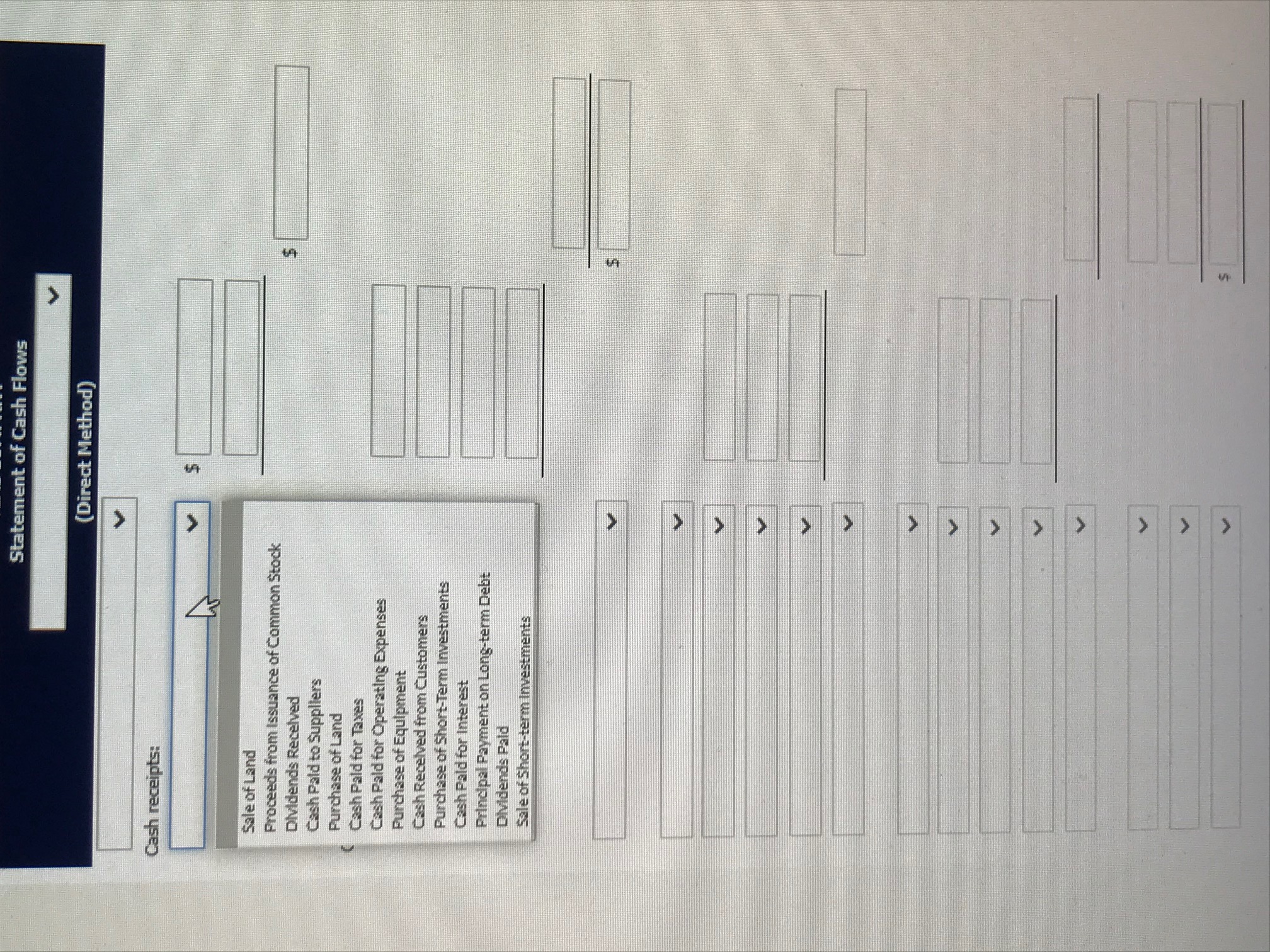

List of accounts for refrence.

(scrolled down)

(scrolled down)

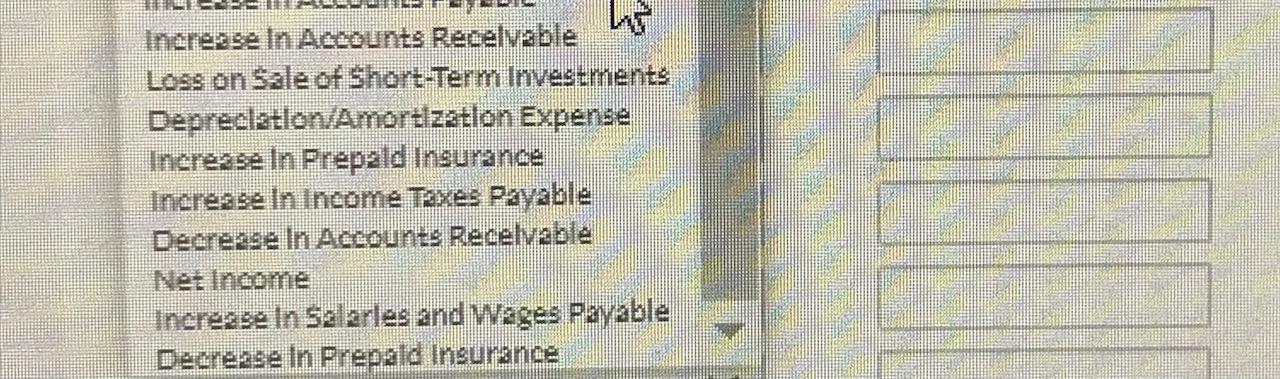

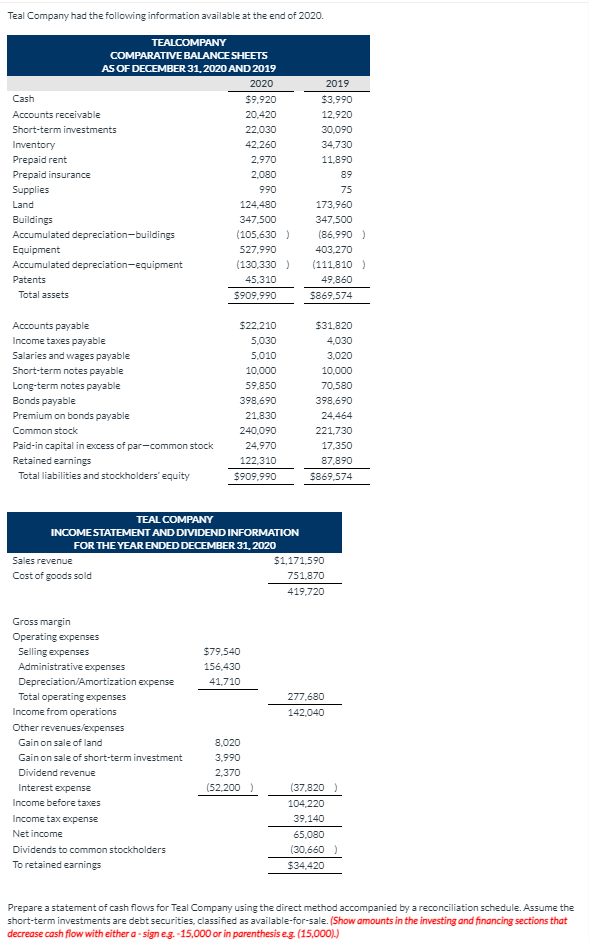

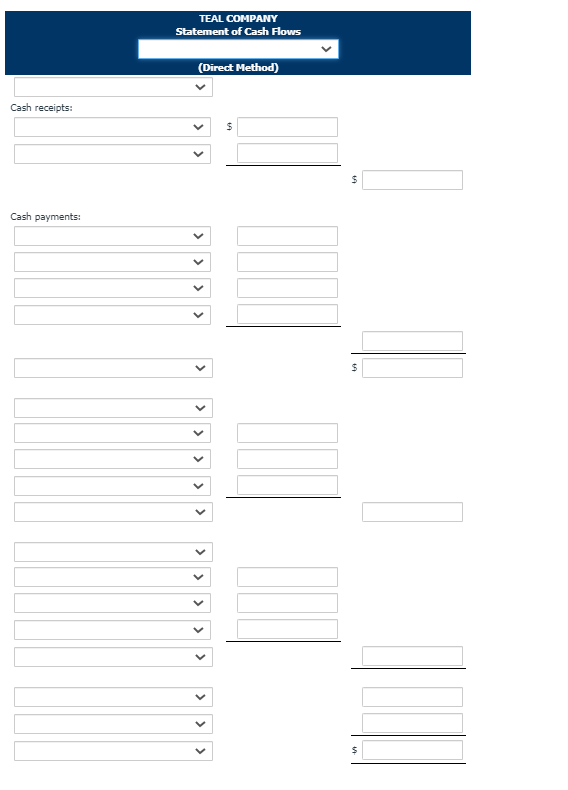

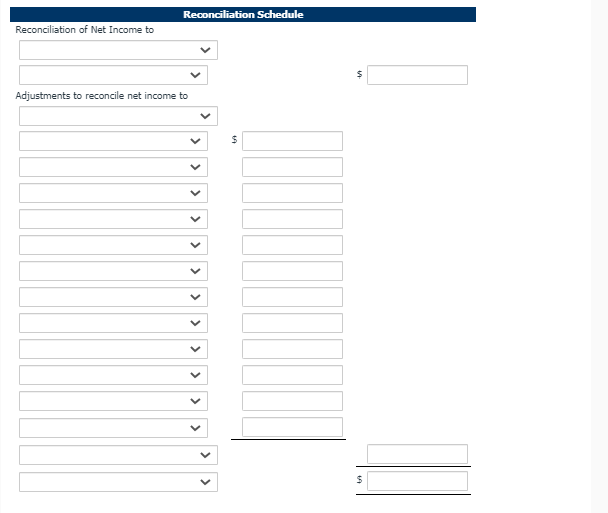

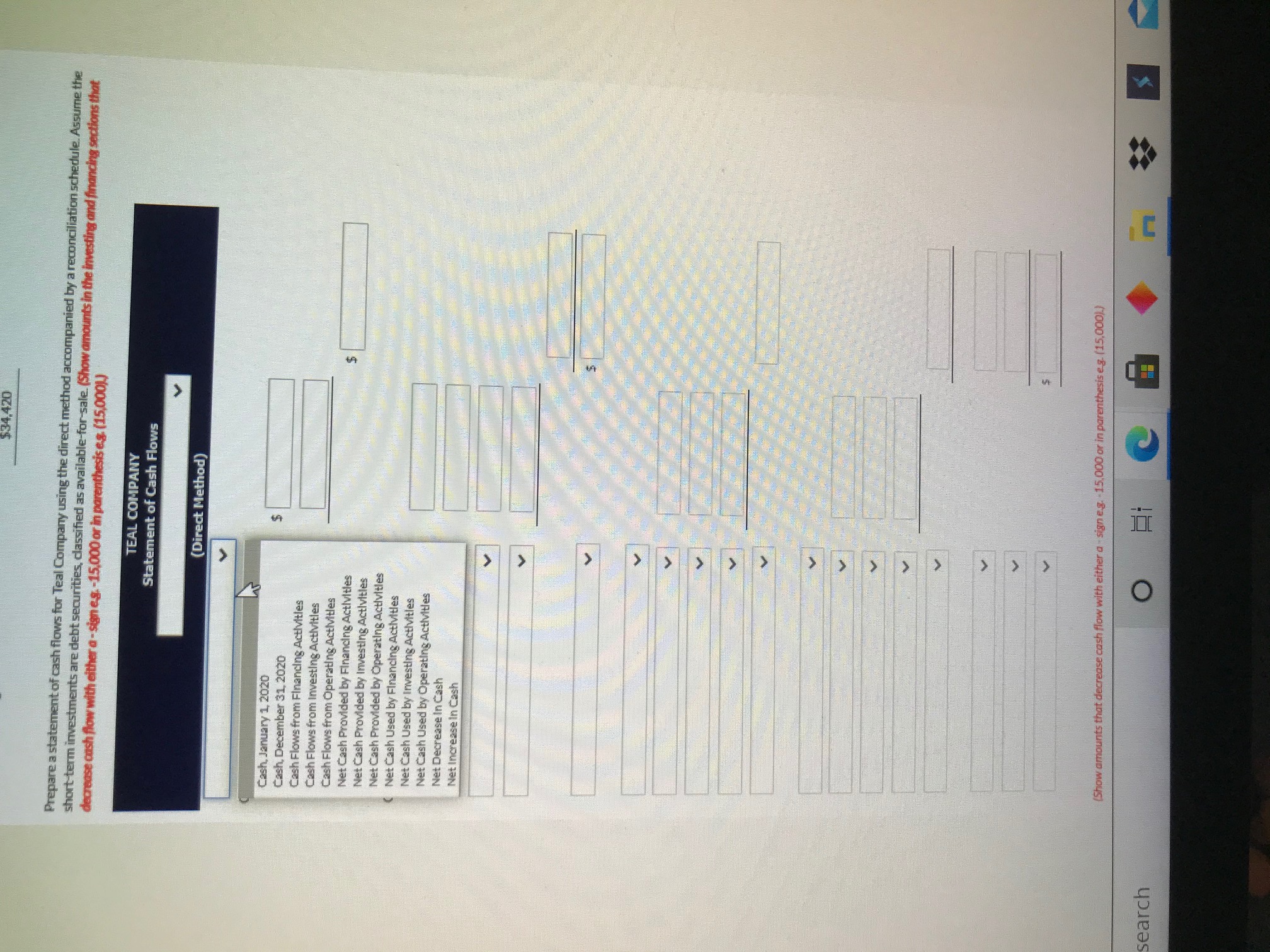

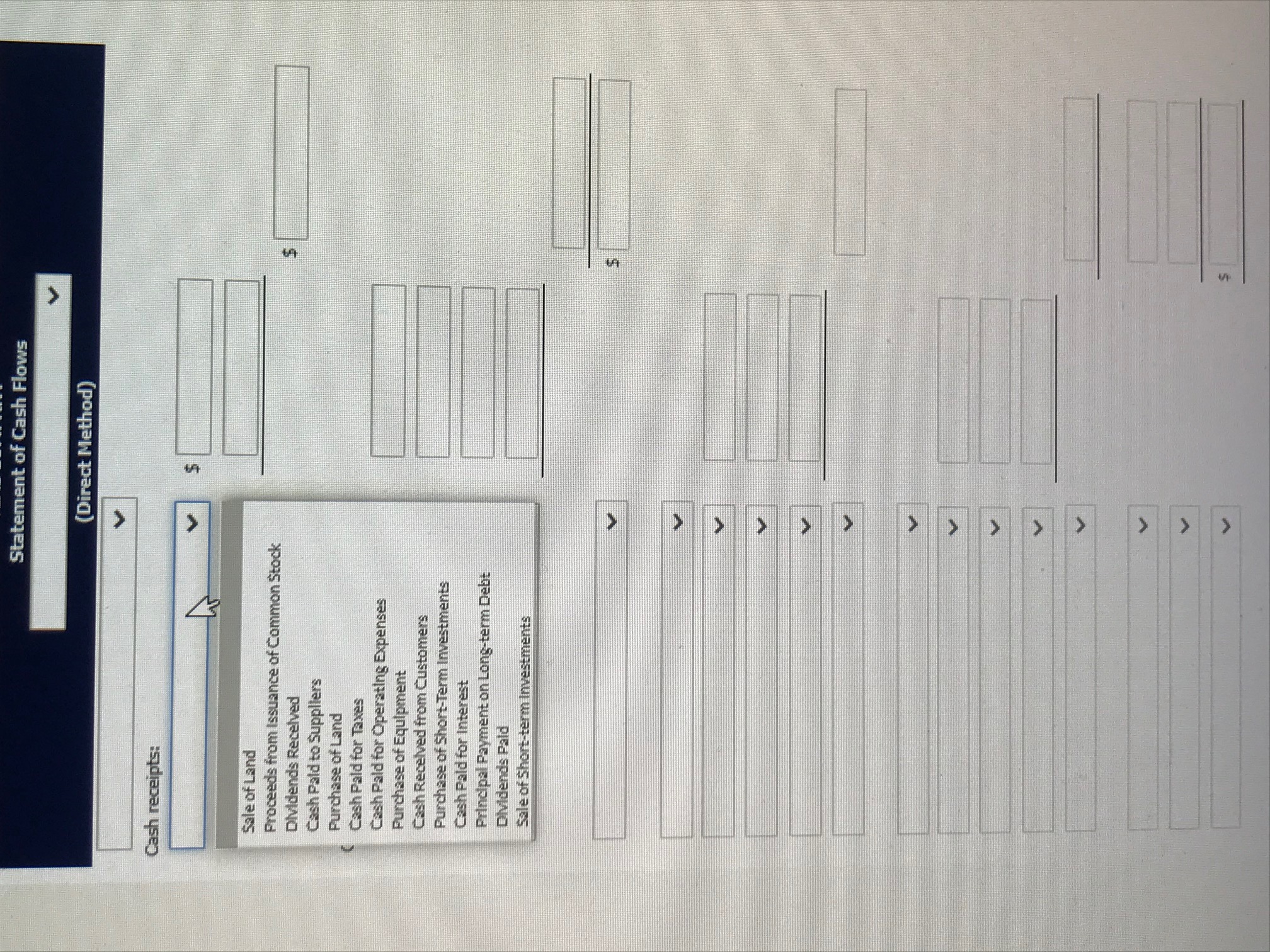

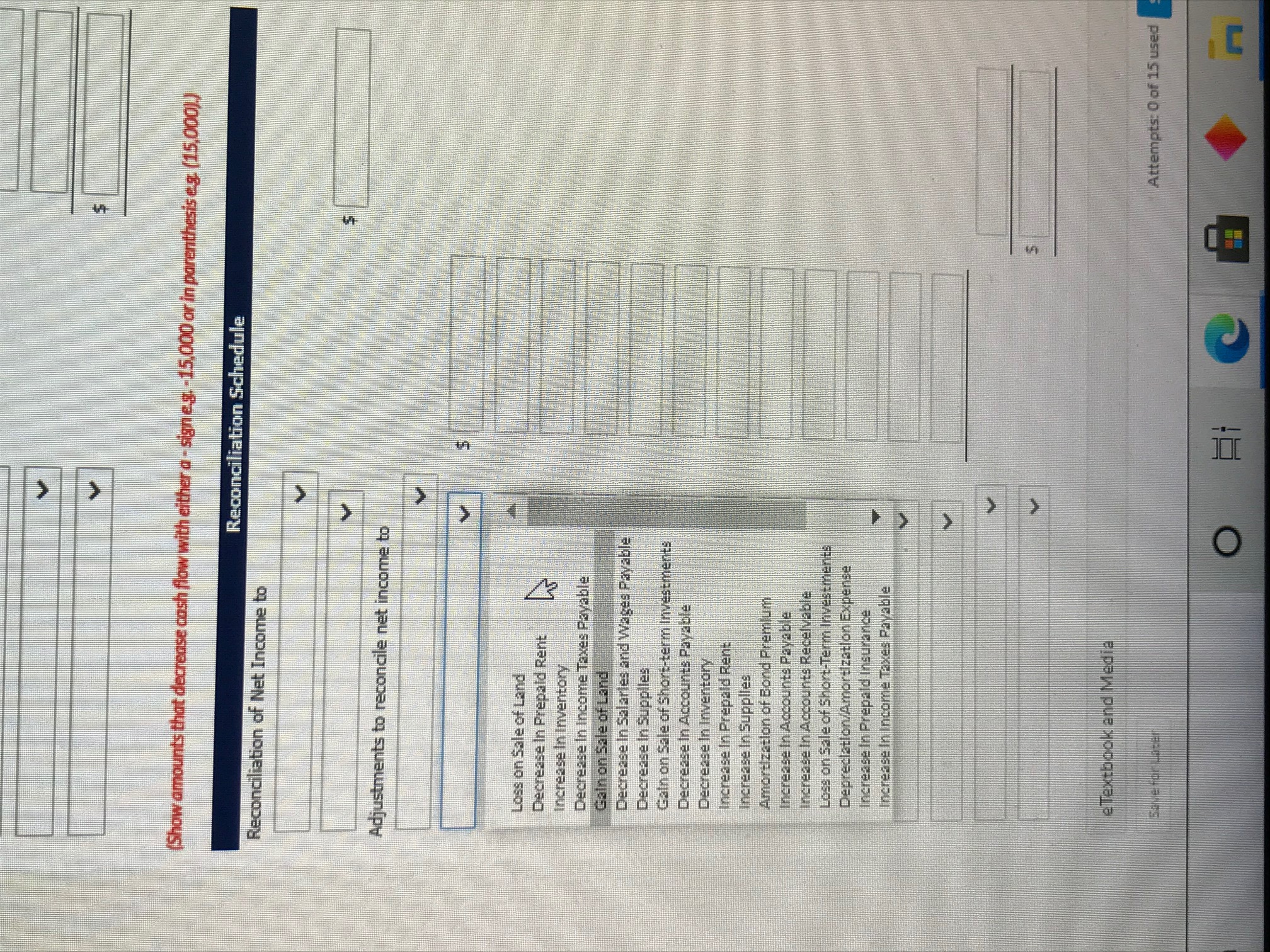

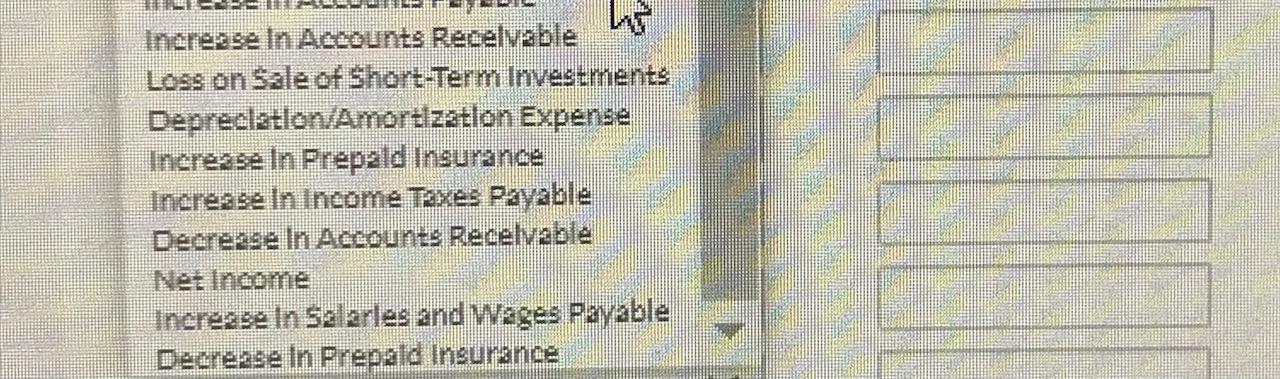

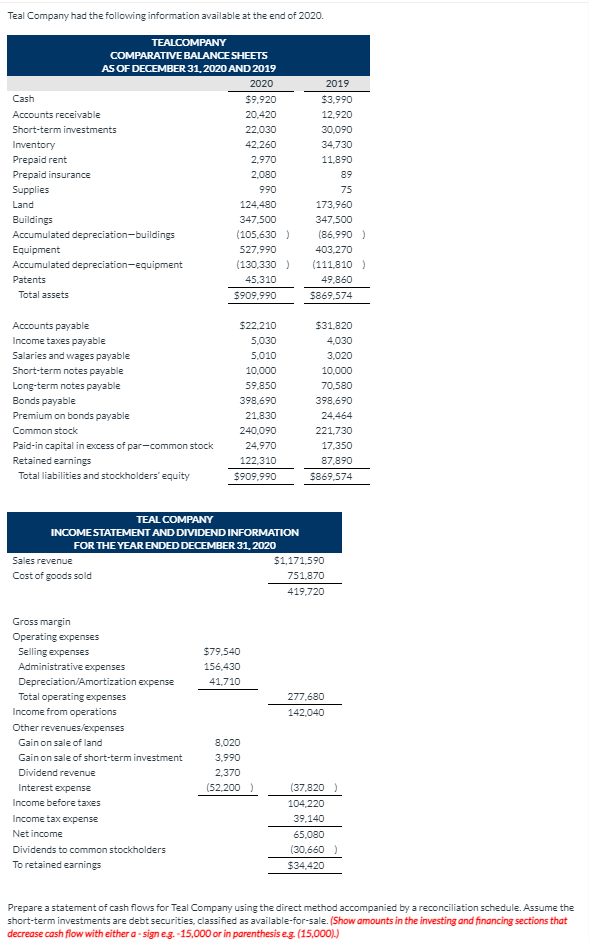

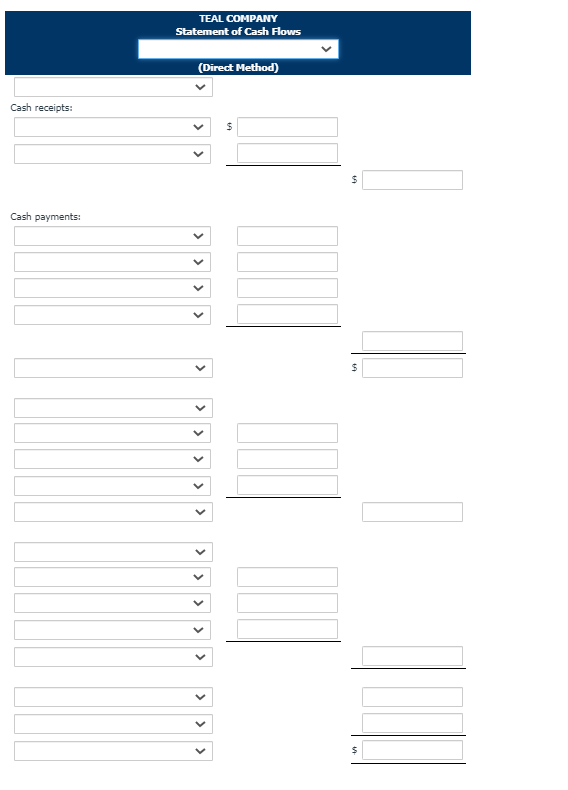

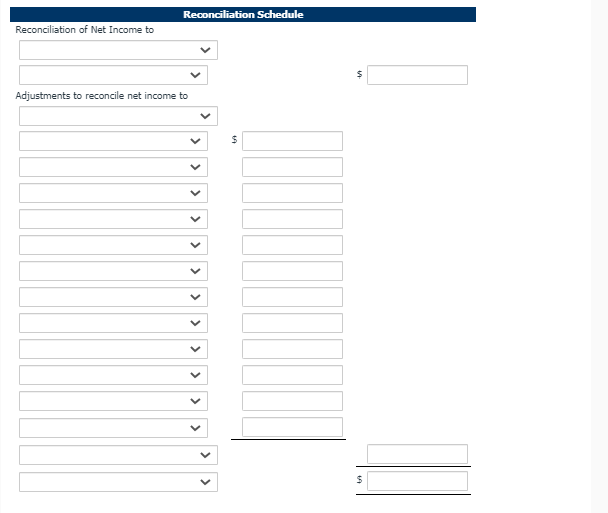

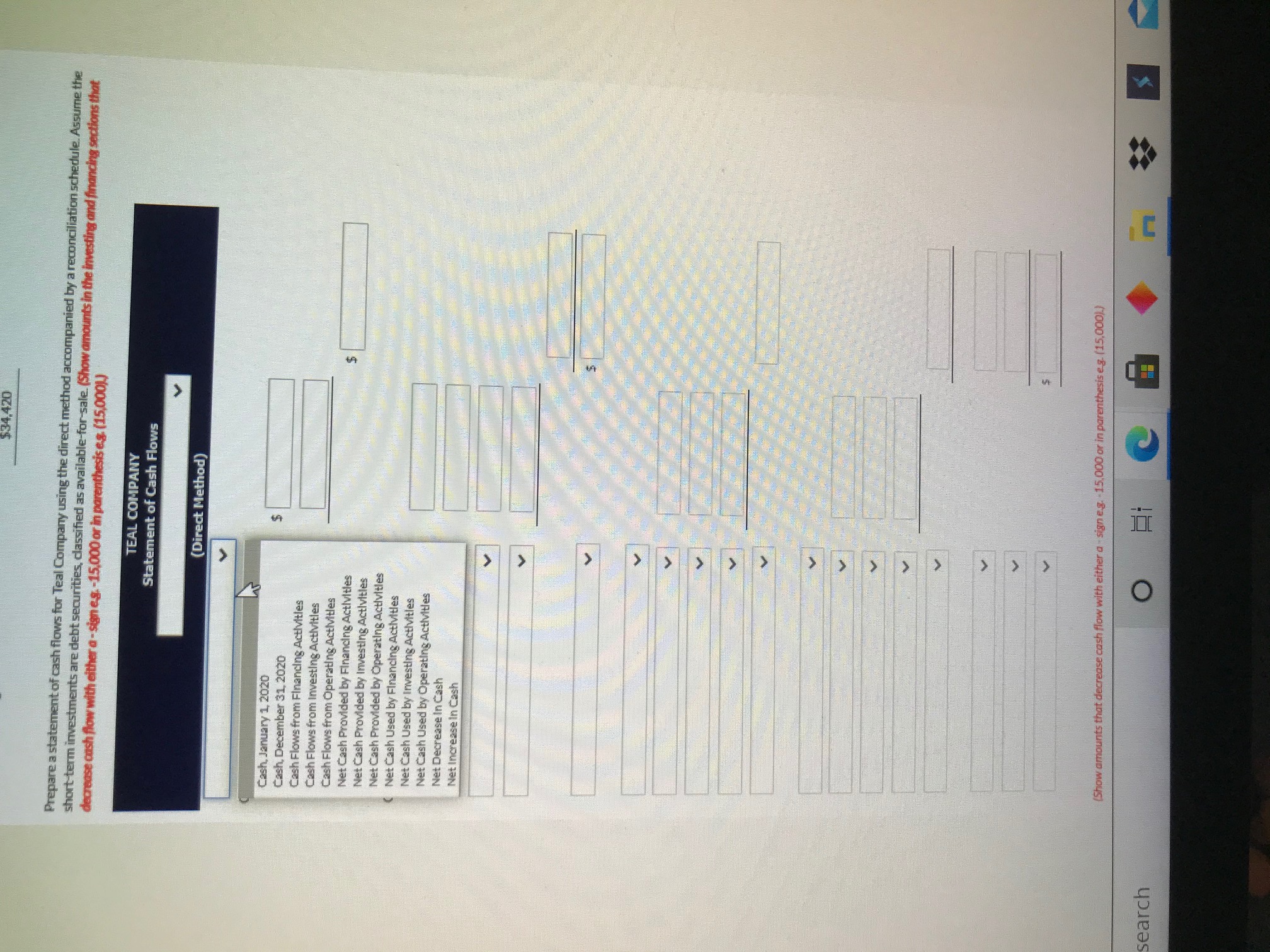

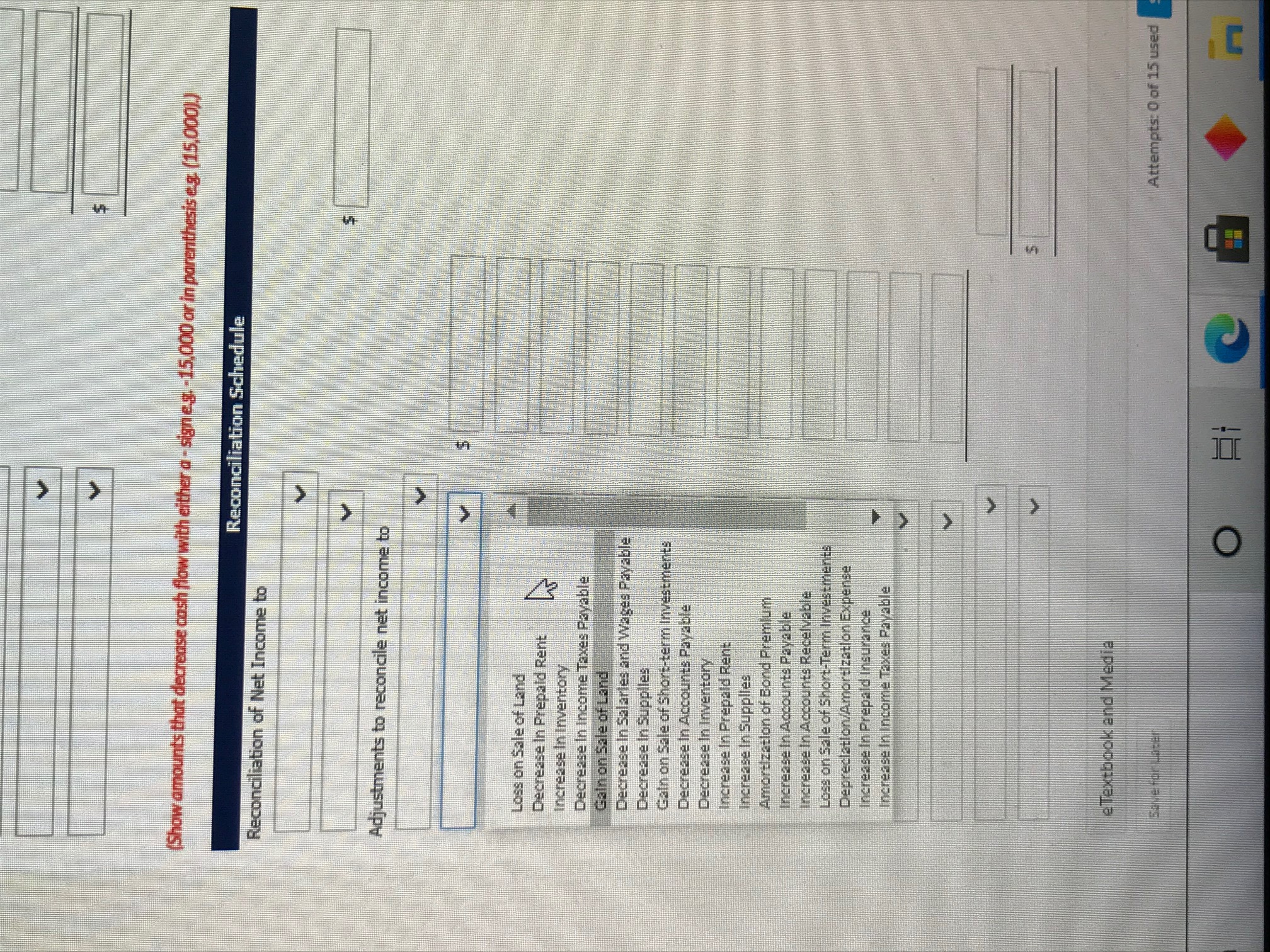

Teal Company had the following information available at the end of 2020. TEALCOMPANY COMPARATIVE BALANCE SHEETS AS OF DECEMBER 31, 2020 AND 2019 2020 Cash $9.920 Accounts receivable 20.420 Short-term investments 22.030 Inventory 42.260 Prepaid rent 2.970 Prepaid insurance 2,080 Supplies 990 Land 124,480 Buildings 347,500 Accumulated depreciation-buildings (105,630) Equipment 527.990 Accumulated depreciation equipment (130,330) Patents 45,310 Total assets $909.990 2019 $3.990 12.920 30.090 34.730 11.890 89 75 173.960 347,500 (86.990) 403,270 (111,810) 49,860 $869,574 Accounts payable Income taxes payable Salaries and wages payable Short-term notes payable Long-term notes payable Bonds payable Premium on bonds payable Common stock Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $22.210 5,030 5,010 10,000 59.850 398,690 21,830 240,090 24,970 122,310 $909.990 $31,820 4,030 3,020 10.000 70.580 398,690 24,464 221,730 17,350 87,890 $869,574 TEAL COMPANY INCOME STATEMENT AND DIVIDEND INFORMATION FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $1,171.590 Cost of goods sold 751,870 419,720 $79,540 156,430 41,710 277,680 142,040 Gross margin Operating expenses Selling expenses Administrative expenses Depreciation/Amortization expense Total operating expenses Income from operations Other revenues/expenses Gain on sale of land Gain on sale of short-term investment Dividend revenue Interest expense Income before taxes Income tax expense Net income Dividends to common stockholders To retained earnings 8,020 3.990 2.370 (52 200) (37,820) 104,220 39,140 65,080 (30,660) $34,420 Prepare a statement of cash flows for Teal Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are debt securities, classified as available-for-sale. (Show amounts in the investing and financing sections that decrease cash flow with either a-sign eg. -15,000 or in parenthesis eg. (15,000). TEAL COMPANY Statement of Cash Flows (Direct Method) Cash receipts: $ $ Cash payments: $ $ Reconciliation Schedule Reconciliation of Net Income to Adjustments to reconcile net income to $ > > $ $34,420 Prepare a statement of cash flows for Teal Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are debt securities, dassified as available-for-sale. (Show amounts in the investing and financing sections that decrease cash flow with either a-sign eg.-15,000 or in parenthesises (15,000) TEAL COMPANY Statement of Cash Flows (Direct Method) Cash, January 1, 2020 Cash, December 31, 2020 Cash Flows from Financing Activities Cash Flows from investing Activitles Cash Flows from Operating Activitles Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Net Increase in Cash > $ (Show amounts that decrease cash flow with either a-signeg.-15,000 or in parenthesiseg (15,000.) Reconciliation Schedule Reconciliation of Net Income to Adjustments to reconcile net income to $ Loss on sale of Land Decrease in Prepaid Rent Increase In Inventory Decrease In Income Taxes Payable Galn on sale of Land Decrease in Salaries and Wages Payable Decrease in Suppiles Galnon Sale of Short-term Investments Decrease in Accounts Payable Decrease In Inventory Increase in Prepaid Rent Increase In Supplles Amortization of Bond Premium Increase in Accounts Payable Increase In Aocounts Recelvable Losg on Sale of Short-Terminvestments Depreciatlon Amortization Expense Increase in Prepald Insurance Increase In Income Taxes Payable $ e Textbook and Media Attempts. O of 15 used O ho Ineresse In Accounts Recelvable Loss on Sale of Short-Term Investments Depreclatlon/Amortizatlon Expense Ineresse In Prepeld Insurance Increase in income Taxes Payable Decrease in Accounts Recelvable Net Income Increase in Selarles and Wages Payable Decrease in Prepald Insurance

(scrolled down)

(scrolled down)