 5(175,400.00) 53 10 Income before income tax 11 Income tax expense 127,000.00 $983,100.00 187,980.00 $796,380.00 120,600.00 $1,158,800.00 181,980.00 $976,820.00 33 11 Net Income (18.09 Liquidity and Solvency Measures Shaded ces have Your friend other accountant, has bed you that with your knowledge of accounting and just the computations for common analytical measures you can figure out many aspects of a company's financial statements you take the bell Match each computation to one of the suity and any measures in the table. (Hint Begin by looking for simple computations and identing the amounts in those computations Look for other measures that use the amount) Liquidity and Solvency Measures Computations Quick Ratio of testo stockholders' equity 31,000 - $340,000 33091000 - 540,000 (309.400 177.000) 5127.000 X Times werest earned 2.000 1.100.000 1.114.109,000 Ratio of free to long Inventory move 54,100,000.00 31.100.000 Accounts receiver umber of days since Currento Houses Howel H. My VeteransUnited Balance Sheet Shaded ca are feet Use the following balance sheet form to enter amounts you dently from the computations on the Land Solvency Measures are you will ently the amounts for the balance on the Potableres panel you nechoice of two amounts, assume the first amount in the main for the end of the year. Computery missing amounts Score: 49/64 Balance Sheet December 31, 2015 SED Martes Accounts receivable 120.000.00 754.000.00 17200000 Depudepes 1.555.000 DO 51.095.000.00 400000 Longo Property purtand equipment 566010000 1 Prepaid expenses 8 Total current assets 1,555,000.00 $3,093,000.00 9 Long-term investments 10 Property, plant, and equipment (net) 824,000.00 2,690,000.00 11 Total assets $6,607,000.00 12 Labilities 13 Current liabilities $840,000.00 14 Long-term Liabilities 15 Total Liabilities 1,690,000.00 $2,530,000.00 1 Stockholders' Equity 17 Preferred stock 510 par 11 Common stock, 55 par 19 Retained earnings 20 Total stockholders equity 11 Total liabilities and stockholders equity $487,500.00 1,250,000.00 2,359,500.00 $4,077,000.00 $6,607,000.00 Profitability Measures Computations Asset turnover $8,280,000 - [($5,781,000 + $5,591,000) + 2] Return on total assets ($801,420 +$127,000) = [($6,605,000+ $6,415,000) = 2] $801,420 - ($4,075,000 $3,871,250) + 2] Return on stockholders' equity Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio ($801,420 - $65,000) = [[$3,587,500 $3,444,000) + 2] (5801,420 + $127,000) = [($6,605,000 + $6,415,000) = 2] Incorrect. $0.70 - $35 Dividends per share $35 - $3.05 Dividend yield $175,000 - 250.000 shares $801.420 - [($4.075,000 - $3.871.250) - 2] (5801.420 - $127.000) = [($6,605.000 - $6 415,000) 21 Feedback (5801 420 - $65.000) - 250,000 shares Check My Work (5801 420-565000) - [(53.587.500 - $3 444,000) - 21 Two of the computations use shares $8.280,000 - (55 781 000 + $5.591.000) = 21 Use the following comparative income form to enter amounts you idently from the computations on the Liquidity and Solvency Measures and on the Profil Measures are computery i am ad complete the hotel com Enterpercentages as decimal amounts rounded to one decimal pace. When rounding look only the five to the right of one decimal places, round down and around up for 2018 300% For 2 arter 32.15 Score 93/128 Comparative Income Statement For the Year Ended December 31, 2018 and 2045 2016 2015 Amount Per In Decrease Decrease 599.000.00 Sales 1 Cost of goods sold Gross Selings 58.28000000 41000000 54.10000000 190 5111940000 144.000.00 141.000.00 $1.45760000 116.00000 $2.563,500.00 51279400.00 120.000 51.158,000.00 1.242.000.00 $3.059.90000 51.116.400.00 656.000 DO 5537,000.00 5564.000.00 156.000.00 5500.000.00 $165,000.00 6:40000 S1010000 Total operating pero Income from operations 185 Interest expense income before income 5985.100.00 VEL BX oscuroussu 1000000 SEPARUUUU 63UUUUU 19 Gross profit Selling expenses $4,180,000.00 $337,000.00 8.8 53,843,000.00 $1,457,600.00 25.0 6 Administrative expenses 123 2 Total operating expenses 1 Income from operations $1,819,400.00 1,242,000.00 $3,059,900.00 $1,116,400.00 1,106,000.00 $2,563,600.00 19.5 $1,279,400.00 (127) Interest expense $364,000.00 136,000.00 $500,000.00 $(163,000.00) 6,400.00 $(169,400.00 6,000.00 5(175,400.00) 53 10 Income before income tax 11 Income tax expense 127,000.00 $983,100.00 187,980.00 $796,380.00 120,600.00 $1,158,800.00 181,980.00 $976,820.00 33 11 Net Income (18.09