Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lisa's Floral Arrangements, Inc. had the following transactions in the month of January: The owners invested $200,000 (the par value of the stock) for

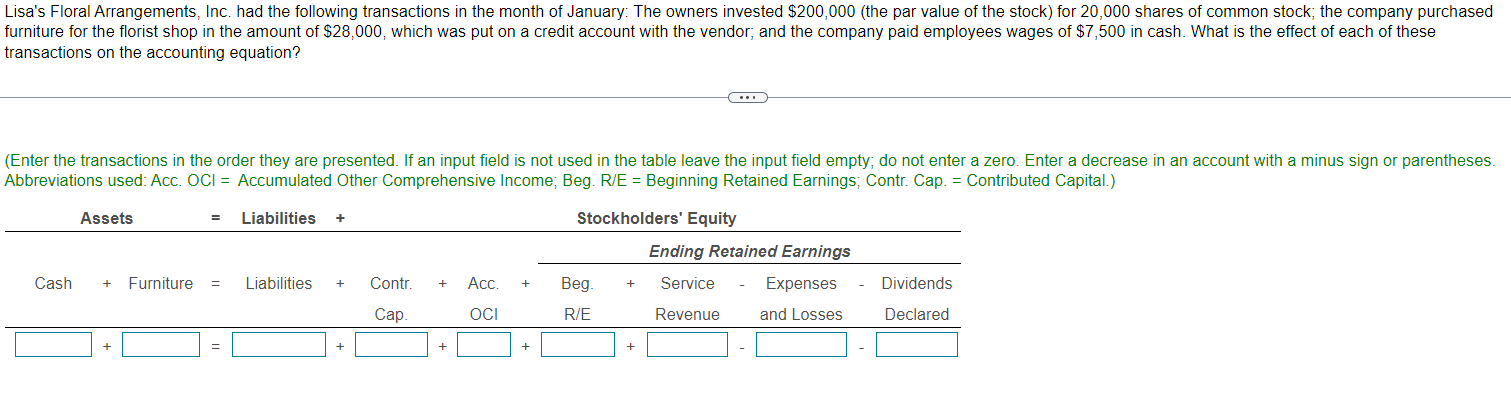

Lisa's Floral Arrangements, Inc. had the following transactions in the month of January: The owners invested $200,000 (the par value of the stock) for 20,000 shares of common stock; the company purchased furniture for the florist shop in the amount of $28,000, which was put on a credit account with the vendor; and the company paid employees wages of $7,500 in cash. What is the effect of each of these transactions on the accounting equation? (Enter the transactions in the order they are presented. If an input field is not used in the table leave the input field empty; do not enter a zero. Enter a decrease in an account with a minus sign or parentheses. Abbreviations used: Acc. OCI = Accumulated Other Comprehensive Income; Beg. R/E = Beginning Retained Earnings; Contr. Cap. = Contributed Capital.) Liabilities + Stockholders' Equity Assets = Cash + Furniture = Liabilities + + Contr. + Acc. + Cap. OCI + + Beg. R/E Ending Retained Earnings + Service - Expenses Revenue and Losses + Dividends Declared

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the effect of each transaction on the accounting equation 1 The owners invested 200000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started