Question

Lisa is a self-employed architect who also is a partner in a successful architectural firm. She receives a substantial part of her income from

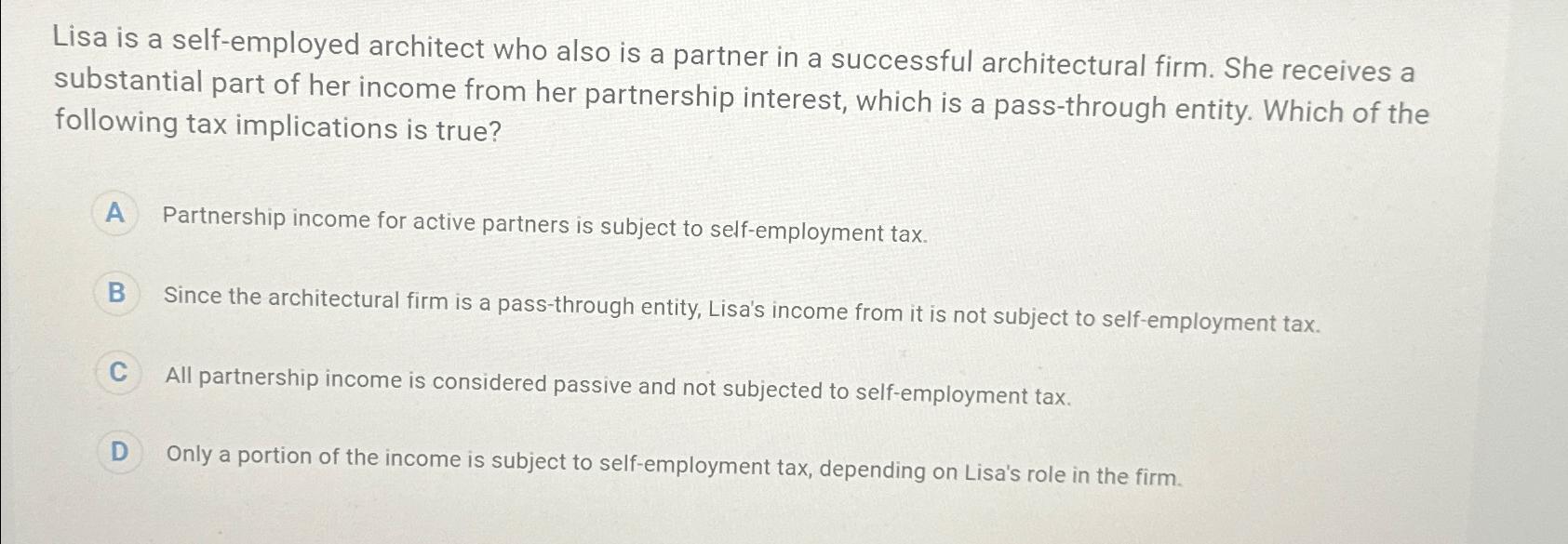

Lisa is a self-employed architect who also is a partner in a successful architectural firm. She receives a substantial part of her income from her partnership interest, which is a pass-through entity. Which of the following tax implications is true? A Partnership income for active partners is subject to self-employment tax. B Since the architectural firm is a pass-through entity, Lisa's income from it is not subject to self-employment tax. C All partnership income is considered passive and not subjected to self-employment tax. D Only a portion of the income is subject to self-employment tax, depending on Lisa's role in the firm.

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics

Authors: Andrew B. Abel, Ben S. Bernanke, Dean Croushore, Ronald D. Kneebone

6th Canadian Edition

321675606, 978-0321675606

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App