Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Listen You are considering the purchase of a quadruplex apartment building. Effective gross income ( EGI ) during the first year of operations is expected

Listen

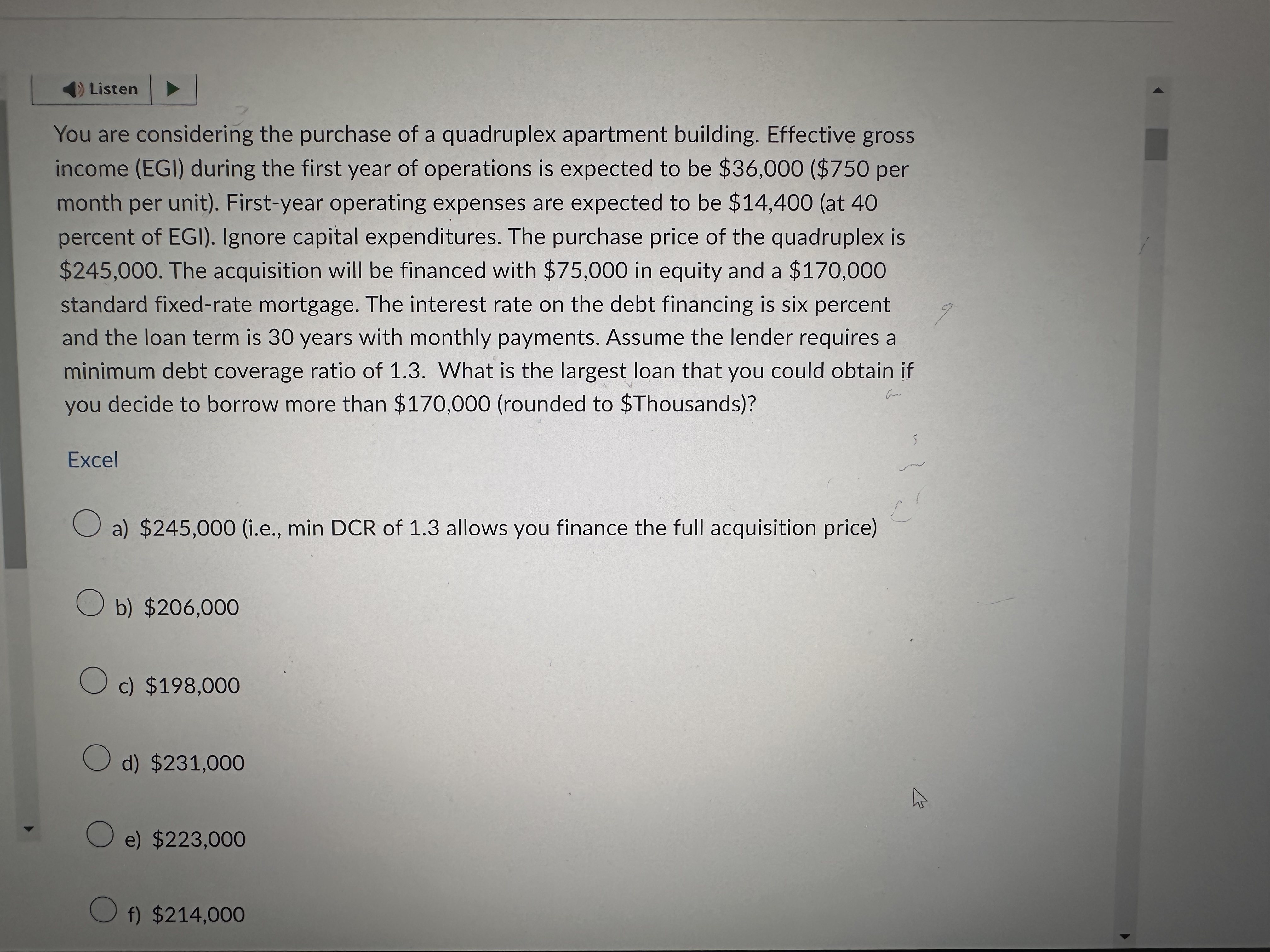

You are considering the purchase of a quadruplex apartment building. Effective gross income EGI during the first year of operations is expected to be $ $ per month per unit Firstyear operating expenses are expected to be $at percent of EGI Ignore capital expenditures. The purchase price of the quadruplex is $ The acquisition will be financed with $ in equity and a $ standard fixedrate mortgage. The interest rate on the debt financing is six percent and the loan term is years with monthly payments. Assume the lender requires a minimum debt coverage ratio of What is the largest loan that you could obtain if you decide to borrow more than $rounded to $ Thousands

Excel

a $ie min DCR of allows you finance the full acquisition price

b $

c $

d $

e $

f $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started