Answered step by step

Verified Expert Solution

Question

1 Approved Answer

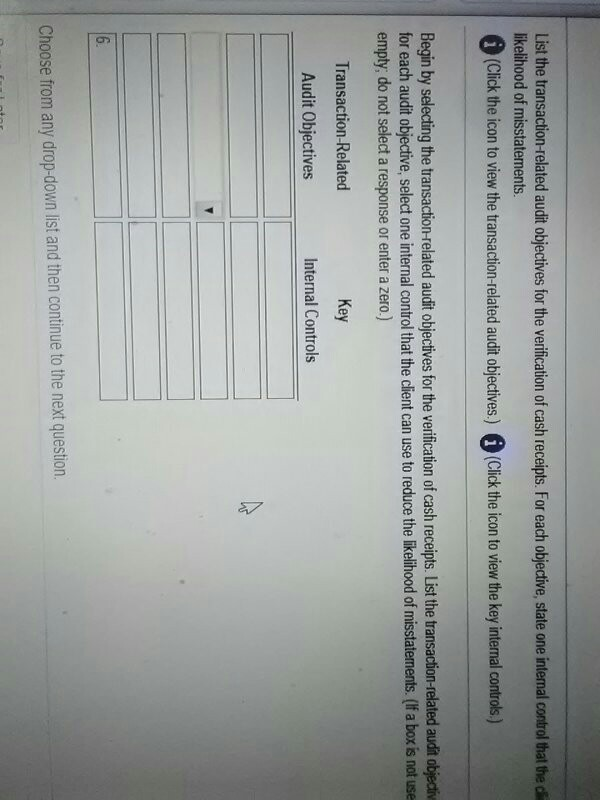

List the transaction-related audit objectives for the verification of cash receipts. For each objective, state one internal control that the di likelihood of misstatements. (Click

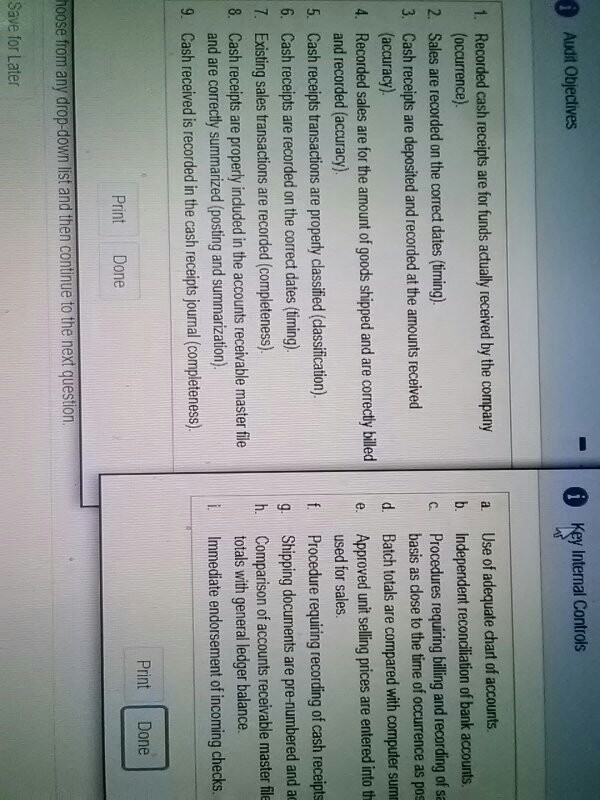

List the transaction-related audit objectives for the verification of cash receipts. For each objective, state one internal control that the di likelihood of misstatements. (Click the icon to view the transaction-elated audit objectives.) Q (Click the icon to view the key internal controls) Begin by selecting the transaction-related audit objectives for the verification of cash receipts. List the transaction-related audit objediv for each audit objective, select one internal control that the client can use to reduce the likelihood of misstaterments. (If a box is not use empty, do not select a response or enter a zero.) Transaction-Related Key Internal Controls Audit Objectives 6. Choose from any drop-down list and then continue to the next question. Audit Objectives Internal Controls 1. Recorded cash receipts are for funds actualy received by the company a Use of adequate chart of accounts (occurrence) 2. Sales are recorded on the coct dats (ing). 3. Cash receipts are deposited and recorded at the amounts received b. Independent reconciliation of bank accounts (accuracy) 4. Recorded sales are for the amount of goods shipped and are correcly illed C. Procedures requiring billing and recording of s basis as dlose to the time of occurrence as pos totals are compared with computer sumn Approved unit selling prices are entered into th and recorded (accuracy) 5. Cash receipts transactions are property classied (dassification) 6. Cash receipts are recorded on the correct dates (timing). 7. Existing sales transactions are recorded (completeness). 8. Cash receipts are properly indluded in the accounts receivable master file used for sales f g. h. Procedure requiring recording of cash receipts Shipping documents are pre-numbered anda Comparison of accounts receivable master file totals with general ledger balance. and are correctly summarized (posting and summarization) Cash received is recorded in the cash receipts journal (completeness). i Immediate endorsement of incoming checks. 9. Print Done Print Done hoose from any drop-down list and then continue to the next question Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started