Question

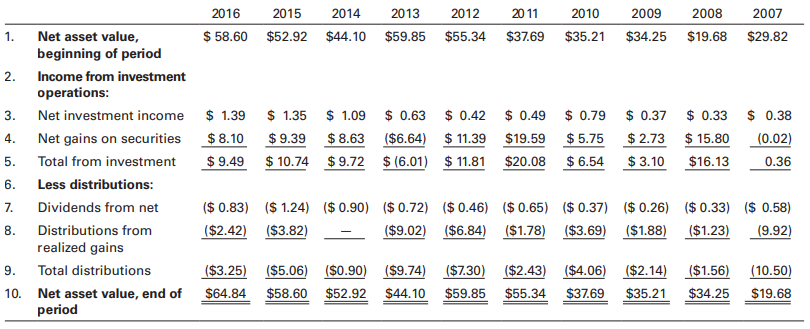

Listed below is the 10-year, per-share performance record of Larry, Moe, & Curleys Growth Fund, as obtained from the funds May 30, 2016, prospectus Use

Listed below is the 10-year, per-share performance record of Larry, Moe, & Curleys Growth Fund, as obtained from the funds May 30, 2016, prospectus

Use this information to find LM&Cs holding period return in 2016 and 2013. Also find the funds rate of return over the 5-year period 20122016, and the 10-year period 2007 2016. Finally, rework the four return figures, assuming the LM&C fund has a front-end load charge of 5% (of NAV). Comment on the impact of load charges on the return behavior of mutual funds.

here is the answer:

my question is how to use the financial calculator to cauclate and get the result.

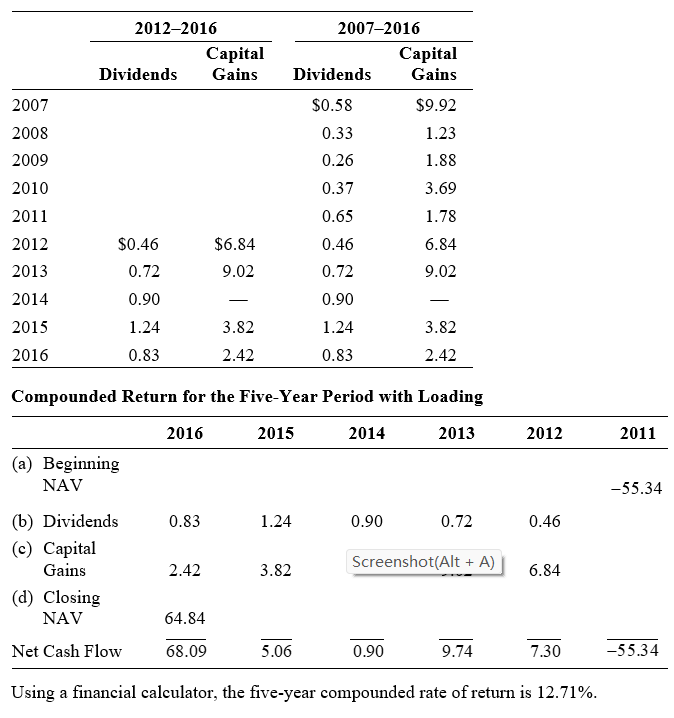

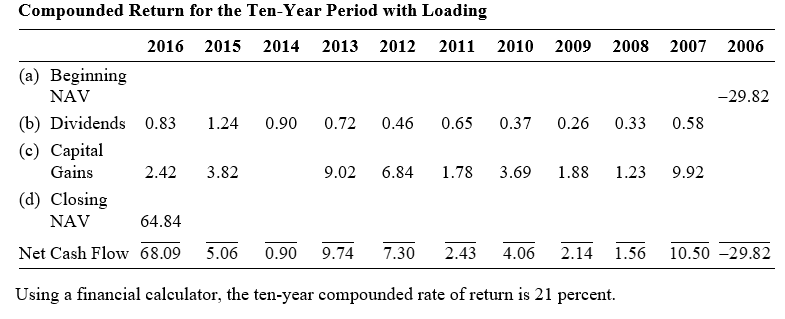

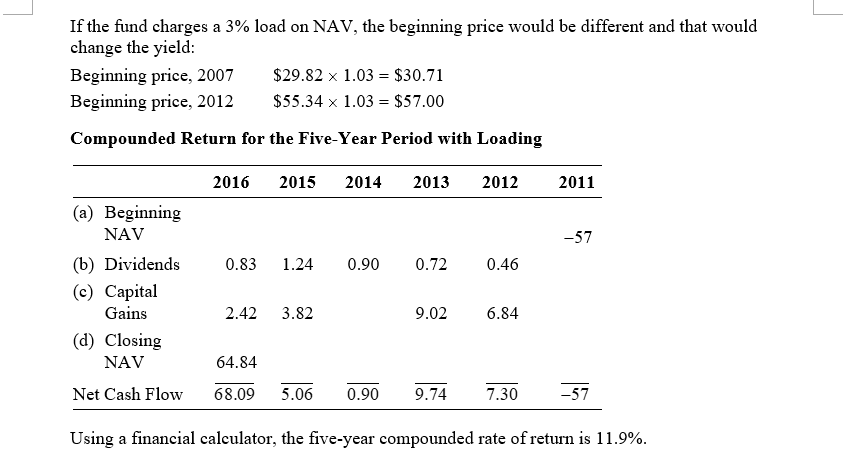

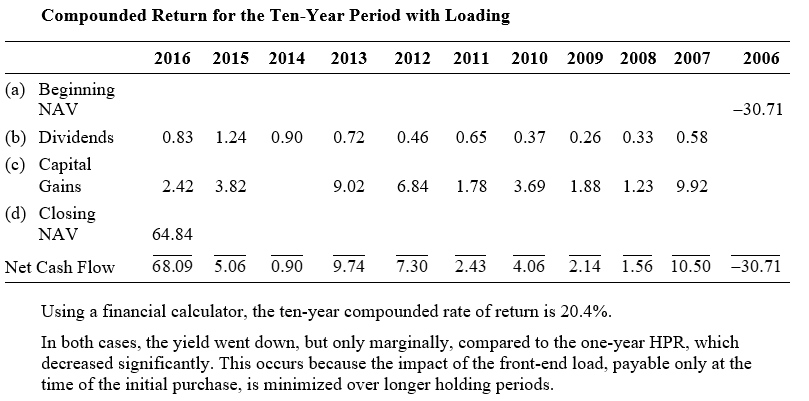

2. Income from investment operations: 6. Less distributions: 7. Dividends from net ($0.83)($1.24)($0.90)($0.72)($0.46)($0.65)($0.37)($0.26)($0.33)($0.58) 8. Distributions from ($2.42)($3.82)($9.02)($6.84)($1.78)($3.69)($1.88)($1.23)(9.92) realized gains period Using a financial calculator, the five-year compounded rate of return is 12.71%. Using a financial calculator, the ten-year compounded rate of return is 21 percent. If the fund charges a 3% load on NAV, the beginning price would be different and that would change the yield: Compounded Return for the Five-Year Period with Loading Using a financial calculator, the five-year compounded rate of return is 11.9%. Using a financial calculator, the ten-year compounded rate of return is 20.4%. In both cases, the yield went down, but only marginally, compared to the one-year HPR, which decreased significantly. This occurs because the impact of the front-end load, payable only at the time of the initial purchase, is minimized over longer holding periods. 2. Income from investment operations: 6. Less distributions: 7. Dividends from net ($0.83)($1.24)($0.90)($0.72)($0.46)($0.65)($0.37)($0.26)($0.33)($0.58) 8. Distributions from ($2.42)($3.82)($9.02)($6.84)($1.78)($3.69)($1.88)($1.23)(9.92) realized gains period Using a financial calculator, the five-year compounded rate of return is 12.71%. Using a financial calculator, the ten-year compounded rate of return is 21 percent. If the fund charges a 3% load on NAV, the beginning price would be different and that would change the yield: Compounded Return for the Five-Year Period with Loading Using a financial calculator, the five-year compounded rate of return is 11.9%. Using a financial calculator, the ten-year compounded rate of return is 20.4%. In both cases, the yield went down, but only marginally, compared to the one-year HPR, which decreased significantly. This occurs because the impact of the front-end load, payable only at the time of the initial purchase, is minimized over longer holding periodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started