Question

list of accounts: Accounts Payable Accounts Receivable Accumulated Depreciation-Plant Assets Allowance from Expropriation Asset Retirement Obligation Cash Depreciation Expense Dividends Payable Due to Customer Discount

list of accounts:

list of accounts:

Accounts Payable Accounts Receivable Accumulated Depreciation-Plant Assets Allowance from Expropriation Asset Retirement Obligation Cash Depreciation Expense Dividends Payable Due to Customer Discount on Notes Payable FICA Taxes Payable Freight-In FUTA Taxes Payable Insurance Premium Payable Interest Expense Interest Payable Inventory Inventory of Premiums Land Improvements Lawsuit Liability Lawsuit Loss Litigation Expense or Loss Litigation Liability Loss from Expropriation Loss on ARO Settlement No Entry Notes Payable Oil Platform Payroll Tax Expense Plant Assets Premium Expense Premium Liability Purchases Purchase Discounts Purchase Returns and Allowances Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Sales Tax Payable SUTA Taxes Payable Trucks Unearned Sales Revenue Unearned Warranty Revenue Union Dues Payable Warranty Expense Warranty Liability Warranty Revenue Withholding Taxes Payable

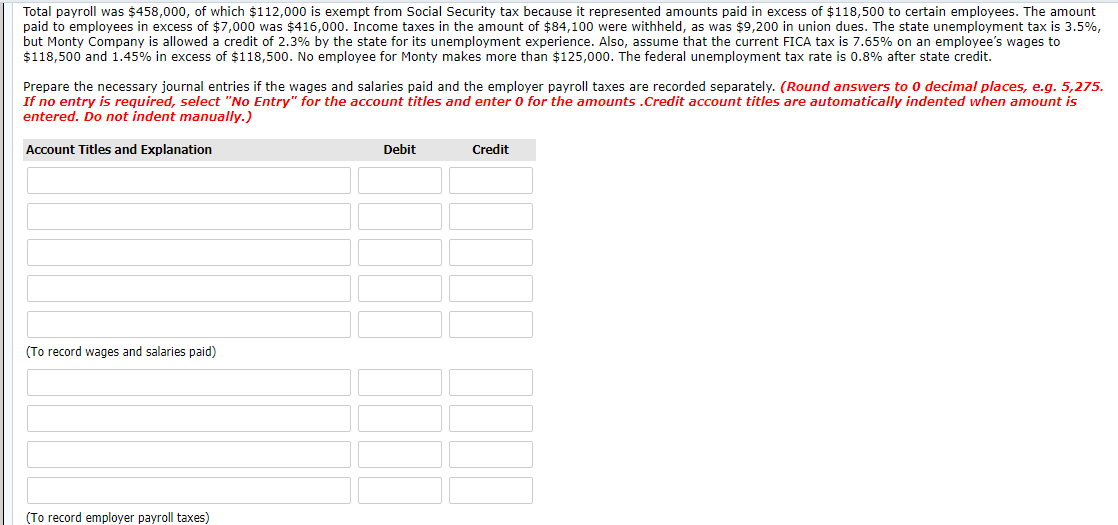

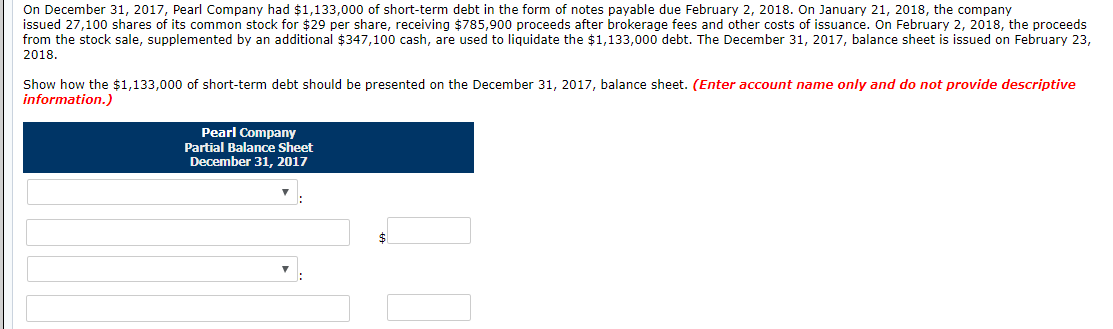

Total payroll was $458,000, of which $112,000 is exempt from Social Security tax because it represented amounts paid in excess of $118,500 to certain employees. The amount paid to employees in excess of $7,000 was $416,000. Income taxes in the amount of $84,100 were withheld, as was $9,200 in union dues. The state unemployment tax is 3.5%, but Monty Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $118,500 and 1.45% in excess of $118,500. No employee for Monty makes more than $125,000. The federal unemployment tax rate is 0.8% after state credit. Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts .Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record wages and salaries paid) (To record employer payroll taxes) On December 31, 2017, Pearl Company had $1,133,000 of short-term debt in the form of notes payable due February 2, 2018. On January 21, 2018, the company issued 27,100 shares of its common stock for $29 per share, receiving $785,900 proceeds after brokerage fees and other costs of issuance. On February 2, 2018, the proceeds from the stock sale, supplemented by an additional $347,100 cash, are used to liquidate the $1,133,000 debt. The December 31, 2017, balance sheet is issued on February 23, 2018. Show how the $1,133,000 of short-term debt should be presented on the December 31, 2017, balance sheet. (Enter account name only and do not provide descriptive information.) Pearl Company Partial Balance Sheet December 31, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started