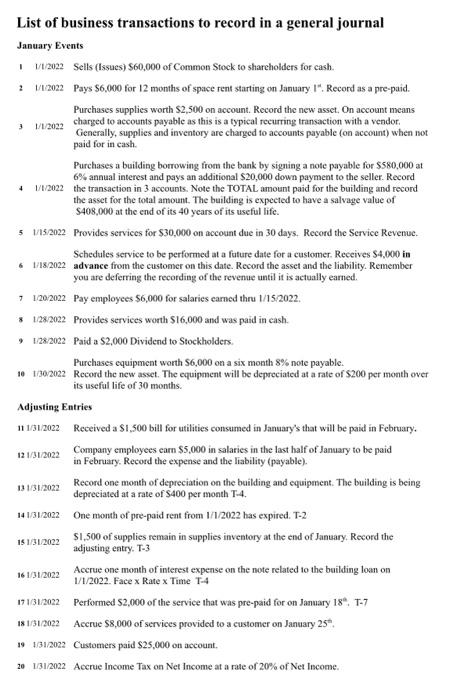

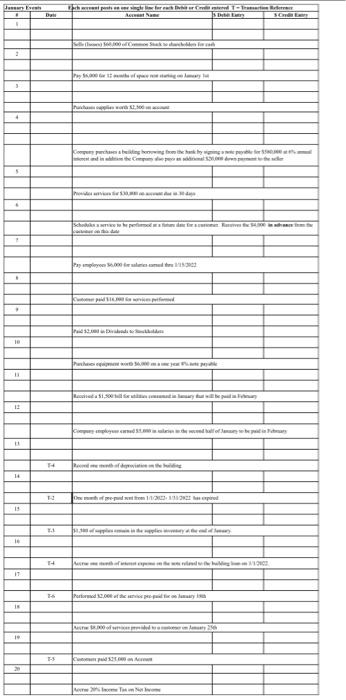

List of business transactions to record in a general journal January Events I/12022 Sells (Issues) \$60,000 of Common Stock to shareholders for cash. 2 I/12022 Pays $6.000 for 12 months of space rent starting on January I". Record as a pre-paid. Purchases supplies worth $2,500 on account. Record the new asset, On account means 3 1/1/2022 charged to accounts payable as this is a typical recurring transaction with a vendor. Generally, supplies and inventory are charged to accounts payable (on account) when not paid for in cash. Purchases a building borrowing from the bank by signing a note payable for $580,000 at 6% annual interest and pays an additional $20,000 down payment to the seller. Record 4 1/1/2022 the transaction in 3 accounts. Note the TOTAL amount paid for the building and record the asset for the total amount. The building is expected to have a salvage value of $408,000 at the end of its 40 years of its useful life. 5 //15/2022 Provides services for $30,000 on account due in 30 days. Record the Service Revenue. Schedules service to be performed at a future date for a customer. Receives $4,000 in 6 1/18/2022 advance from the customer on this date. Record the asset and the liability. Remember you are deferring the recording of the revenue until it is actually earned. 7 1/20/2022 Pay employees $6,000 for salaries carned thru 1/15/2022, 8 1/28,2022 Provides services worth $16,000 and was paid in cash. 9 1/28/2022 Paid a \$2,000 Dividend to Stockholders. Purchases equipment worth 56,000 on a six month 8% note payable. 10 1302022 Record the new asset. The equipment will be depreciated at a rate of $200 per month over its useful life of 30 months. Adjusting Entries 11 1/31/2022 Received a \$1,500 bill for utilities consumed in January's that will be paid in February. 12 1/31/2022 Company employees carn $5,000 in salaries in the last half of January to be paid in February. Record the expense and the liability (payable). 13 1/31/2022 Record one month of depreciation on the building and equipment. The building is being depreciated at a rate of $400 per month T-4. 14 1/31/2022 One month of pre-paid rent from 1/1/2022 has expired. T-2 15 1/31/2022 \$1,500 of supplies remain in supplies inventory at the end of January. Record the adjusting entry. T-3 16 1/31/2022 Accrue one month of interest expense on the note related to the building loan on 1/1/2022. Face Rate Time T4 17 1/31/2022 Performed $2,000 of the service that was pre-paid for on January 18, T-7 18 1/31/2022 Accrue $8,000 of services provided to a customer on January 25t.. 19 \$/31/2022 Customers paid $25,000 on account. 20 1/31/2022 Accrue Income Tax on Net Income at a rate of 20% of Net Income