Answered step by step

Verified Expert Solution

Question

1 Approved Answer

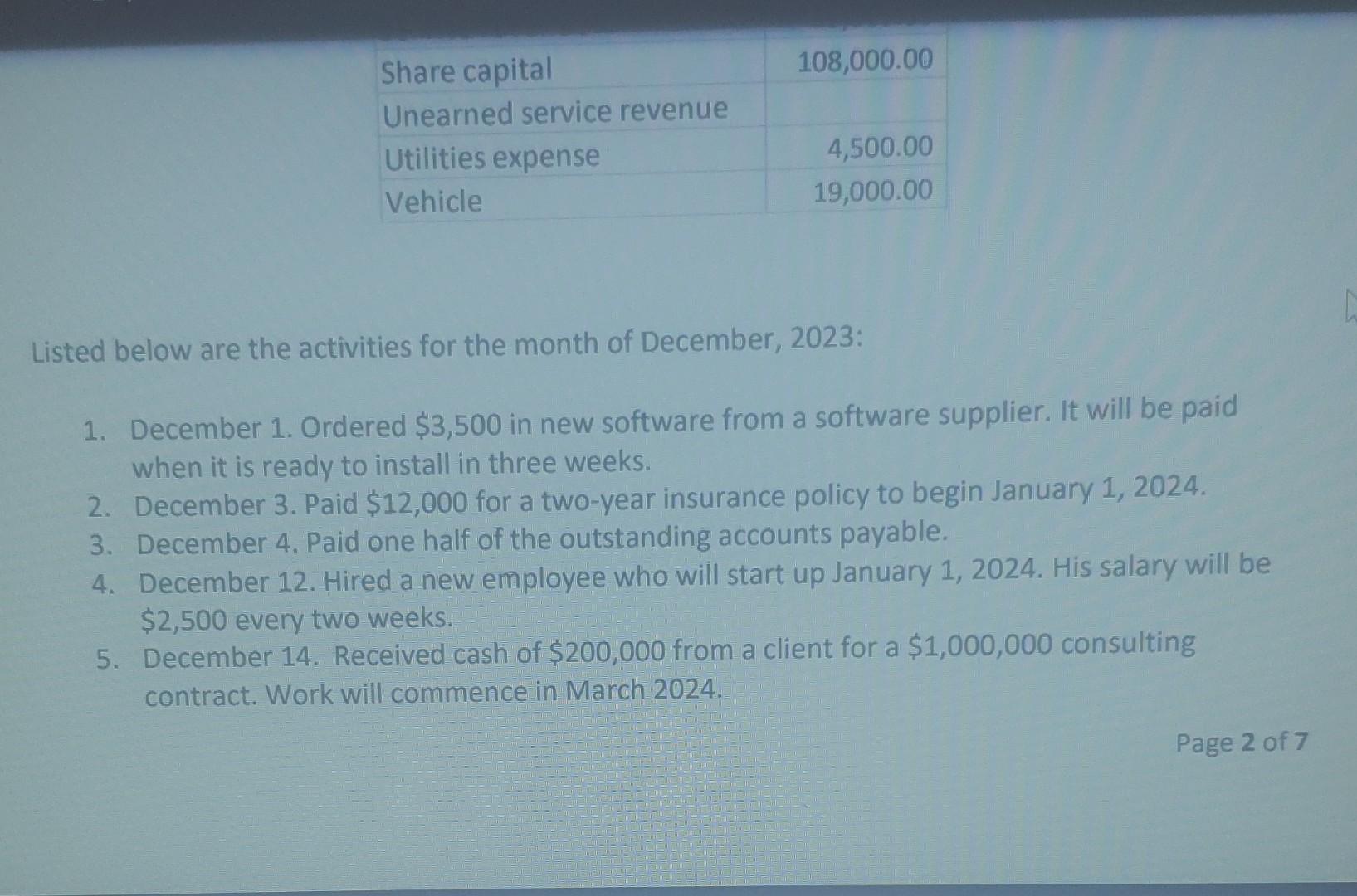

Listed below are the activities for the month of December, 2023: 1. December 1. Ordered $3,500 in new software from a software supplier. It will

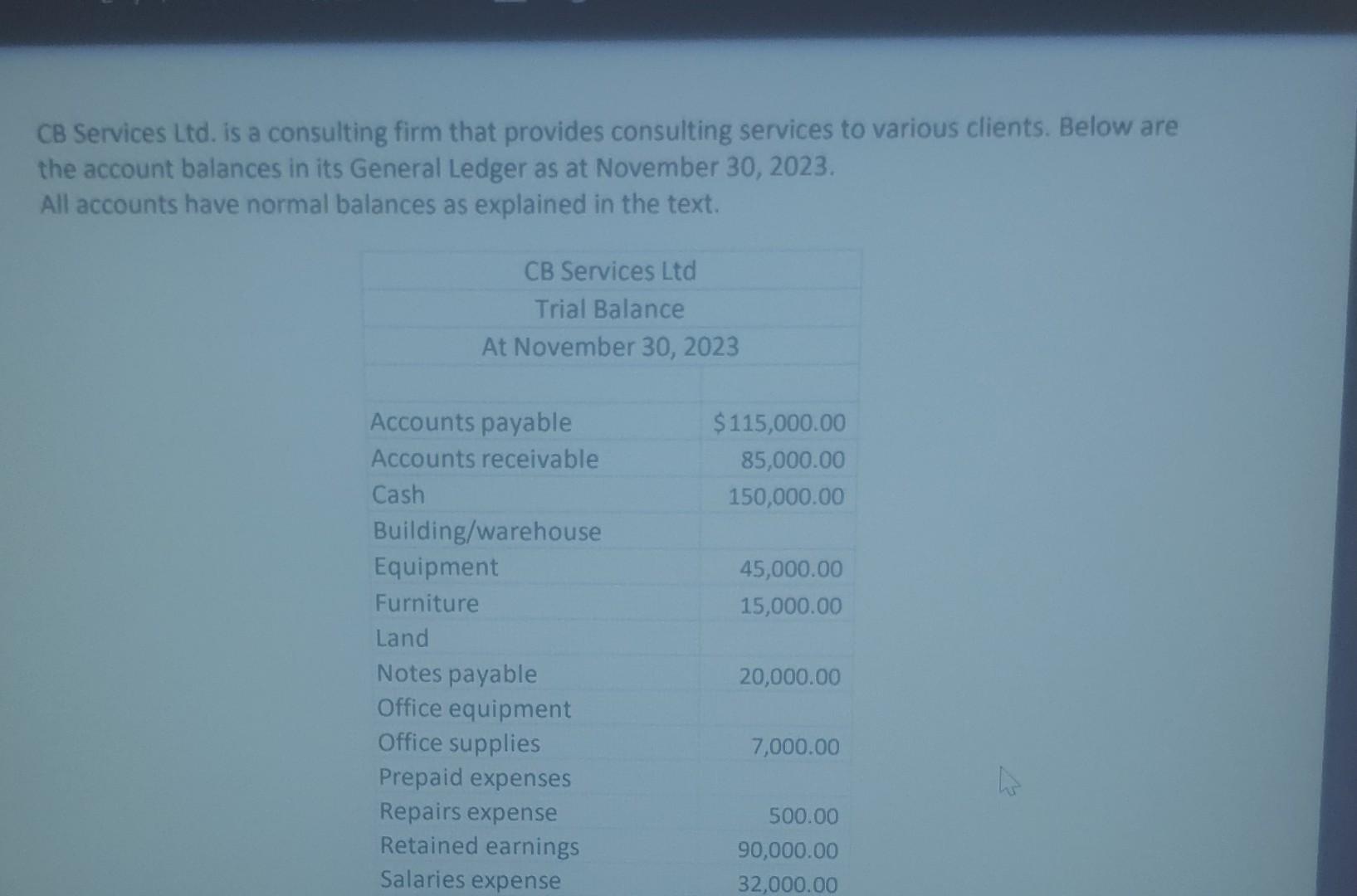

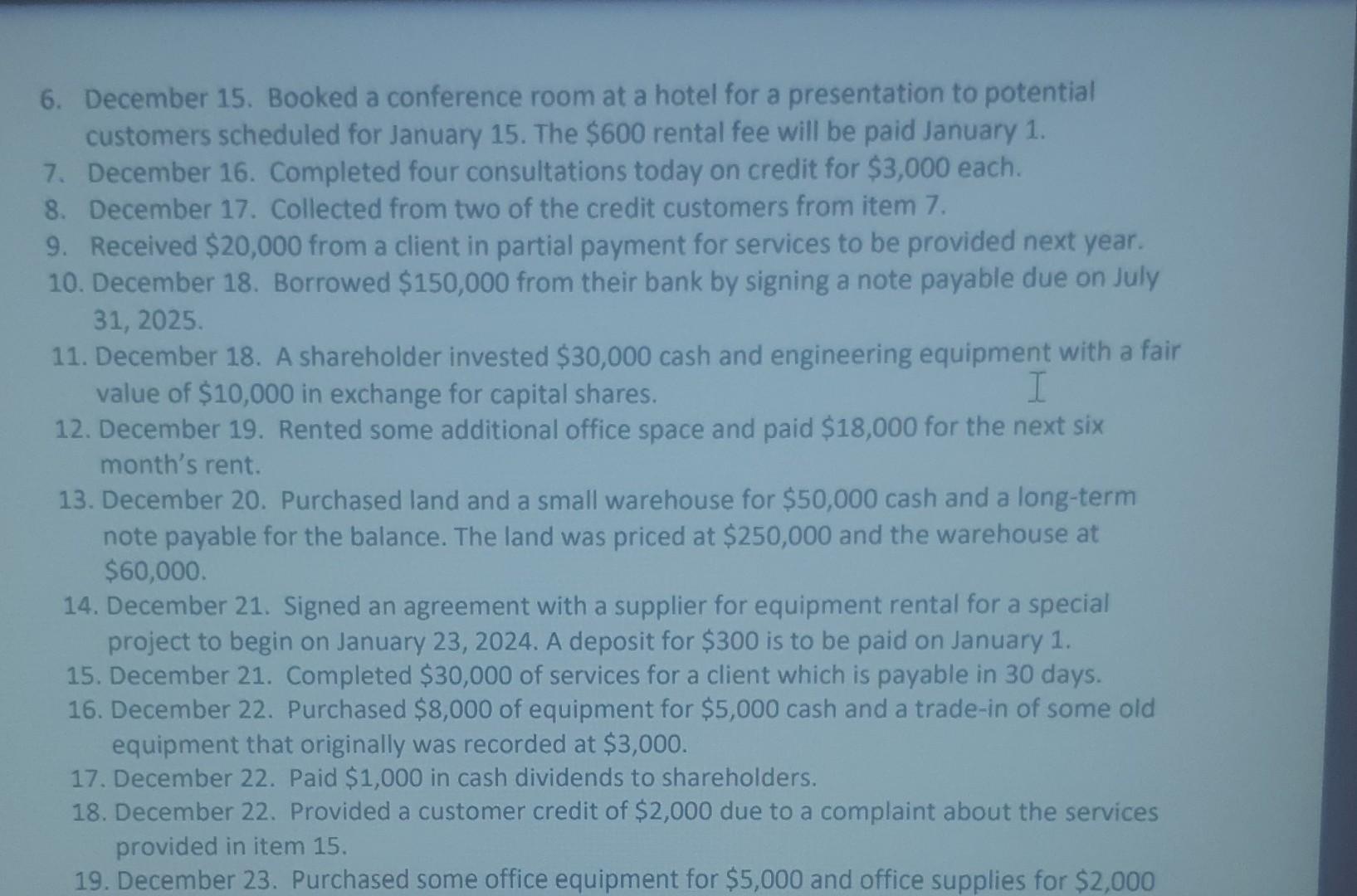

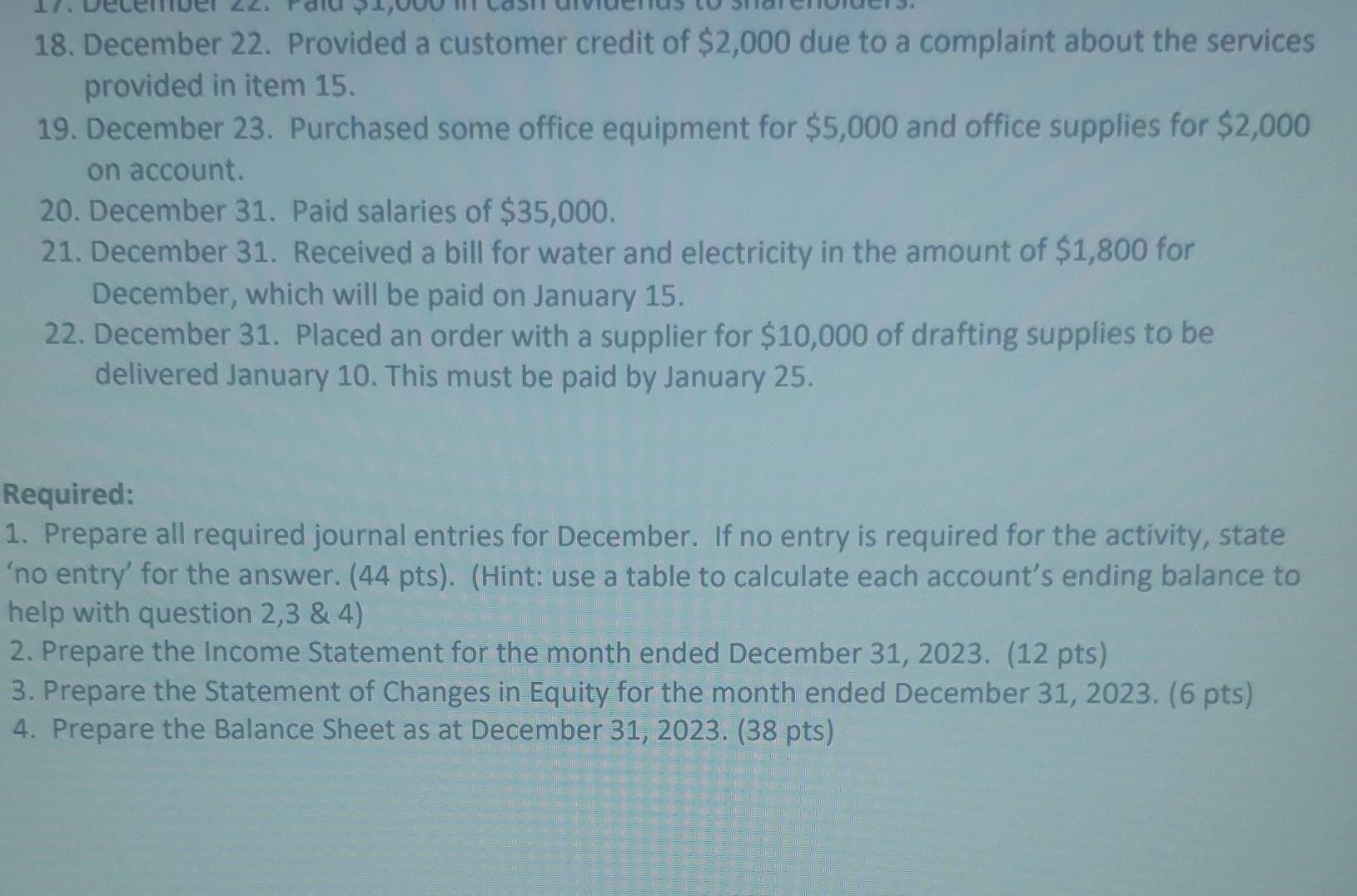

Listed below are the activities for the month of December, 2023: 1. December 1. Ordered $3,500 in new software from a software supplier. It will be paid when it is ready to install in three weeks. 2. December 3. Paid $12,000 for a two-year insurance policy to begin January 1, 2024. 3. December 4. Paid one half of the outstanding accounts payable. 4. December 12 . Hired a new employee who will start up January 1,2024 . His salary will be $2,500 every two weeks. 5. December 14 . Received cash of $200,000 from a client for a $1,000,000 consulting contract. Work will commence in March 2024. CB Services Ltd. is a consulting firm that provides consulting services to various clients. Below are the account balances in its General Ledger as at November 30, 2023. All accounts have normal balances as explained in the text. 18. December 22. Provided a customer credit of $2,000 due to a complaint about the services provided in item 15. 19. December 23. Purchased some office equipment for $5,000 and office supplies for $2,000 on account. 20. December 31. Paid salaries of $35,000. 21. December 31. Received a bill for water and electricity in the amount of $1,800 for December, which will be paid on January 15. 22. December 31. Placed an order with a supplier for $10,000 of drafting supplies to be delivered January 10. This must be paid by January 25 . Required: 1. Prepare all required journal entries for December. If no entry is required for the activity, state 'no entry' for the answer. ( 44pts ). (Hint: use a table to calculate each account's ending balance to help with question 2,3 \& 4) 2. Prepare the Income Statement for the month ended December 31, 2023. (12 pts) 3. Prepare the Statement of Changes in Equity for the month ended December 31, 2023. ( 6pts ) 4. Prepare the Balance Sheet as at December 31, 2023. (38 pts) 6. December 15. Booked a conference room at a hotel for a presentation to potential customers scheduled for January 15 . The $600 rental fee will be paid January 1. 7. December 16. Completed four consultations today on credit for $3,000 each. 8. December 17. Collected from two of the credit customers from item 7. 9. Received $20,000 from a client in partial payment for services to be provided next year. 10. December 18 . Borrowed $150,000 from their bank by signing a note payable due on July 31, 2025. 11. December 18. A shareholder invested $30,000 cash and engineering equipment with a fair value of $10,000 in exchange for capital shares. 12. December 19. Rented some additional office space and paid $18,000 for the next six month's rent. 13. December 20. Purchased land and a small warehouse for $50,000 cash and a long-term note payable for the balance. The land was priced at $250,000 and the warehouse at $60,000. 14. December 21. Signed an agreement with a supplier for equipment rental for a special project to begin on January 23,2024 . A deposit for $300 is to be paid on January 1 . 15. December 21. Completed $30,000 of services for a client which is payable in 30 days. 16. December 22. Purchased $8,000 of equipment for $5,000 cash and a trade-in of some old equipment that originally was recorded at $3,000. 17. December 22. Paid $1,000 in cash dividends to shareholders. 18. December 22. Provided a customer credit of $2,000 due to a complaint about the services provided in item 15. 19. December 23. Purchased some office equipment for $5,000 and office supplies for $2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started