Question

Liquidity Risk Debtors ageing budget The historical records show that the debtors balance at the end of each quarter is usually about 20% of the

Liquidity Risk

Debtors ageing budget

The historical records show that the debtors balance at the end of each quarter is usually about 20% of the

quarter's sales. At any time in the debtors balances 1% of the total debtors is overdue 90 days and over, 5% is 60

days overdue, 10% is 30 days overdue and the balance of the total debtors is current. The aged debtors' budgets

are only distributed to the accountant and the accounts receivable clerk.

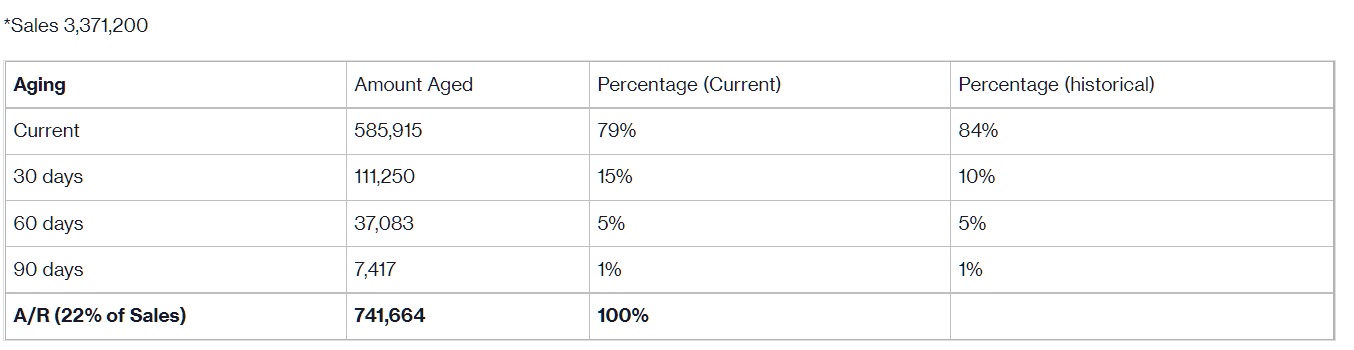

AGED DEBTORS BUDGET Qtr 1

Sales 3,371,200

% Debtors Sales 22%

Total Debtors 741,664

Current 585,915

30 days 111,250

60 days 37,083

90 days 7,417

Total Debtors 741,664

How can calculate the financial analysis of the liquidity risk based on the given information?

And how the risk treatment options will impact on future financial performance.

This question has been ANSWERED already

see below:

Explanation:

Liquidity Risk Analysisreports are viewed as monetary administration apparatuses that are utilized by monetary administrators to screen and project the organization's liquidity. A vital usefulness in this sort of report permits the client to score the danger dependent on a weighted normal of different drivers that include the general liquidity hazard number as found in the picture underneath. The client can discover more subtleties by growing the part underneath the danger rating. In this part, parts, like money, receivables, EBITDA, payables, obligation, and so forth can be seen. The report pulls these figures from the fundamental Cash Flow gauge, which binds to the Profit and Loss and Balance Sheet estimate. You will discover an illustration of this sort of report beneath.

Purpose behind Liquidity Analysis Reports

Organizations and associations use Liquidity Analysis Reports to break down authentic and anticipated periods to all the more likely oversee liquidity. It can likewise distinguish unanticipated, just as, arranged business exercises that require money or financing. When utilized as a component of good strategic policies in a Finance and Accounting Department, an organization can further develop its liquidity-related choices just as decrease the danger that it runs out of cash.

Financial Analysis on Liquidity Risk

Aging of Receivables

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started