Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Liquidity Premium Incorporated uses the Liquidity Premium Theory. On 10/05/20 they forecasts that (1-year) interest rates are going to be higher over the next two

Liquidity Premium Incorporated uses the Liquidity Premium Theory. On 10/05/20 they forecasts that (1-year) interest rates are going to be higher over the next two years at .19%; i.e. 2021 = 2022 = 0.19%.

Liquidity Premium Incorporated uses the Liquidity Premium Theory. On 10/05/20 they forecasts that (1-year) interest rates are going to be higher over the next two years at .19%; i.e. 2021 = 2022 = 0.19%.

Please post detailed process, not an excle sheet, thank you!

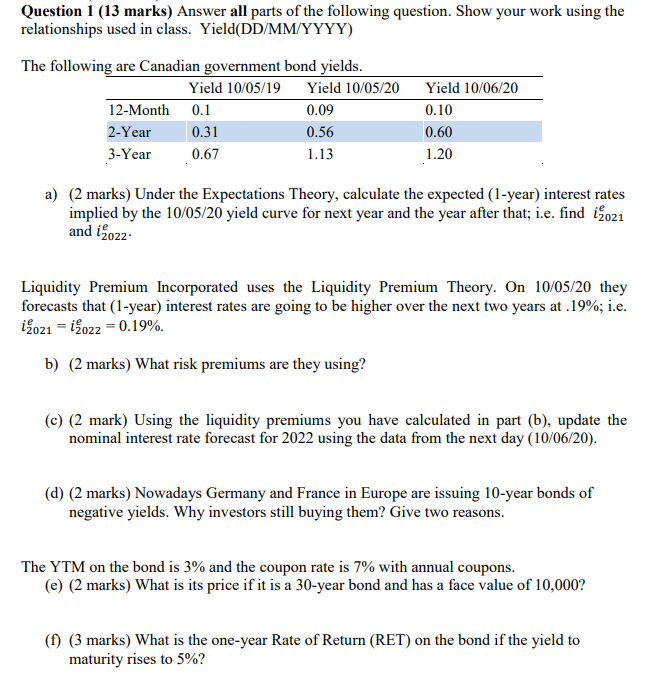

Question 1 (13 marks) Answer all parts of the following question. Show your work using the relationships used in class. Yield(DD/MM/YYYY) The following are Canadian government bond yields. Yield 10/05/19 Yield 10/05/20 Yield 10/06/20 12-Month 0.1 0.09 0.10 2-Year 0.31 0.56 0.60 3-Year 0.67 1.13 1.20 a) (2 marks) Under the Expectations Theory, calculate the expected (1-year) interest rates implied by the 10/05/20 yield curve for next year and the year after that; i.e. find i2021 and io22 Liquidity Premium Incorporated uses the Liquidity Premium Theory. On 10/05/20 they forecasts that (1-year) interest rates are going to be higher over the next two years at .19%; i.e. i oz1 = 2022 = 0.19%. b) (2 marks) What risk premiums are they using? (c) (2 mark) Using the liquidity premiums you have calculated in part (b), update the nominal interest rate forecast for 2022 using the data from the next day (10/06/20). (d) (2 marks) Nowadays Germany and France in Europe are issuing 10-year bonds of negative yields. Why investors still buying them? Give two reasons. The YTM on the bond is 3% and the coupon rate is 7% with annual coupons. (e) (2 marks) What is its price if it is a 30-year bond and has a face value of 10,000? (f) (3 marks) What is the one-year Rate of Return (RET) on the bond if the yield to maturity rises to 5%? Question 1 (13 marks) Answer all parts of the following question. Show your work using the relationships used in class. Yield(DD/MM/YYYY) The following are Canadian government bond yields. Yield 10/05/19 Yield 10/05/20 Yield 10/06/20 12-Month 0.1 0.09 0.10 2-Year 0.31 0.56 0.60 3-Year 0.67 1.13 1.20 a) (2 marks) Under the Expectations Theory, calculate the expected (1-year) interest rates implied by the 10/05/20 yield curve for next year and the year after that; i.e. find i2021 and io22 Liquidity Premium Incorporated uses the Liquidity Premium Theory. On 10/05/20 they forecasts that (1-year) interest rates are going to be higher over the next two years at .19%; i.e. i oz1 = 2022 = 0.19%. b) (2 marks) What risk premiums are they using? (c) (2 mark) Using the liquidity premiums you have calculated in part (b), update the nominal interest rate forecast for 2022 using the data from the next day (10/06/20). (d) (2 marks) Nowadays Germany and France in Europe are issuing 10-year bonds of negative yields. Why investors still buying them? Give two reasons. The YTM on the bond is 3% and the coupon rate is 7% with annual coupons. (e) (2 marks) What is its price if it is a 30-year bond and has a face value of 10,000? (f) (3 marks) What is the one-year Rate of Return (RET) on the bond if the yield to maturity rises to 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started