Answered step by step

Verified Expert Solution

Question

1 Approved Answer

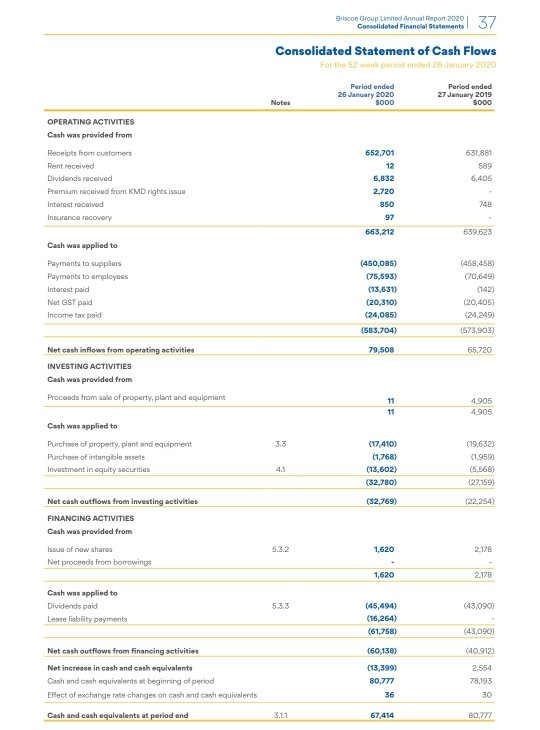

List The Sources of cash Receipts and what they spent on during the year 26 January 2020 ? Briscoe Group Limited Annual Report 2020 Consolidated

List The Sources of cash Receipts and what they spent on during the year 26 January 2020 ?

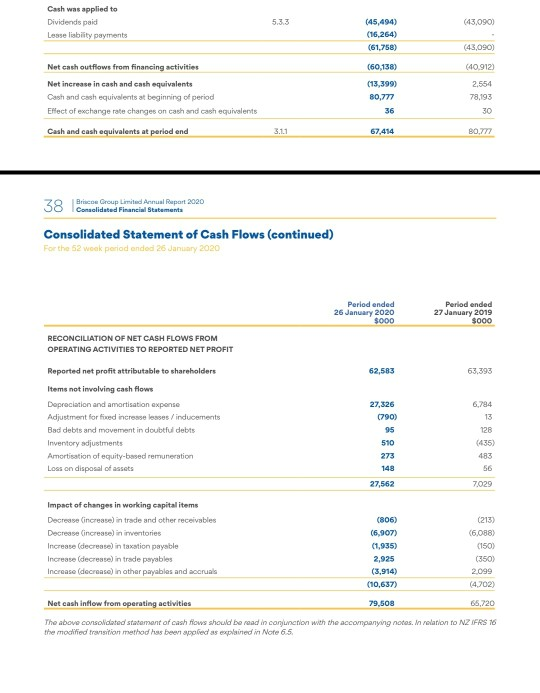

Briscoe Group Limited Annual Report 2020 Consolidated Financial Statements 37 Consolidated Statement of Cash Flows For the 52 week period anded 26 January 2020 Period ended 26 January 2020 $000 Period ended 27 January 2019 $000 Notes OPERATING ACTIVITIES Cash was provided from Receipts from customers Rent received Dividends received Premium received from KMD rights Issue Interest received Insurance recovery 631,881 589 6.405 652,701 12 6,832 2,720 850 97 663,212 748 639.623 Cash was applied to Payments to suppliers Payments to employees Interest paid Not GST paid Income tax paid (450,085) (75.593) (13,631) (20,310) (24,085) (583,704) (458,458) (70,649) (142) (20,405) 24,249 (573,903) 79,508 65.720 Net cash inflows from operating activities INVESTING ACTIVITIES Cash was provided from Proceeds from sale of property, plant and equipment 11 11 4.905 4,905 3.3 Cash was applied to Purchase of property, plant and equipment Purchase of intangibles Investment in equity securities (17,410) (1768) (19,632) (1,9599 (5,568) (27.159) 4.1 (13,602) (32,780) (32,769) (22,254) Net cash outflows from investing activities FINANCING ACTIVITIES Cash was provided from Issue of new shares Net proceeds from borrowings 5.3.2 1,620 2.178 1,620 2.178 Cash was applied to Dividends paid Lease liability payments 5.33 (43,090) (45,494) (16.264) (61,758) (43,090) (60,138) (40.912 Net cash outflows from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Effect of exchange rate changes on cash and cash equivalents (13,399) 80,777 36 2.554 78,193 30 Cash and cash equivalents at period end 3.11 67,414 80,777 Cash was applied to Dividends paid Lease liability payments 5.3.3 (43,090) (45,494) (16,264) (61.758) (43,090) (60,138) (40.912) Net cash outflows from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at period and (13,399) 80,777 36 2.554 78,193 30 3.11 67,414 80,777 38 Braco Group Limited Annual Report 2020 Consolidated Financial Statements Consolidated Statement of Cash Flows (continued) For the 52 work period ended 26 January 2020 Period ended 26 January 2020 $000 Period ended 27 January 2019 $000 62,583 63,393 RECONCILIATION OF NET CASH FLOWS FROM OPERATING ACTIVITIES TO REPORTED NET PROFIT Reported net profit attributable to shareholders Items not involving cash flows Depreciation and amortisation expense Adjustment for fixed increase lesses / inducements Bad debts and movement in doubtful debts Inventory adjustments Amortisation of equity-based remuneration Loss on disposal of assets 27,326 (790) 95 510 273 148 6.794 13 126 (435) 483 56 27,562 7.029 Impact of changes in working capital items Decrease increase) in trade and other receivables Decrease increase in inventories Increase (decrease in taxation payable Increase (decrease in trade payables Increase (decrease in other payables and accruals (806) (6,907) (1,935) 2,925 (3,914) (10,637) (213) (6088) (150) (350) 2099 (4.702) Net cash inflow from operating activities 79,508 66,720 The above consolidated statement of cash flows should be read in conjunction with the accompanying notes. In relation to NZ IFRS 16 the modified transition method has been applied as explained in Note 6.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started