Answered step by step

Verified Expert Solution

Question

1 Approved Answer

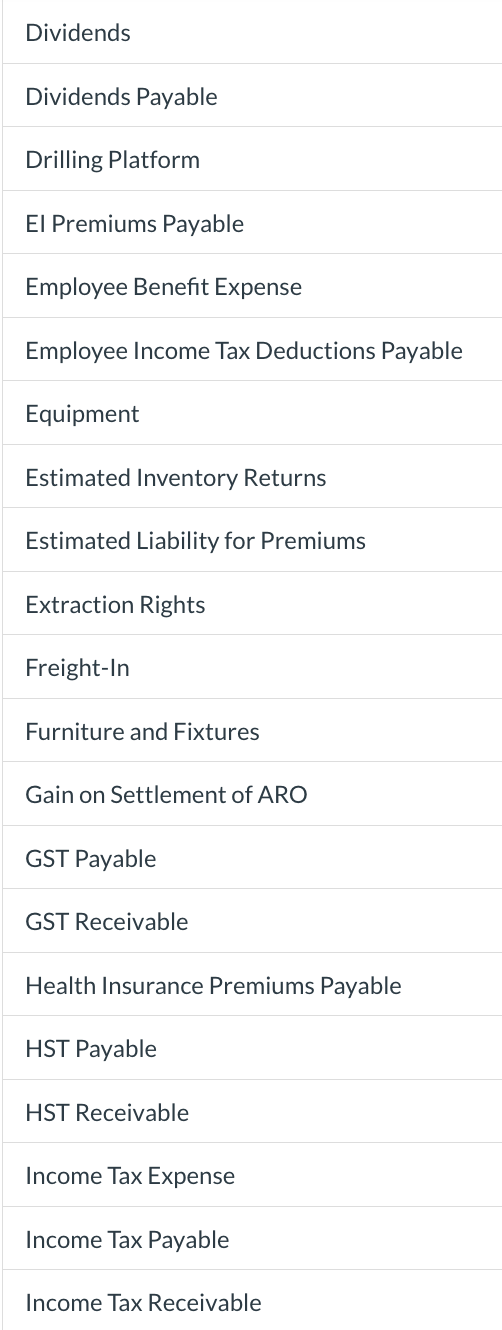

List of Accounts Accounts Payable Accounts Receivable Accretion Expense Accrued Liabilities Accumulated Depreciation - Buildings Accumulated Depreciation - Drilling Platform Accumulated Depreciation - Equipment Accumulated

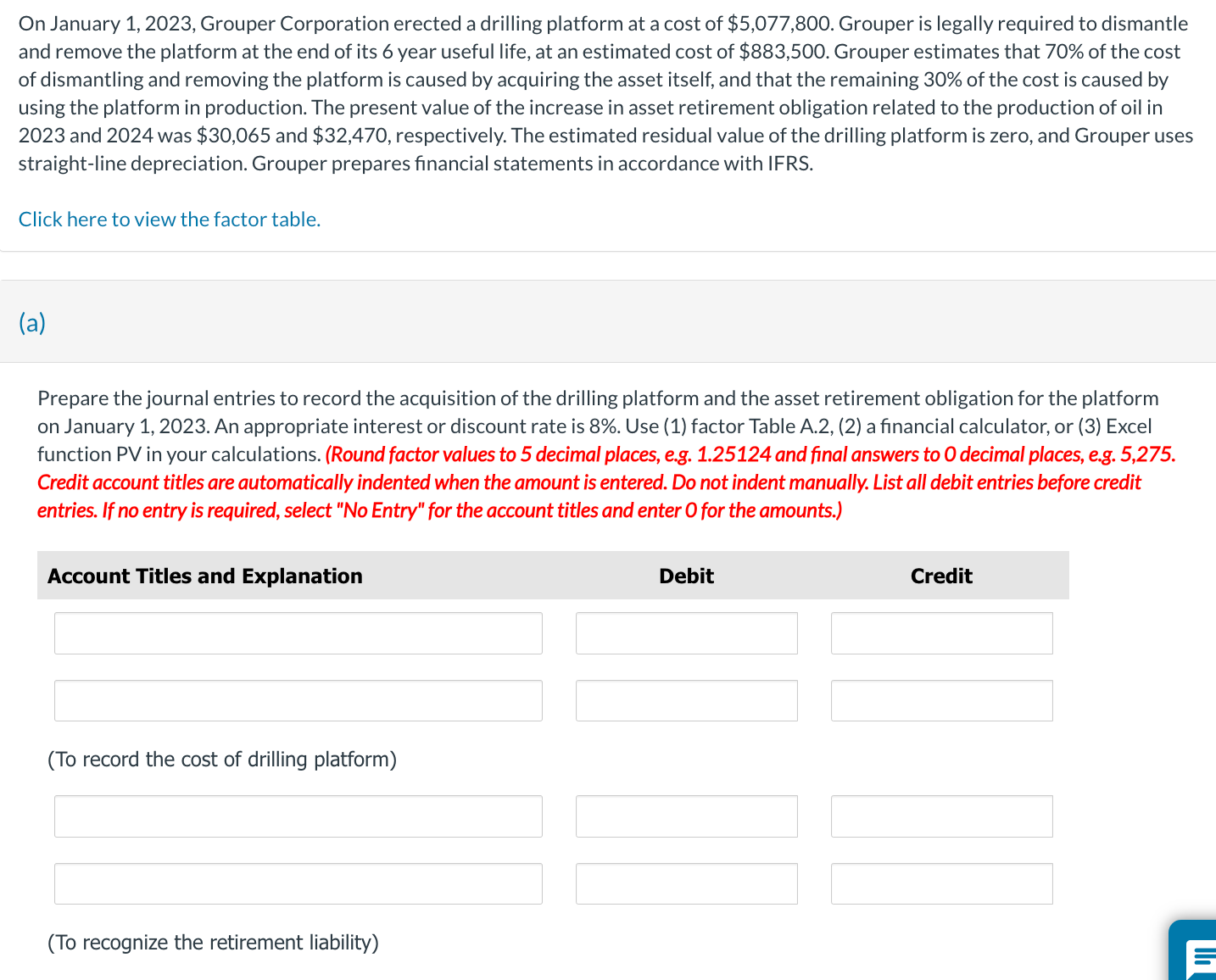

List of Accounts Accounts Payable Accounts Receivable Accretion Expense Accrued Liabilities Accumulated Depreciation - Buildings Accumulated Depreciation - Drilling Platform Accumulated Depreciation - Equipment Accumulated Depreciation - Land Improvements Accumulated Depreciation - Mineral Resources Accumulated Depreciation - Oil Tanker Depot Asset Retirement Obligation Bonus Expense Bonus Payable Buildings Cash Cost of Goods Sold CPP Contributions Payable Current Tax Expense Deposits Depreciation Expense Dividends Dividends Payable Drilling Platform El Premiums Payable Employee Benefit Expense Employee Income Tax Deductions Payable Equipment Estimated Inventory Returns Estimated Liability for Premiums Extraction Rights Freight-In Furniture and Fixtures Gain on Settlement of ARO GST Payable GST Receivable Health Insurance Premiums Payable HST Payable HST Receivable Income Tax Expense Income Tax Payable Income Tax Receivable Returned Inventory Salaries and Wages Expense Salaries and Wages Payable Sales Returns and Allowances Sales Revenue Sales Tax Payable Service Revenue Sick Pay Wages Payable Subscriptions Revenue Supplies Expense Trucks Unearned Rent Revenue Unearned Revenue Unearned Subscriptions Revenue Unearned Warranty Revenue Union Dues Payable Vacation Wages Payable Vehicles Warranty Expense Warranty Liability Warranty Revenue Notes Receivable Oil Tanker Depot Parental Leave Benefits Payable Payroll Tax Expense Payroll Taxes Payable Premium Expense Premium Liability Prepaid Expenses Property Tax Expense Property Tax Payable PST Payable Purchase Discounts Purchase Discounts Lost Purchase Returns and Allowances Purchases Refund Liability Rent Expense Rent Payable Rent Revenue Retained Earnings Returnable Deposits Interest Expense Interest Income Interest Payable Interest Receivable Inventory Inventory of Premiums Inventory or Accumulated Impairment Losses Land Improvements Liability for Environmental Clean-up Liability for Guarantee Liability to Affiliated Company Litigation Expense Litigation Liability Loss Due to Environmental Clean-up Loss on Expropriation Loss on Guarantee Loss on Settlement of ARO Materials, Cash, Payables Mineral Resources No Entry Notes Payable On January 1,2023 , Grouper Corporation erected a drilling platform at a cost of $5,077,800. Grouper is legally required to dismantle and remove the platform at the end of its 6 year useful life, at an estimated cost of $883,500. Grouper estimates that 70% of the cost of dismantling and removing the platform is caused by acquiring the asset itself, and that the remaining 30% of the cost is caused by using the platform in production. The present value of the increase in asset retirement obligation related to the production of oil in 2023 and 2024 was $30,065 and $32,470, respectively. The estimated residual value of the drilling platform is zero, and Grouper uses straight-line depreciation. Grouper prepares financial statements in accordance with IFRS. Click here to view the factor table. (a) Prepare the journal entries to record the acquisition of the drilling platform and the asset retirement obligation for the platform on January 1, 2023. An appropriate interest or discount rate is 8%. Use (1) factor Table A.2, (2) a financial calculator, or (3) Excel function PV in your calculations. (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

List of Accounts Accounts Payable Accounts Receivable Accretion Expense Accrued Liabilities Accumulated Depreciation - Buildings Accumulated Depreciation - Drilling Platform Accumulated Depreciation - Equipment Accumulated Depreciation - Land Improvements Accumulated Depreciation - Mineral Resources Accumulated Depreciation - Oil Tanker Depot Asset Retirement Obligation Bonus Expense Bonus Payable Buildings Cash Cost of Goods Sold CPP Contributions Payable Current Tax Expense Deposits Depreciation Expense Dividends Dividends Payable Drilling Platform El Premiums Payable Employee Benefit Expense Employee Income Tax Deductions Payable Equipment Estimated Inventory Returns Estimated Liability for Premiums Extraction Rights Freight-In Furniture and Fixtures Gain on Settlement of ARO GST Payable GST Receivable Health Insurance Premiums Payable HST Payable HST Receivable Income Tax Expense Income Tax Payable Income Tax Receivable Returned Inventory Salaries and Wages Expense Salaries and Wages Payable Sales Returns and Allowances Sales Revenue Sales Tax Payable Service Revenue Sick Pay Wages Payable Subscriptions Revenue Supplies Expense Trucks Unearned Rent Revenue Unearned Revenue Unearned Subscriptions Revenue Unearned Warranty Revenue Union Dues Payable Vacation Wages Payable Vehicles Warranty Expense Warranty Liability Warranty Revenue Notes Receivable Oil Tanker Depot Parental Leave Benefits Payable Payroll Tax Expense Payroll Taxes Payable Premium Expense Premium Liability Prepaid Expenses Property Tax Expense Property Tax Payable PST Payable Purchase Discounts Purchase Discounts Lost Purchase Returns and Allowances Purchases Refund Liability Rent Expense Rent Payable Rent Revenue Retained Earnings Returnable Deposits Interest Expense Interest Income Interest Payable Interest Receivable Inventory Inventory of Premiums Inventory or Accumulated Impairment Losses Land Improvements Liability for Environmental Clean-up Liability for Guarantee Liability to Affiliated Company Litigation Expense Litigation Liability Loss Due to Environmental Clean-up Loss on Expropriation Loss on Guarantee Loss on Settlement of ARO Materials, Cash, Payables Mineral Resources No Entry Notes Payable On January 1,2023 , Grouper Corporation erected a drilling platform at a cost of $5,077,800. Grouper is legally required to dismantle and remove the platform at the end of its 6 year useful life, at an estimated cost of $883,500. Grouper estimates that 70% of the cost of dismantling and removing the platform is caused by acquiring the asset itself, and that the remaining 30% of the cost is caused by using the platform in production. The present value of the increase in asset retirement obligation related to the production of oil in 2023 and 2024 was $30,065 and $32,470, respectively. The estimated residual value of the drilling platform is zero, and Grouper uses straight-line depreciation. Grouper prepares financial statements in accordance with IFRS. Click here to view the factor table. (a) Prepare the journal entries to record the acquisition of the drilling platform and the asset retirement obligation for the platform on January 1, 2023. An appropriate interest or discount rate is 8%. Use (1) factor Table A.2, (2) a financial calculator, or (3) Excel function PV in your calculations. (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started