Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lisa is in her mid-20s. She just found a secure job as a middle school teacher. Her investment in the tax-deferred retirement account will

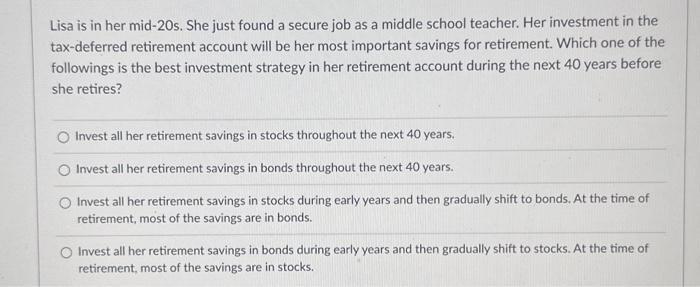

Lisa is in her mid-20s. She just found a secure job as a middle school teacher. Her investment in the tax-deferred retirement account will be her most important savings for retirement. Which one of the followings is the best investment strategy in her retirement account during the next 40 years before she retires? Invest all her retirement savings in stocks throughout the next 40 years. Invest all her retirement savings in bonds throughout the next 40 years. Invest all her retirement savings in stocks during early years and then gradually shift to bonds. At the time of retirement, most of the savings are in bonds. O Invest all her retirement savings in bonds during early years and then gradually shift to stocks. At the time of retirement, most of the savings are in stocks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Based on Lisas age time horizon and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started