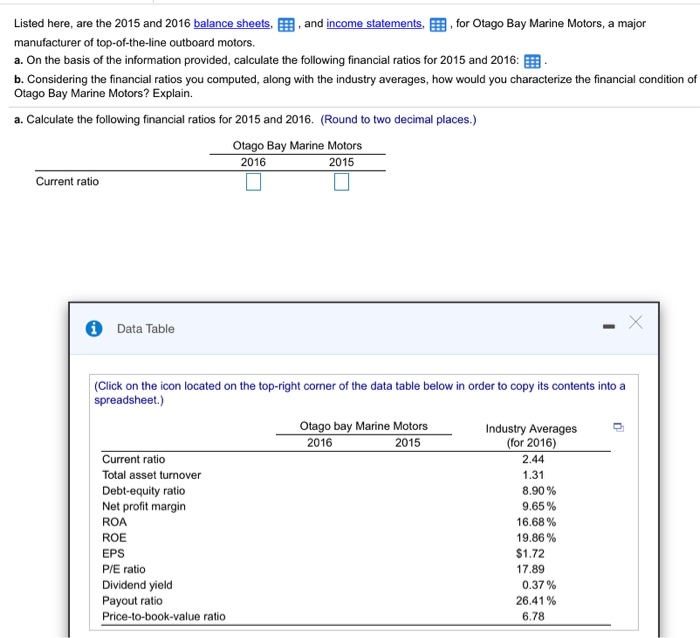

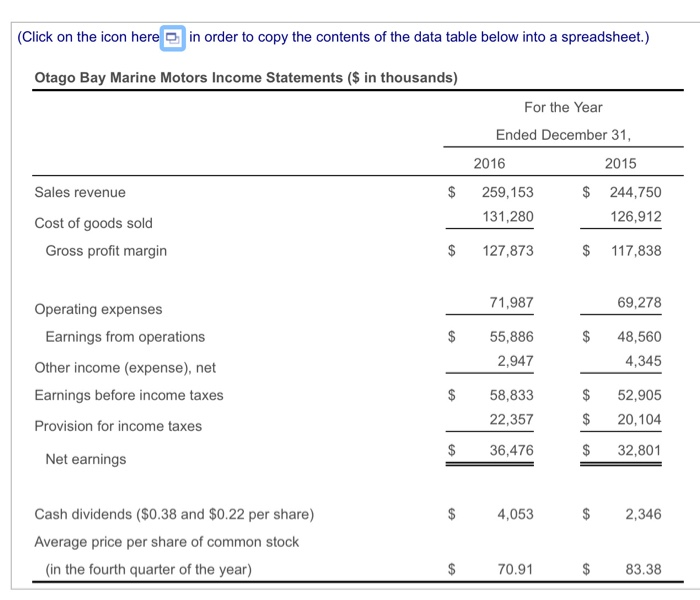

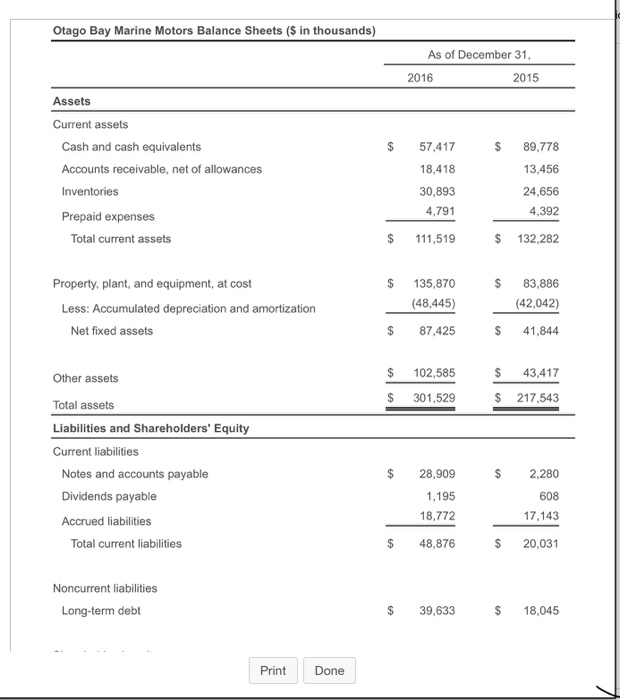

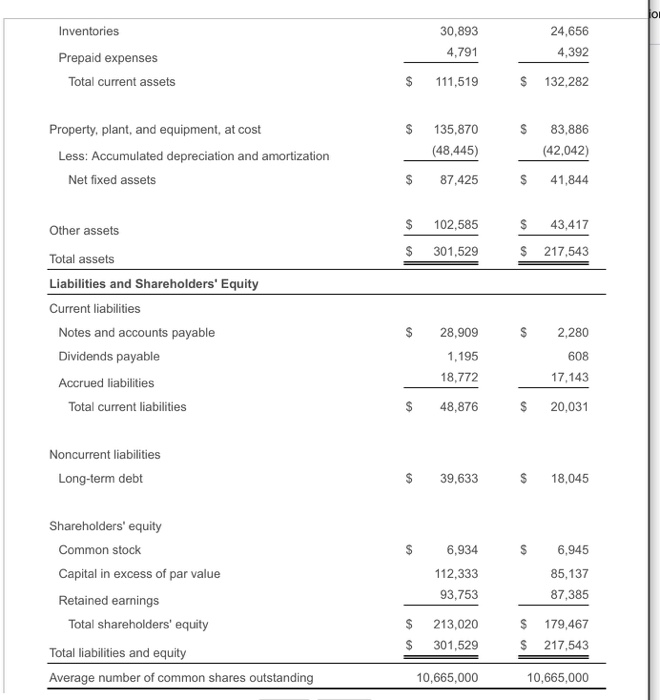

Listed here, are the 2015 and 2016 balance sheets, and income statements, for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2015 and 2016: b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. a. Calculate the following financial ratios for 2015 and 2016. (Round to two decimal places.) Otago Bay Marine Motors 2016 2015 Current ratio Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Otago bay Marine Motors 2016 2015 Current ratio Total asset turnover Debt-equity ratio Net profit margin ROA ROE EPS PIE ratio Dividend yield Payout ratio Price-to-book-value ratio Industry Averages (for 2016) 2.44 1.31 8.90% 9.65% 16.68% 19.86% $1.72 17.89 0.37% 26.41% 6.78 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago Bay Marine Motors Income Statements ($ in thousands) For the Year Ended December 31, 2016 2015 259,153 $ 244,750 131,280 126,912 Sales revenue $ Cost of goods sold Gross profit margin $ 127,873 $ 117,838 71,987 69,278 $ $ Operating expenses Earnings from operations Other income (expense), net Earnings before income taxes 55,886 2,947 48,560 4,345 58,833 22,357 36,476 $ $ 52,905 20,104 Provision for income taxes $ $ 32,801 Net earnings $ 4,053 $ 2,346 Cash dividends ($0.38 and $0.22 per share) Average price per share of common stock (in the fourth quarter of the year) $ 70.91 $ 83.38 Otago Bay Marine Motors Balance Sheets ($ in thousands) As of December 31, 2016 2015 Assets Current assets Cash and cash equivalents Accounts receivable, net of allowances $ $ 57,417 18,418 89,778 13,456 24,656 4,392 Inventories 30,893 4,791 Prepaid expenses Total current assets $ 111,519 $ 132,282 Property, plant, and equipment, at cost $ $ 135,870 (48,445) 83,886 (42,042) Less: Accumulated depreciation and amortization Net fixed assets $ 87,425 $ 41,844 Other assets $ $ 102,585 301,529 $ $ 43,417 217,543 Total assets Liabilities and Shareholders' Equity Current liabilities Notes and accounts payable Dividends payable $ $ 28,909 1,195 18,772 2,280 608 17,143 Accrued liabilities Total current liabilities $ 48,876 $ 20,031 Noncurrent liabilities Long-term debt $ 39,633 $ 18,045 Print Print Done Done Inventories 30,893 4,791 24,656 4,392 Prepaid expenses Total current assets $ 111,519 $ 132,282 Property, plant, and equipment, at cost $ $ 135,870 (48,445) 83,886 (42,042) Less: Accumulated depreciation and amortization Net fixed assets $ 87,425 $ 41,844 Other assets $ 43,417 $ $ 102,585 301,529 $ 217,543 Total assets Liabilities and Shareholders' Equity Current liabilities Notes and accounts payable Dividends payable $ $ 28,909 1,195 18,772 2,280 608 17,143 Accrued liabilities Total current liabilities $ 48,876 $ 20,031 Noncurrent liabilities Long-term debt $ 39,633 $ 18,045 Shareholders' equity Common stock Capital in excess of par value $ 6,934 $ 6,945 112,333 93,753 85,137 87,385 Retained earnings Total shareholders' equity $ $ 213,020 301,529 $ $ 179,467 217,543 Total liabilities and equity Average number of common shares outstanding 10,665,000 10,665,000