Listed is the question ans the requirements for this question. Please help

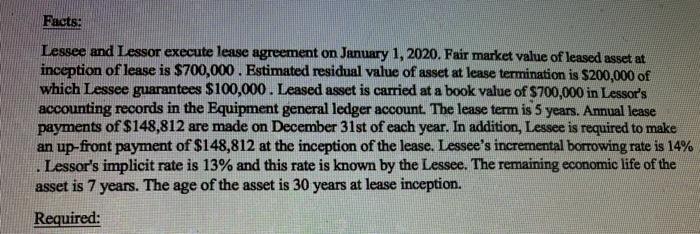

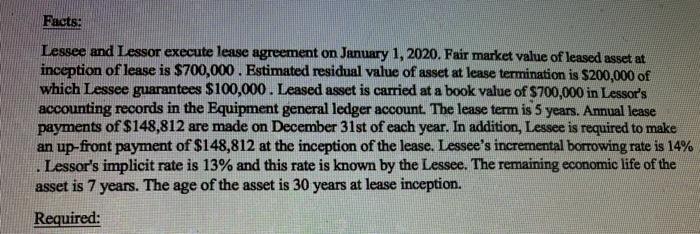

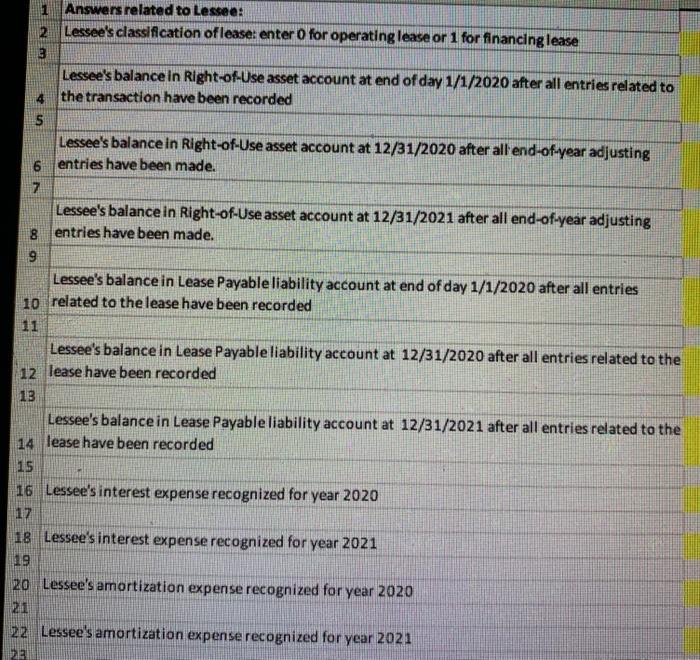

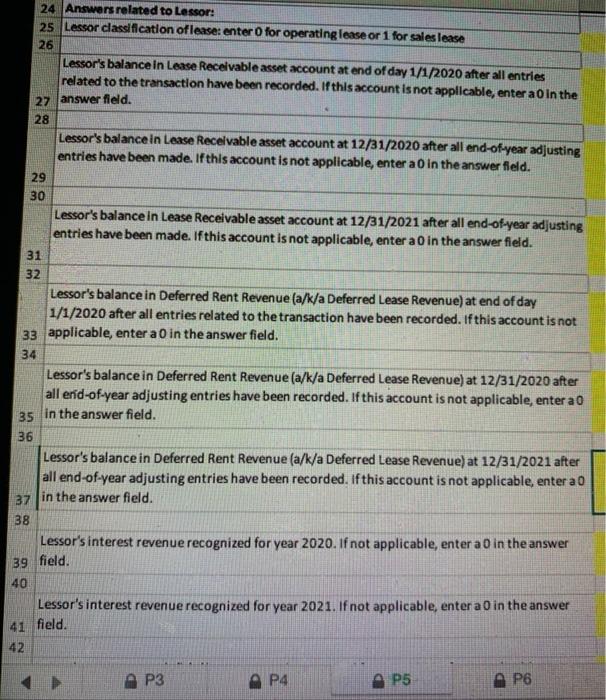

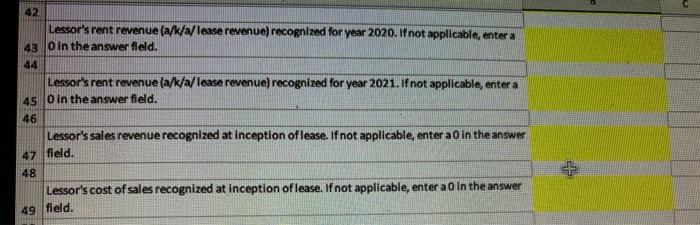

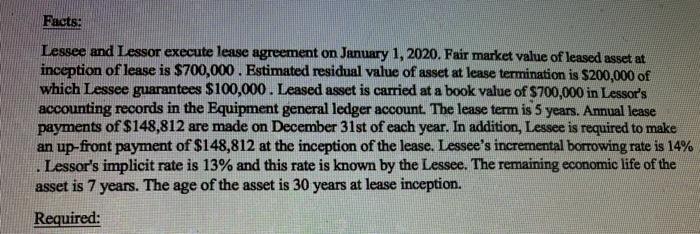

Facts: Lessee and Lessor execute lease agreement on January 1, 2020. Fair market value of leased asset at inception of lease is $700,000. Estimated residual value of asset at lease termination is $200,000 of which Lessee guarantees $100,000. Leased asset is carried at a book value of $700,000 in Lessor's Accounting records in the Equipment general ledger account. The lease term is 5 years. Annual lease payments of $148,812 are made on December 31st of each year. In addition, Lessee is required to make an up-front payment of $148,812 at the inception of the lease. Lessee's incremental borrowing rate is 14% Lessor's implicit rate is 13% and this rate is known by the Lessee. The remaining economic life of the asset is 7 years. The age of the asset is 30 years at lease inception. Required: Answers related to Lessee: 2 Lessee's classification of lease: enter 0 for operating lease or 1 for financing lease 3 Lessee's balance in Right-of-Use asset account at end of day 1/1/2020 after all entries related to 4 the transaction have been recorded u Lessee's balance in Right-of-Use asset account at 12/31/2020 after all end-of-year adjusting 6 entries have been made. 7 Lessee's balance in Right-of-Use asset account at 12/31/2021 after all end-of-year adjusting 8 entries have been made. 9 Lessee's balance in Lease Payable liability account at end of day 1/1/2020 after all entries 10 related to the lease have been recorded 11 Lessee's balance in Lease Payable liability account at 12/31/2020 after all entries related to the 12 lease have been recorded 13 Lessee's balance in Lease Payable liability account at 12/31/2021 after all entries related to the 14 lease have been recorded 15 16 Lessee's interest expense recognized for year 2020 17 18 Lessee's interest expense recognized for year 2021 1 7 19 20 Lessee's amortization expense recognized for year 2020 2 22 Lessee's amortization expense recognized for year 2021 24 Answers related to Lessor: 25 Lessor classification of lease: enter for operating lease or 1 for sales lease 26 Lessor's balance in Lease Receivable asset account at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not applicable, enter a in the 27 answer field, 28 Lessor's balance in Lease Receivable asset account at 12/31/2020 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a 0 in the answer field. 29 30 Lessor's balance in Lease Receivable asset account at 12/31/2021 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a 0 in the answer field. 31 32 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not 33 applicable, enter a 0 in the answer field. 34 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2020 after all end-of-year adjusting entries have been recorded. If this account is not applicable, enter a 0 35 in the answer field. 36 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2021 after all end-of-year adjusting entries have been recorded. If this account is not applicable, enter a 0 37 in the answer field. 38 Lessor's interest revenue recognized for year 2020. If not applicable, enter a 0 in the answer 39 field. 40 Lessor's interest revenue recognized for year 2021. If not applicable, enter a 0 in the answer 41 field. 42 AP3 P4 P5 AP 42 Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2020. If not applicable, enter a 43 O in the answer field. 44 Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2021. If not applicable, enter a 45 O in the answer field. 46 Lessor's sales revenue recognized at inception of lease. If not applicable, enter ao in the answer 47 field. 48 Lessor's cost of sales recognized at inception of lease. If not applicable, enter a O in the answer 49 field