Answered step by step

Verified Expert Solution

Question

1 Approved Answer

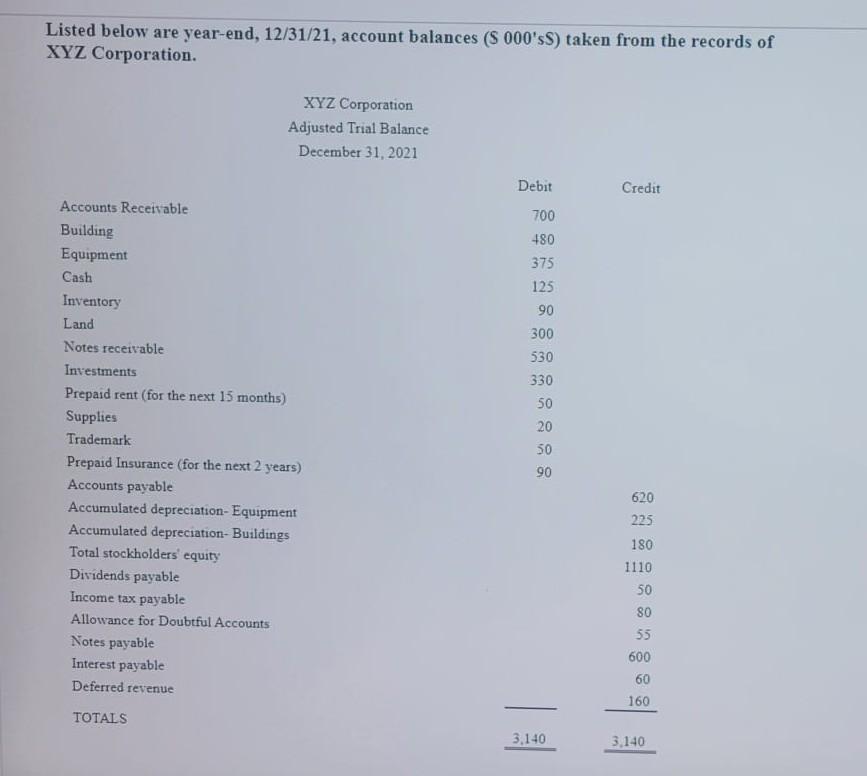

Listed below are year-end, 12/31/21, account balances (S 000's) taken from the records of XYZ Corporation. XYZ Corporation Adjusted Trial Balance December 31, 2021 Debit

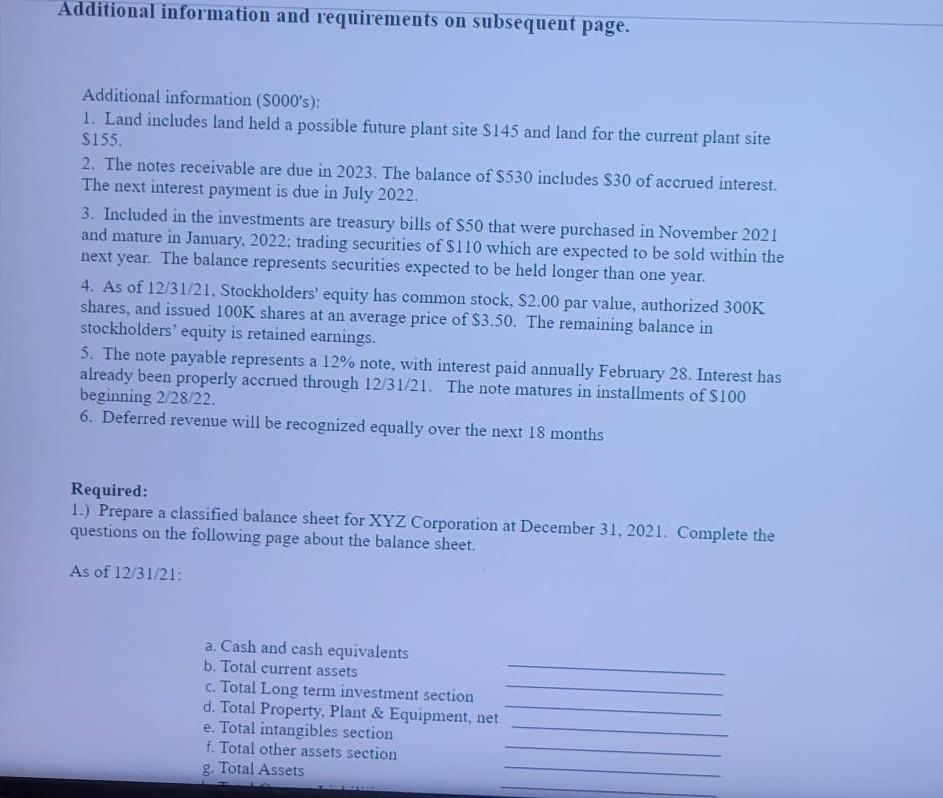

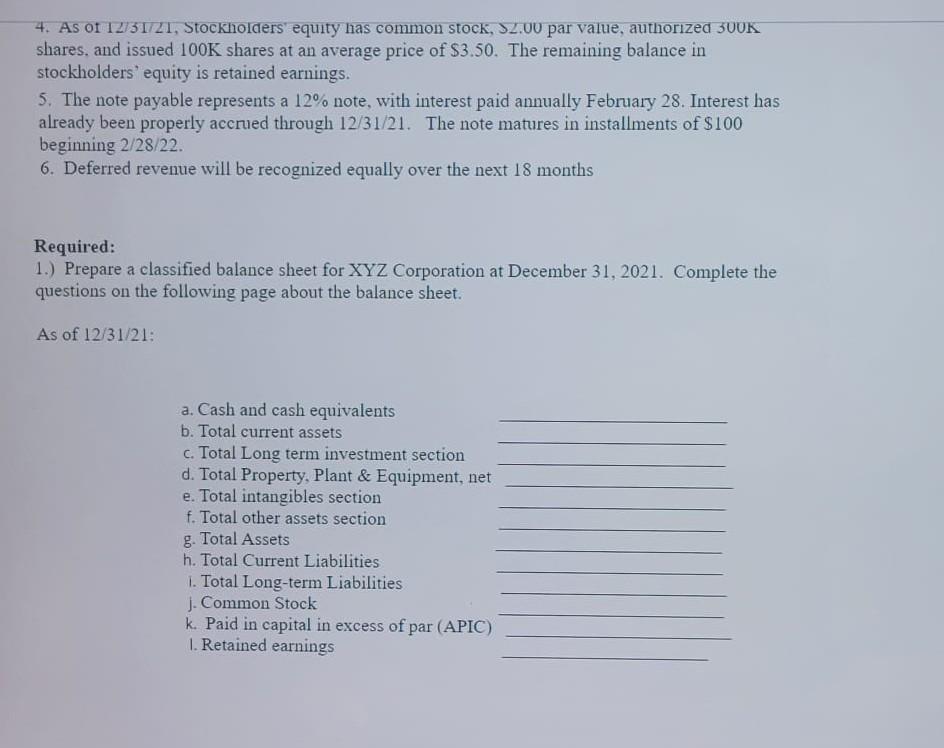

Listed below are year-end, 12/31/21, account balances (S 000's) taken from the records of XYZ Corporation. XYZ Corporation Adjusted Trial Balance December 31, 2021 Debit Credit Accounts Receivable Building Equipment Cash Inventory Land Notes receivable Investments Prepaid rent (for the next 15 months) Supplies Trademark Prepaid Insurance (for the next 2 years) Accounts payable Accumulated depreciation Equipment Accumulated depreciation-Buildings Total stockholders equity Dividends payable Income tax payable Allowance for Doubtful Accounts Notes payable Interest payable Deferred revenue 700 480 375 125 90 300 530 330 50 20 50 90 620 225 180 1110 50 80 55 600 60 160 TOTALS 3.140 3.140 Additional information and requirements on subsequent page. Additional information (S000's): 1. Land includes land held a possible future plant site $145 and land for the current plant site $155. 2. The notes receivable are due in 2023. The balance of $530 includes $30 of accrued interest. The next interest payment is due in July 2022. 3. Included in the investments are treasury bills of $50 that were purchased in November 2021 and mature in January, 2022; trading securities of $110 which are expected to be sold within the next year. The balance represents securities expected to be held longer than one year. 4. As of 12/31/21, Stockholders' equity has common stock, $2.00 par value, authorized 300K shares, and issued 100K shares at an average price of $3.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. Interest has already been properly accrued through 12/31/21. The note matures in installments of $100 beginning 2/28/22 6. Deferred revenue will be recognized equally over the next 18 months Required: 1.) Prepare a classified balance sheet for XYZ Corporation at December 31, 2021. Complete the questions on the following page about the balance sheet. As of 12/31/21: a. Cash and cash equivalents b. Total current assets c. Total Long term investment section d. Total Property, Plant & Equipment, net e. Total intangibles section f. Total other assets section g. Total Assets 4. As of 12/31721, Stockholders equity has common stock, Sz.00 par value, authorized 300K shares, and issued 100K shares at an average price of $3.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. Interest has already been properly accred through 12/31/21. The note matures in installments of $100 beginning 2/28/22. 6. Deferred revenue will be recognized equally over the next 18 months Required: 1.) Prepare a classified balance sheet for XYZ Corporation at December 31, 2021. Complete the questions on the following page about the balance sheet. As of 12/31/21: a. Cash and cash equivalents b. Total current assets c. Total Long term investment section d. Total Property, Plant & Equipment, net e. Total intangibles section f. Total other assets section g. Total Assets h. Total Current Liabilities 1. Total Long-term Liabilities J. Common Stock k. Paid in capital in excess of par (APIC) 1. Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started