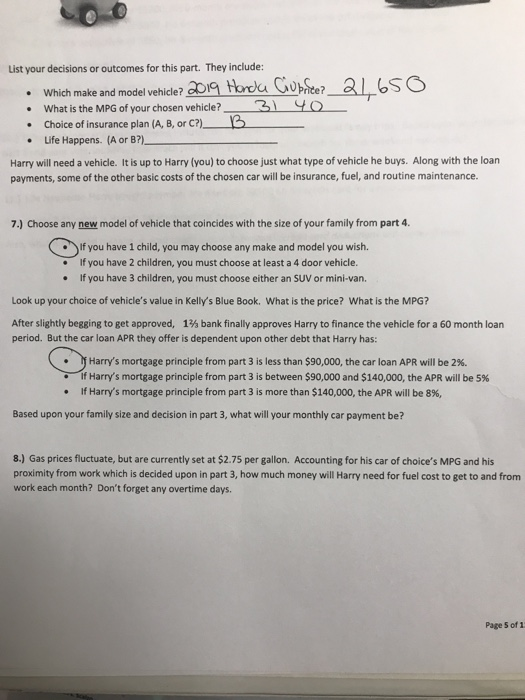

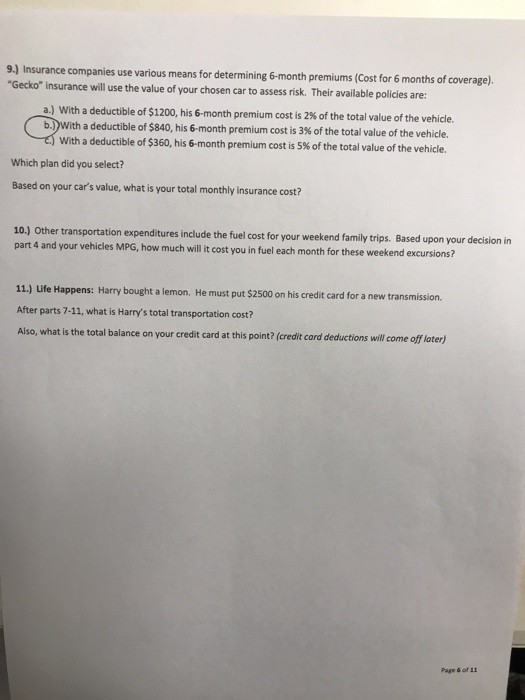

List your decisions or outcomes for this part. They include: Which make and model vehicle? 2019 Honda Ciuboee? 21.650 What is the MPG of your chosen vehicle? _ 31 40 Choice of insurance plan (A, B, or C?) B Life Happens. (A or B?). Harry will need a vehicle. It is up to Harry (you) to choose just what type of vehicle he buys. Along with the loan payments, some of the other basic costs of the chosen car will be insurance, fuel, and routine maintenance. 7.) Choose any new model of vehicle that coincides with the size of your family from part 4 ( "If you have 1 child, you may choose any make and model you wish. If you have 2 children, you must choose at least a 4 door vehicle. If you have 3 children, you must choose either an SUV or mini-van. Look up your choice of vehicle's value in Kelly's Blue Book. What is the price? What is the MPG? After slightly begging to get approved, 1% bank finally approves Harry to finance the vehicle for a 60 month loan period. But the car loan APR they offer is dependent upon other debt that Harry has: Harry's mortgage principle from part 3 is less than $90,000, the car loan APR will be 2%. If Harry's mortgage principle from part 3 is between $90,000 and $140,000, the APR will be 5% If Harry's mortgage principle from part 3 is more than $140,000, the APR will be 8%, Based upon your family size and decision in part 3, what will your monthly car payment be? 8.) Gas prices fluctuate, but are currently set at $2.75 per gallon. Accounting for his car of choice's MPG and his proximity from work which is decided upon in part 3, how much money will Harry need for fuel cost to get to and from work each month? Don't forget any overtime days. Page 5 of 1 9.) Insurance companies use various means for determining 6-month premiums (Cost for 6 months of coverage), "Gecko" insurance will use the value of your chosen car to assess risk. Their available policies are: ( a.) With a deductible of $1200, his 6-month premium cost is 2% of the total value of the vehicle. b.)) with a deductible of $840, his 6-month premium cost is 3% of the total value of the vehicle. With a deductible of $360, his 6-month premium cost is 5% of the total value of the vehicle. Which plan did you select? Based on your car's value, what is your total monthly insurance cost? 10.) Other transportation expenditures include the fuel cost for your weekend family trips. Based upon your decision in part 4 and your vehicles MPG, how much will it cost you in fuel each month for these weekend excursions? 11.) Ufe Happens: Harry bought a lemon. He must put $2500 on his credit card for a new transmission After parts 7-11, what is Harry's total transportation cost? Also, what is the total balance on your credit card at this point? (credit card deductions will come off loter) Page 6 of 11 List your decisions or outcomes for this part. They include: Which make and model vehicle? 2019 Honda Ciuboee? 21.650 What is the MPG of your chosen vehicle? _ 31 40 Choice of insurance plan (A, B, or C?) B Life Happens. (A or B?). Harry will need a vehicle. It is up to Harry (you) to choose just what type of vehicle he buys. Along with the loan payments, some of the other basic costs of the chosen car will be insurance, fuel, and routine maintenance. 7.) Choose any new model of vehicle that coincides with the size of your family from part 4 ( "If you have 1 child, you may choose any make and model you wish. If you have 2 children, you must choose at least a 4 door vehicle. If you have 3 children, you must choose either an SUV or mini-van. Look up your choice of vehicle's value in Kelly's Blue Book. What is the price? What is the MPG? After slightly begging to get approved, 1% bank finally approves Harry to finance the vehicle for a 60 month loan period. But the car loan APR they offer is dependent upon other debt that Harry has: Harry's mortgage principle from part 3 is less than $90,000, the car loan APR will be 2%. If Harry's mortgage principle from part 3 is between $90,000 and $140,000, the APR will be 5% If Harry's mortgage principle from part 3 is more than $140,000, the APR will be 8%, Based upon your family size and decision in part 3, what will your monthly car payment be? 8.) Gas prices fluctuate, but are currently set at $2.75 per gallon. Accounting for his car of choice's MPG and his proximity from work which is decided upon in part 3, how much money will Harry need for fuel cost to get to and from work each month? Don't forget any overtime days. Page 5 of 1 9.) Insurance companies use various means for determining 6-month premiums (Cost for 6 months of coverage), "Gecko" insurance will use the value of your chosen car to assess risk. Their available policies are: ( a.) With a deductible of $1200, his 6-month premium cost is 2% of the total value of the vehicle. b.)) with a deductible of $840, his 6-month premium cost is 3% of the total value of the vehicle. With a deductible of $360, his 6-month premium cost is 5% of the total value of the vehicle. Which plan did you select? Based on your car's value, what is your total monthly insurance cost? 10.) Other transportation expenditures include the fuel cost for your weekend family trips. Based upon your decision in part 4 and your vehicles MPG, how much will it cost you in fuel each month for these weekend excursions? 11.) Ufe Happens: Harry bought a lemon. He must put $2500 on his credit card for a new transmission After parts 7-11, what is Harry's total transportation cost? Also, what is the total balance on your credit card at this point? (credit card deductions will come off loter) Page 6 of 11