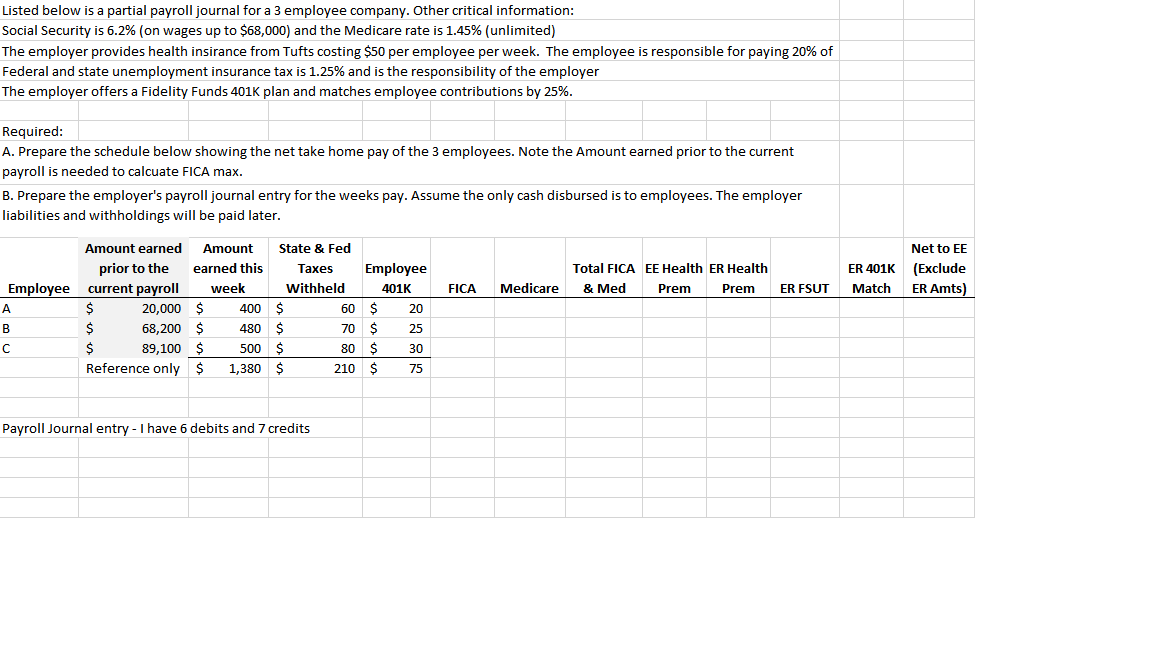

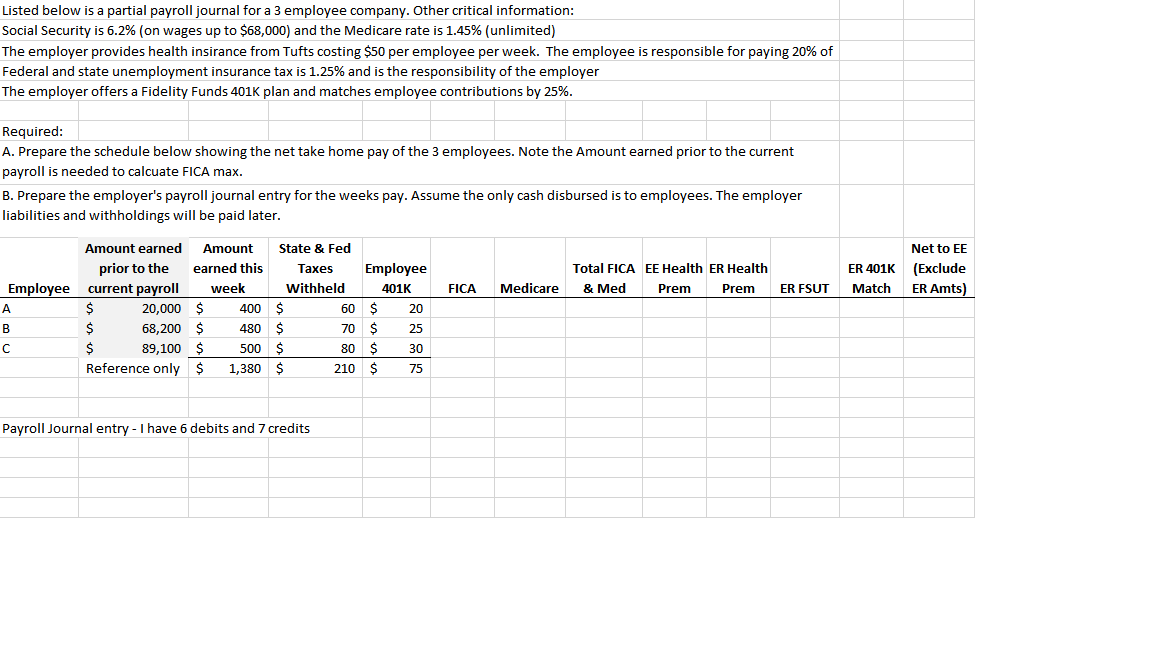

Listed below is a partial payroll journal for a 3 employee company. Other critical information: Social Security is 6.2% (on wages up to $68,000) and the Medicare rate is 1.45% (unlimited) The employer provides health insirance from Tufts costing $50 per employee per week. The employee is responsible for paying 20% of Federal and state unemployment insurance tax is 1.25% and is the responsibility of the employer The employer offers a Fidelity Funds 401K plan and matches employee contributions by 25%. Required: A. Prepare the schedule below showing the net take home pay of the 3 employees. Note the Amount earned prior to the current payroll is needed to calcuate FICA max. B. Prepare the employer's payroll journal entry for the weeks pay. Assume the only cash disbursed is to employees. The employer liabilities and withholdings will be paid later. Total FICA EE Health ER Health & Med Prem Prem Net to EE ER 401K (Exclude Match ER Amts) 401K FICA Medicare ER FSUT Amount earned Amount State & Fed prior to the earned this Taxes Employee Employee current payroll week withheld $ 20,000 $ 400 $ 60 $ 20 B $ 68,200 $ 480 $ 70 $ 25 $ 89,100 $ 500 $ 80 S 30 Reference only $ 1,380 $ 210 $ 75 Payroll Journal entry - I have 6 debits and 7 credits Listed below is a partial payroll journal for a 3 employee company. Other critical information: Social Security is 6.2% (on wages up to $68,000) and the Medicare rate is 1.45% (unlimited) The employer provides health insirance from Tufts costing $50 per employee per week. The employee is responsible for paying 20% of Federal and state unemployment insurance tax is 1.25% and is the responsibility of the employer The employer offers a Fidelity Funds 401K plan and matches employee contributions by 25%. Required: A. Prepare the schedule below showing the net take home pay of the 3 employees. Note the Amount earned prior to the current payroll is needed to calcuate FICA max. B. Prepare the employer's payroll journal entry for the weeks pay. Assume the only cash disbursed is to employees. The employer liabilities and withholdings will be paid later. Total FICA EE Health ER Health & Med Prem Prem Net to EE ER 401K (Exclude Match ER Amts) 401K FICA Medicare ER FSUT Amount earned Amount State & Fed prior to the earned this Taxes Employee Employee current payroll week withheld $ 20,000 $ 400 $ 60 $ 20 B $ 68,200 $ 480 $ 70 $ 25 $ 89,100 $ 500 $ 80 S 30 Reference only $ 1,380 $ 210 $ 75 Payroll Journal entry - I have 6 debits and 7 credits