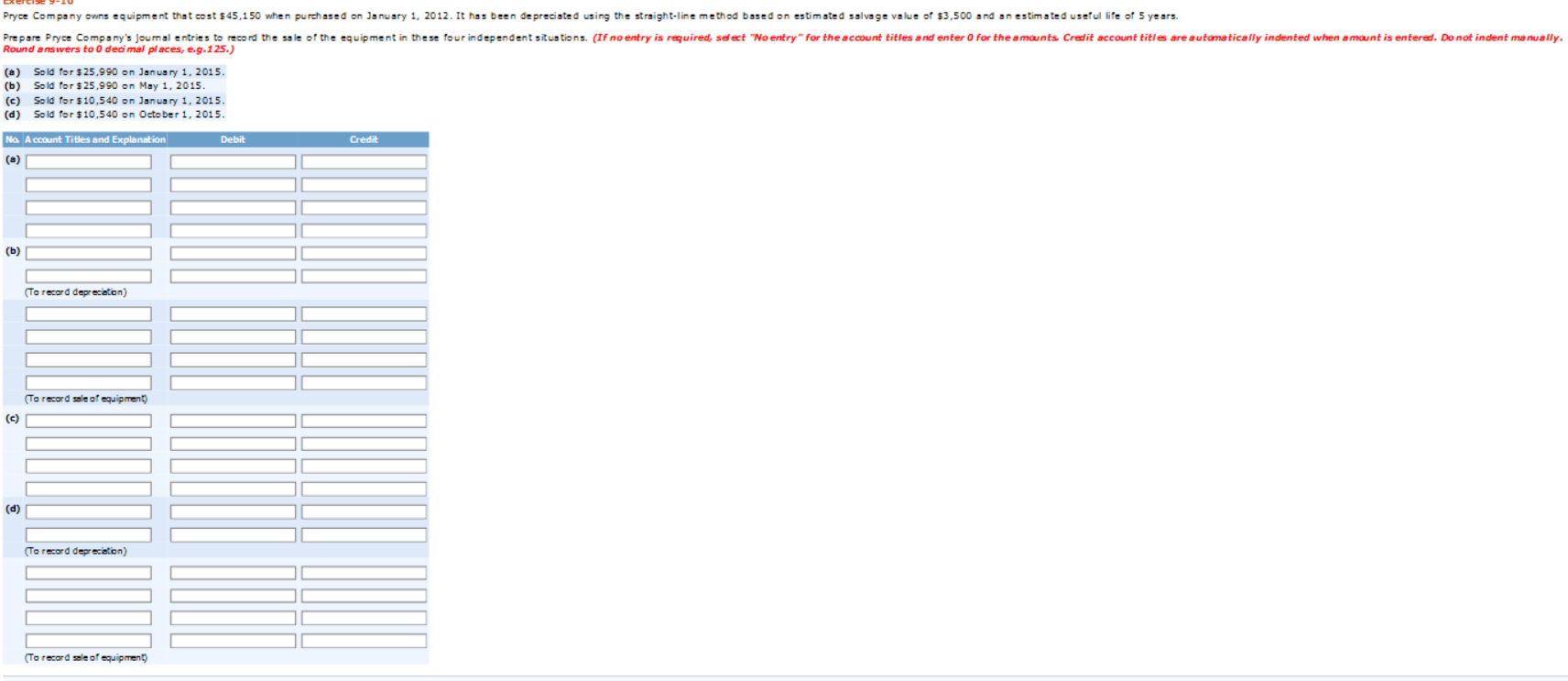

Question

List Of Accounts: Accounts Payable Accounts Receivable Accumulated Depletion Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debts Expense Buildings

List Of Accounts:

Accounts Payable Accounts Receivable Accumulated Depletion Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debts Expense Buildings Cash Coal Mine Copyrights Cost of Goods Sold Depletion Expense Depreciation Expense Equipment Franchises Gain on Disposal of Plant Assets Goodwill Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Land Improvements Loss on Disposal of Plant Assets Maintenance and Repairs Expense No Entry Notes Payable Notes Receivable Ore Mine Other Operating Expenses Patents Prepaid Insurance Rent Revenue Research and Development Expense Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Unearned Rent Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started