Question

List of Accounts: Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debts Expense Buildings Cash Cash Dividends Common Stock Common

List of Accounts:

Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debts Expense Buildings Cash Cash Dividends Common Stock Common Stock Dividends Distributable Cost of Goods Sold Depreciation Expense Dividends Payable Equipment Income Summary Interest Expense Interest Payable Land No Entry Operating Expenses Organization Expense Other Operating Expenses Paid-in Capital from Treasury Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Patents Preferred Stock Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Stock Dividends Supplies Supplies Expense Treasury Stock Unearned Service Revenue

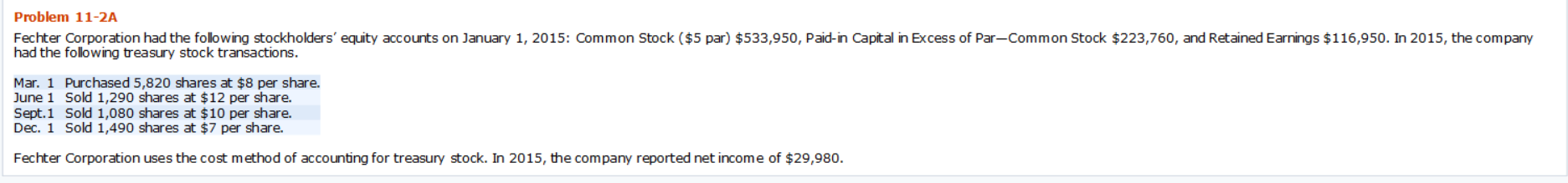

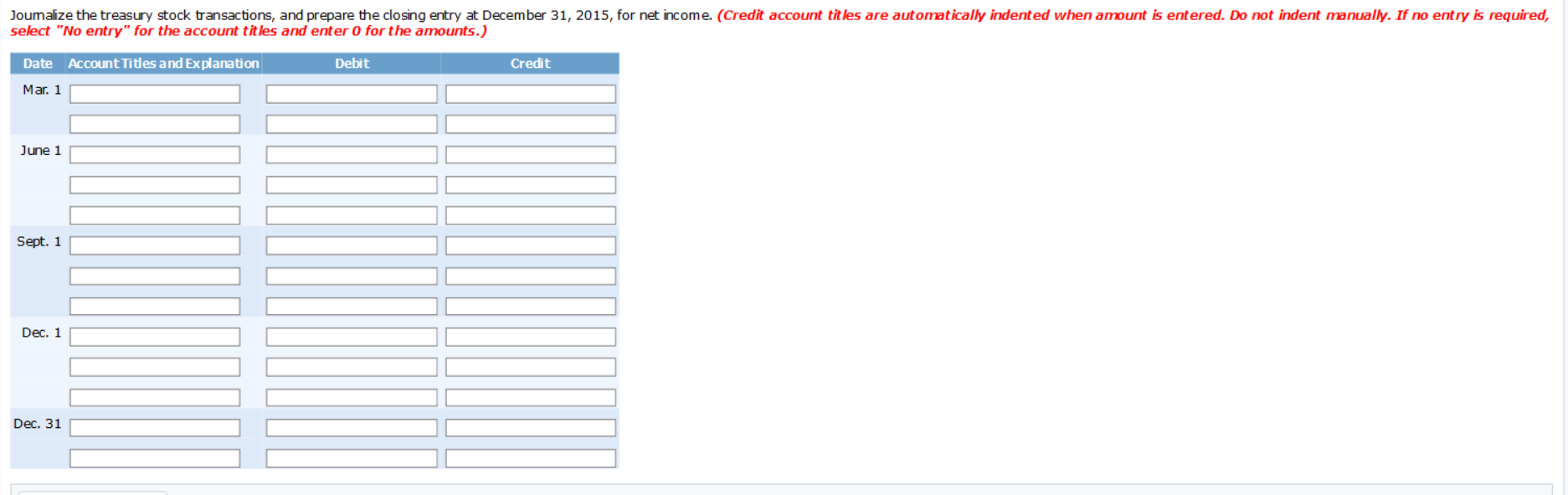

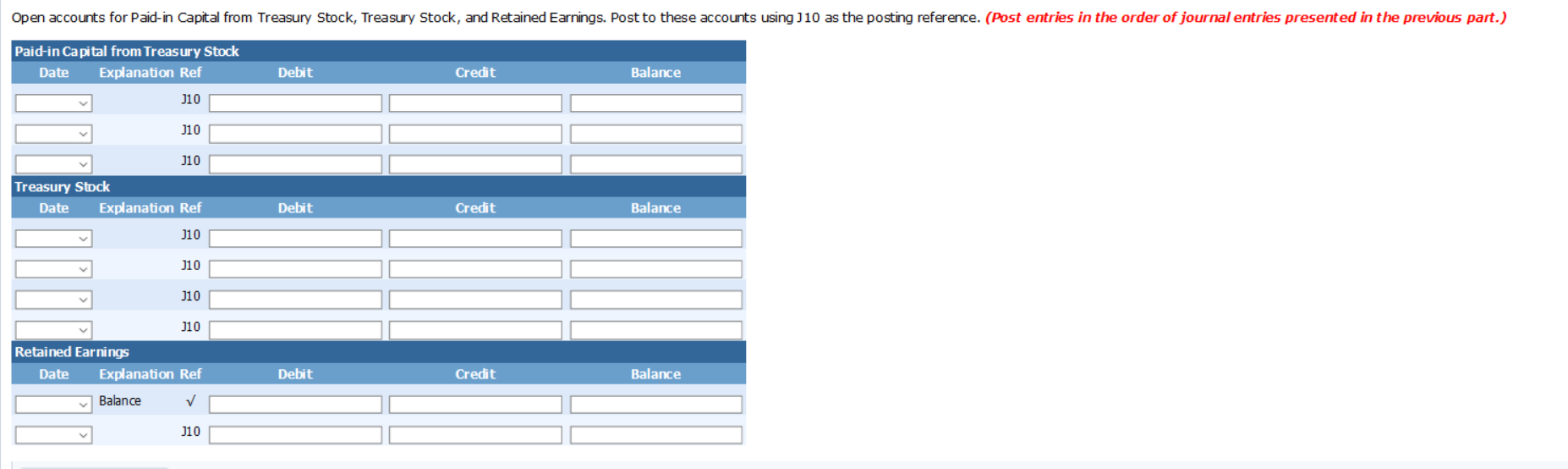

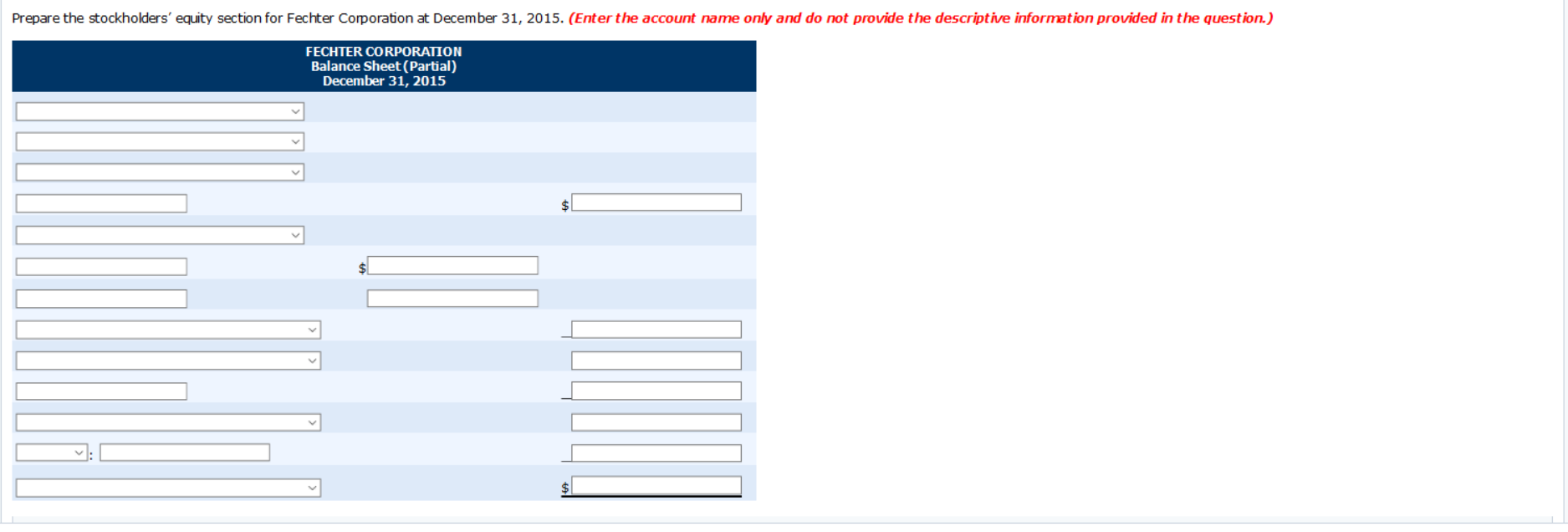

Problem 11-2A Fechter Corporation had the following stockholders' equity accounts on January 1, 2015: Common Stock ($5 par) $533,950, Paid-in Capital in Excess of Par-Common Stock $223,760, and Retained Earnings $116,950. In 2015, the company had the following treasury stock transactions. Mar. 1 Purchased 5,820 shares at $8 per share. June 1 Sold 1,290 shares at $12 per share. Sept.1 Sold 1,080 shares at $10 per share. Dec. 1 Sold 1,490 shares at $7 per share. Fechter Corporation uses the cost method of accounting for treasury stock. In 2015, the company reported net income of $29,980. Joumalize the treasury stock transactions, and prepare the closing entry at December 31, 2015, for net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 1 June 1 Sept. 1 Dec. 1 Dec. 31 Open accounts for Paid-in Capital from Treasury Stock, Treasury Stock, and Retained Earnings. Post to these accounts using J10 as the posting reference. (Post entries in the order of journal entries presented in the previous part.) Paid-in Capital from Treasury Stock Date Explanation Ref J10 Debit Credit Balance J10 J10 Treasury Stock Date Explanation Ref Debit Credit Balance J10 210 J10 110 Retained Earnings Date Explanation Ref Debit Credit Balance Balance 210 Prepare the stockholders' equity section for Fechter Corporation at December 31, 2015. (Enter the account name only and do not provide the descriptive information provided in the question.) FECHTER CORPORATION Balance Sheet (Partial) December 31, 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started