Answered step by step

Verified Expert Solution

Question

1 Approved Answer

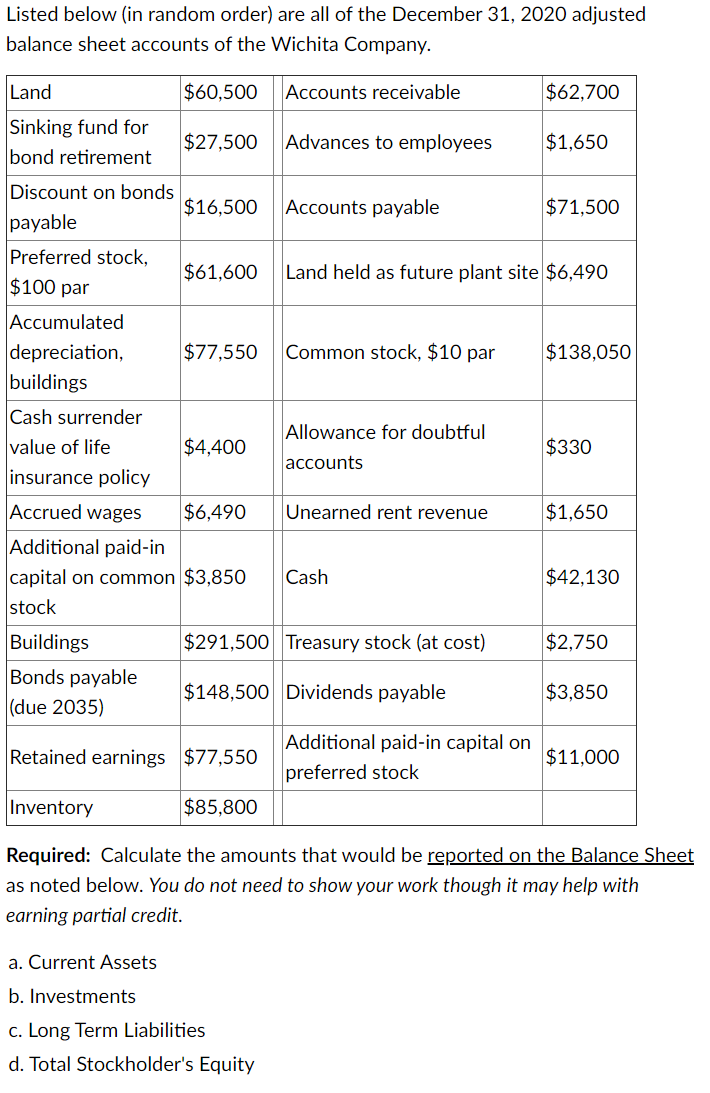

Listed below (in random order) are all of the December 31, 2020 adjusted balance sheet accounts of the Wichita Company. Land $60,500 Accounts receivable $62,700

Listed below (in random order) are all of the December 31, 2020 adjusted balance sheet accounts of the Wichita Company.

| Land | $60,500 | Accounts receivable | $62,700 | |

| Sinking fund for bond retirement | $27,500 | Advances to employees | $1,650 | |

| Discount on bonds payable | $16,500 | Accounts payable | $71,500 | |

| Preferred stock, $100 par | $61,600 | Land held as future plant site | $6,490 | |

| Accumulated depreciation, buildings | $77,550 | Common stock, $10 par | $138,050 | |

| Cash surrender value of life insurance policy | $4,400 | Allowance for doubtful accounts | $330 | |

| Accrued wages | $6,490 | Unearned rent revenue | $1,650 | |

| Additional paid-in capital on common stock | $3,850 | Cash | $42,130 | |

| Buildings | $291,500 | Treasury stock (at cost) | $2,750 | |

| Bonds payable (due 2035) | $148,500 | Dividends payable | $3,850 | |

| Retained earnings | $77,550 | Additional paid-in capital on preferred stock | $11,000 | |

| Inventory | $85,800 |

Required: Calculate the amounts that would be reported on the Balance Sheet as noted below. You do not need to show your work though it may help with earning partial credit.

| a. Current Assets |

| b. Investments |

| c. Long Term Liabilities |

| d. Total Stockholder's Equity |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started