Question

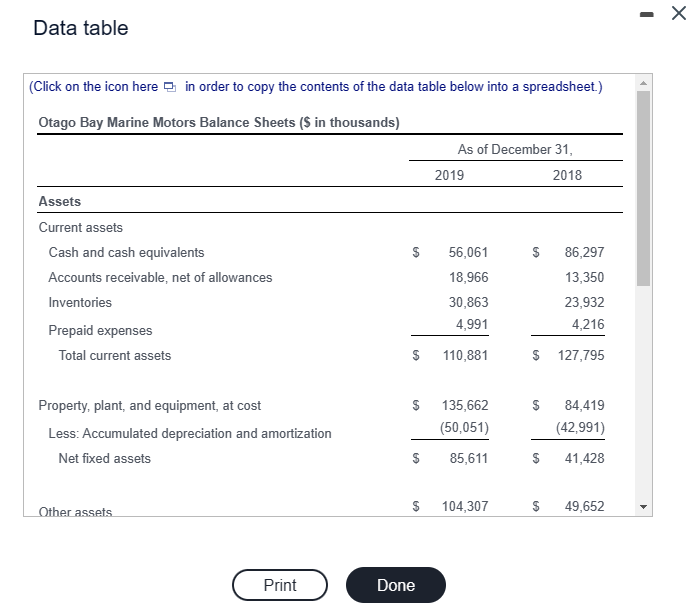

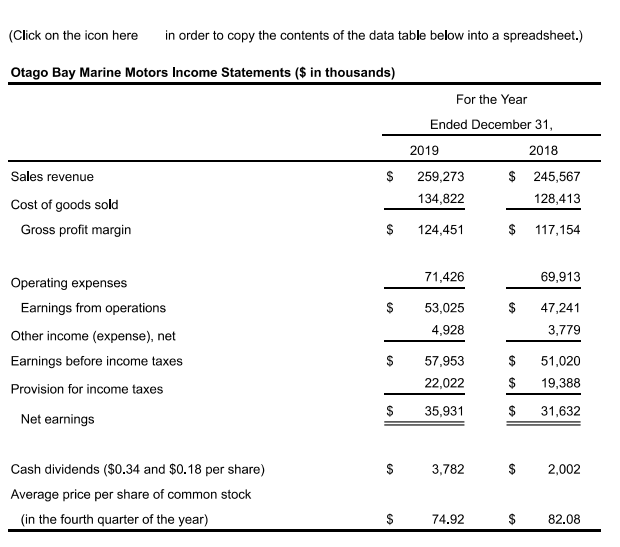

Listed here, are the 2018 and 2019 balance sheets, and income statements, for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a.

Listed here, are the 2018 and 2019 balance sheets, and income statements, for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2018and 2019: b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. 8) PE ratio = Market value per share / EPS P/E 2018 = P/E 2019 = 9) Dividend yield = Dividend per share / Price per share Yield 2018 = Yield 2019 = 10) Payout ratio = Total dividends / Net income Payout ratio 2018 = Payout ratio 2019 = 11) Price to book ratio = Market value per share / Book value per share P/B 2018 = P/B 2019 =

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started