Answered step by step

Verified Expert Solution

Question

1 Approved Answer

list and describe five factors that are used to determine credit score? conclude on the acceptability of Jim's credit score to the bank. - Assume

list and describe five factors that are used to determine credit score? conclude on the acceptability of Jim's credit score to the bank.

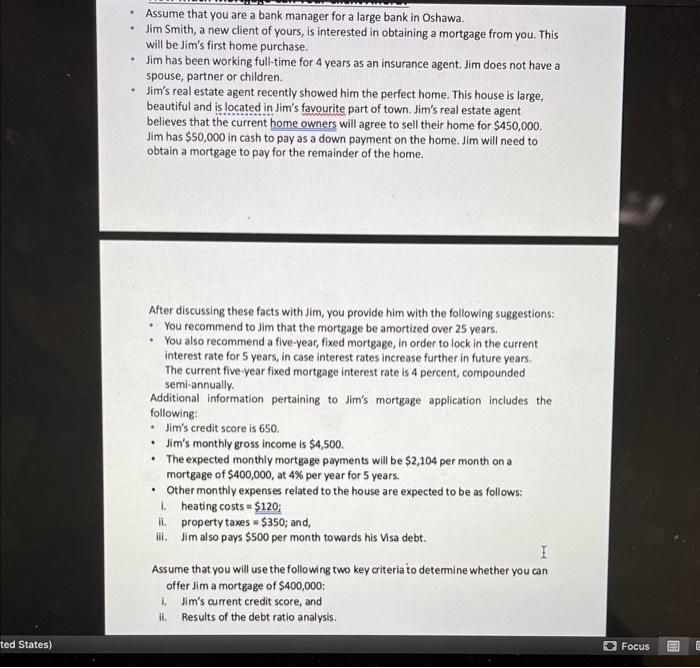

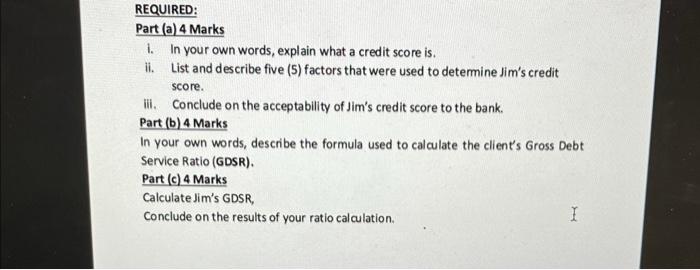

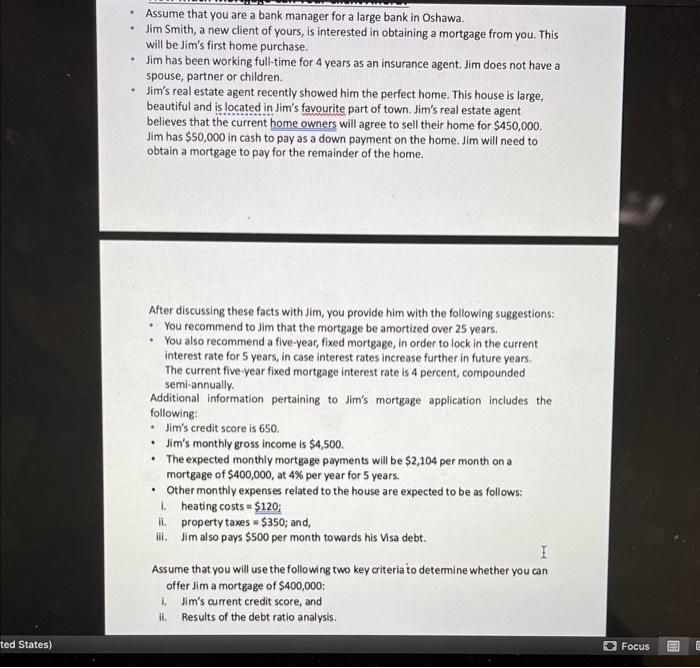

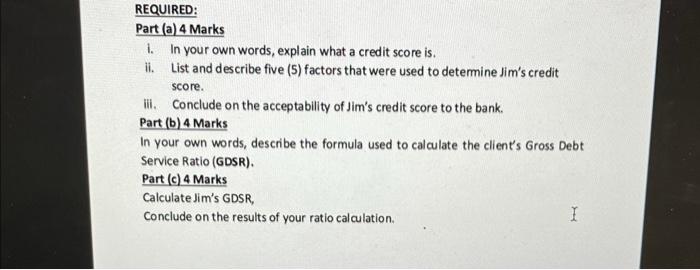

- Assume that you are a bank manager for a large bank in Oshawa. - Jim Smith, a new client of yours, is interested in obtaining a mortgage from you. This will be Jim's first home purchase. - Jim has been working full-time for 4 years as an insurance agent. Jim does not have a spouse, partner or children. - Jim's real estate agent recently showed him the perfect home. This house is large, beautiful and is located in Jim's favourite part of town. Jim's real estate agent believes that the current home owners will agree to sell their home for $450,000. Jim has $50,000 in cash to pay as a down payment on the home. Jim will need to obtain a mortgage to pay for the remainder of the home. After discussing these facts with Jim, you provide him with the following suggestions: - You recommend to Jim that the mortgage be amortized over 25 years. - You also recommend a five-year, fixed mortgage, in order to lock in the current interest rate for 5 years, in case interest rates increase further in future years. The current five-year fixed mortgage interest rate is 4 percent, compounded semi-annually. Additional information pertaining to Jim's mortgage application includes the following: - Jim's credit score is 650 . - Jim's monthly gross income is $4,500. - The expected monthly mortgage payments will be $2,104 per month on a mortgage of $400,000, at 4% per year for 5 years. - Other monthly expenses related to the house are expected to be as follows: i. heating costs =$120; ii. property taxes =$350; and, iii. Jim also pays $500 per month towards his Visa debt. Assume that you will use the following two key criteria to determine whether you can offer Jim a mortgage of $400,000 : i. Jim's current credit score, and ii. Results of the debt ratio analysis. REQUIRED: Part (a) 4 Marks 1. In your own words, explain what a credit score is. ii. List and describe five (5) factors that were used to detemine Jim's credit score. iii. Conclude on the acceptability of Jim's credit score to the bank. Part (b) 4 Marks In your own words, describe the formula used to calculate the client's Gross Debt Service Ratio (GDSR). Part (c) 4 Marks Calculate Jim's GDSR, Conclude on the results of your ratio calculation. - Assume that you are a bank manager for a large bank in Oshawa. - Jim Smith, a new client of yours, is interested in obtaining a mortgage from you. This will be Jim's first home purchase. - Jim has been working full-time for 4 years as an insurance agent. Jim does not have a spouse, partner or children. - Jim's real estate agent recently showed him the perfect home. This house is large, beautiful and is located in Jim's favourite part of town. Jim's real estate agent believes that the current home owners will agree to sell their home for $450,000. Jim has $50,000 in cash to pay as a down payment on the home. Jim will need to obtain a mortgage to pay for the remainder of the home. After discussing these facts with Jim, you provide him with the following suggestions: - You recommend to Jim that the mortgage be amortized over 25 years. - You also recommend a five-year, fixed mortgage, in order to lock in the current interest rate for 5 years, in case interest rates increase further in future years. The current five-year fixed mortgage interest rate is 4 percent, compounded semi-annually. Additional information pertaining to Jim's mortgage application includes the following: - Jim's credit score is 650 . - Jim's monthly gross income is $4,500. - The expected monthly mortgage payments will be $2,104 per month on a mortgage of $400,000, at 4% per year for 5 years. - Other monthly expenses related to the house are expected to be as follows: i. heating costs =$120; ii. property taxes =$350; and, iii. Jim also pays $500 per month towards his Visa debt. Assume that you will use the following two key criteria to determine whether you can offer Jim a mortgage of $400,000 : i. Jim's current credit score, and ii. Results of the debt ratio analysis. REQUIRED: Part (a) 4 Marks 1. In your own words, explain what a credit score is. ii. List and describe five (5) factors that were used to detemine Jim's credit score. iii. Conclude on the acceptability of Jim's credit score to the bank. Part (b) 4 Marks In your own words, describe the formula used to calculate the client's Gross Debt Service Ratio (GDSR). Part (c) 4 Marks Calculate Jim's GDSR, Conclude on the results of your ratio calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started