Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Listed below are the industry standards of the ratios for Wynn Memorial's peer group. Current ratio 1 . 9 8 Acid test ratio 0 .

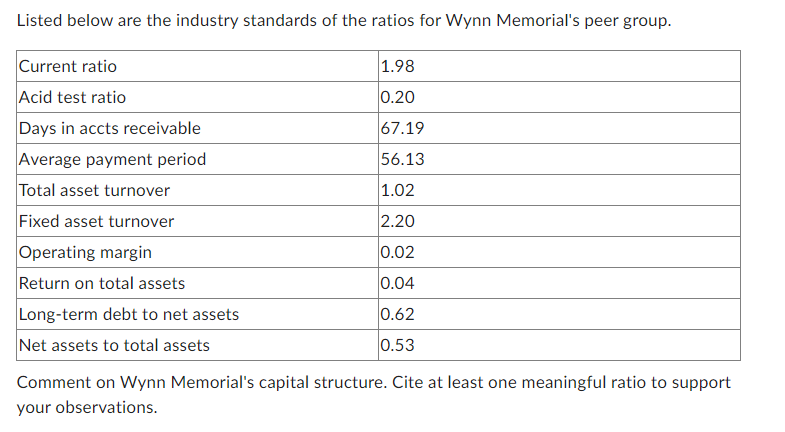

Listed below are the industry standards of the ratios for Wynn Memorial's peer group.

Current ratioAcid test ratioDays in accts receivableAverage payment periodTotal asset turnoverFixed asset turnoverOperating marginReturn on total assetsLongterm debt to net assetsNet assets to total assets

Comment on Wynn Memorial's capital structure. Cite at least one meaningful ratio to support your observations. Listed below are the industry standards of the ratios for Wynn Memorial's peer group.

begintabularll

hline Current ratio &

hline Acid test ratio &

hline Days in accts receivable &

hline Average payment period &

hline Total asset turnover &

hline Fixed asset turnover &

hline Operating margin &

hline Return on total assets &

hline Longterm debt to net assets &

hline Net assets to total assets &

hline

endtabular

Comment on Wynn Memorial's capital structure. Cite at least one meaningful ratio to support your observations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started