Answered step by step

Verified Expert Solution

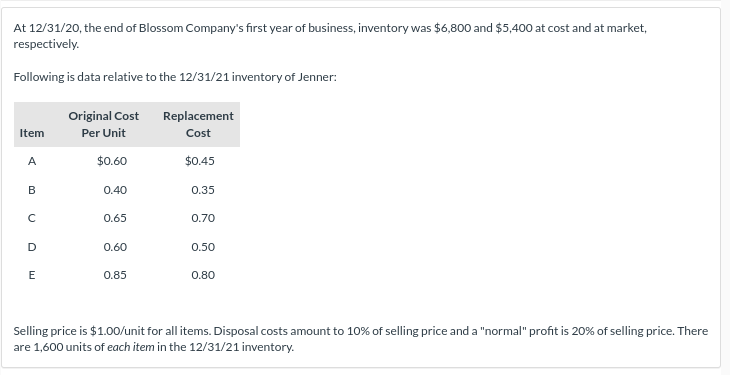

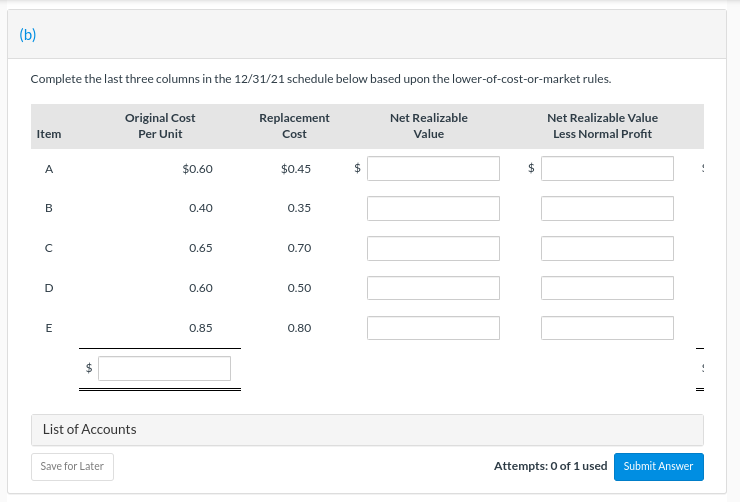

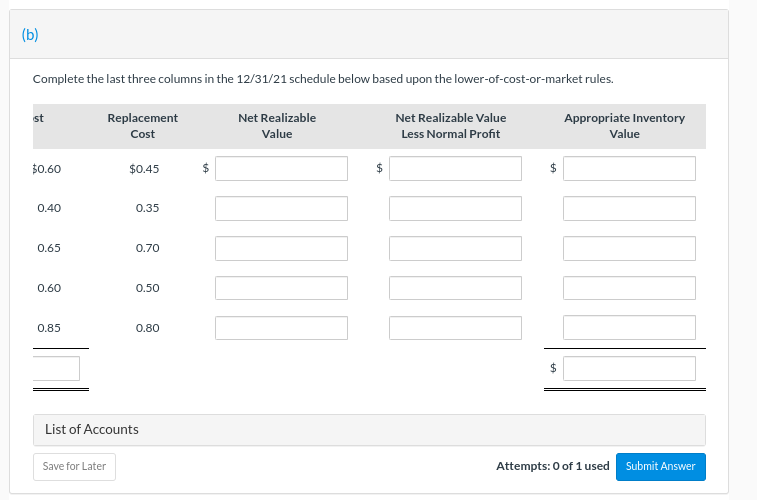

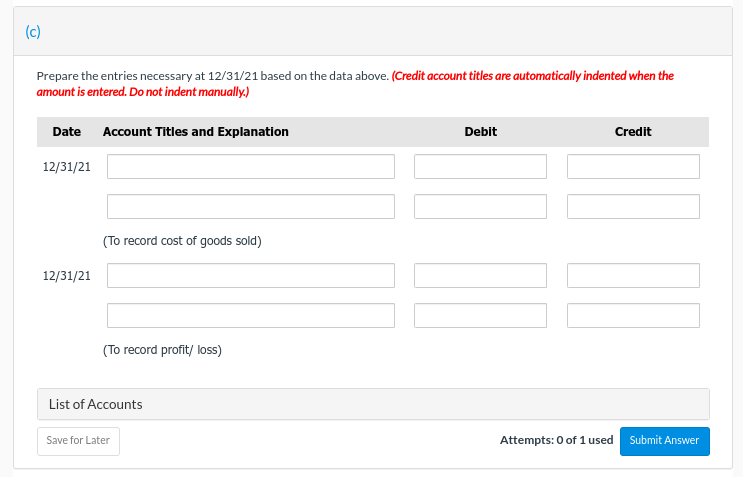

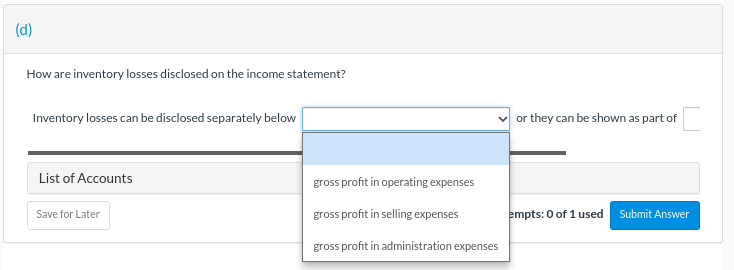

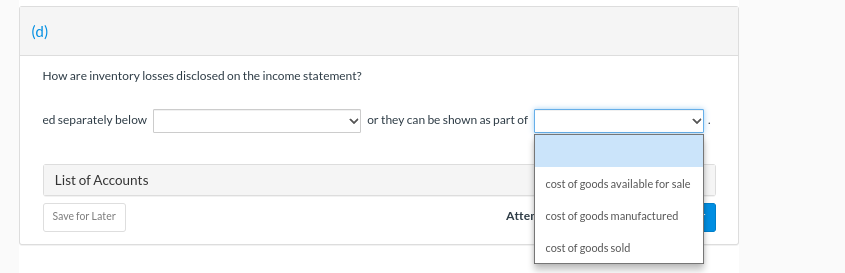

Question

1 Approved Answer

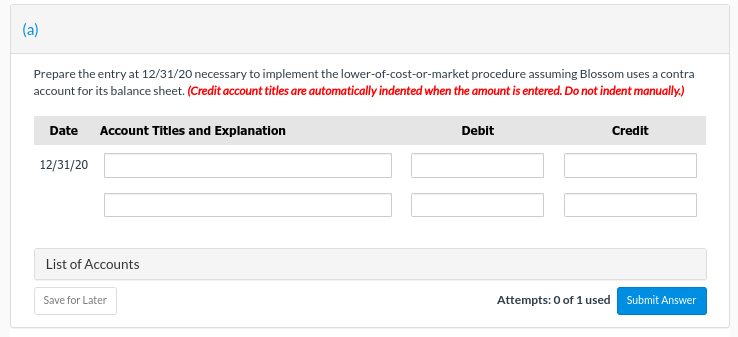

List of Accounts Accounts Payable Adjustment to Record Inventory at Cost Allowance to Reduce Inventory to Market Allowance to Reduce Inventory to NRV Biological Assets

List of Accounts

- Accounts Payable

- Adjustment to Record Inventory at Cost

- Allowance to Reduce Inventory to Market

- Allowance to Reduce Inventory to NRV

- Biological Assets - Shearing Sheep

- Cash

- Cost of Goods Sold

- Estimated Liability on Purchase Commitments

- Income Summary

- Inventory

- Inventory Over and Short

- Loss Due to Decline of Inventory to NRV

- Loss Due to Market Decline of Inventory

- Loss on Fire

- Notes Payable

- Purchases

- Raw Materials

- Recovery of Loss Due to Market Decline of Inventory

- Recovery of Loss Due to Impairment

- Recovery of Loss Inventory

- Salaries and Wages Expense

- Sales Revenue

- Unrealized Holding Gain or Loss - Equity

- Unrealized Holding Gain or Loss - Income

- Wool Inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started