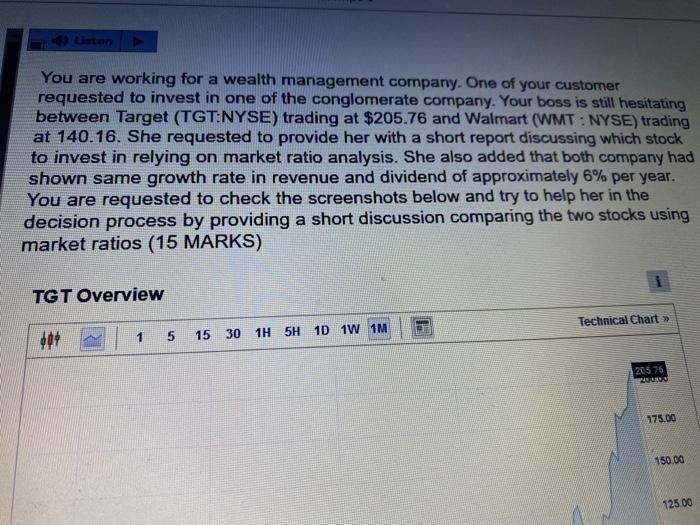

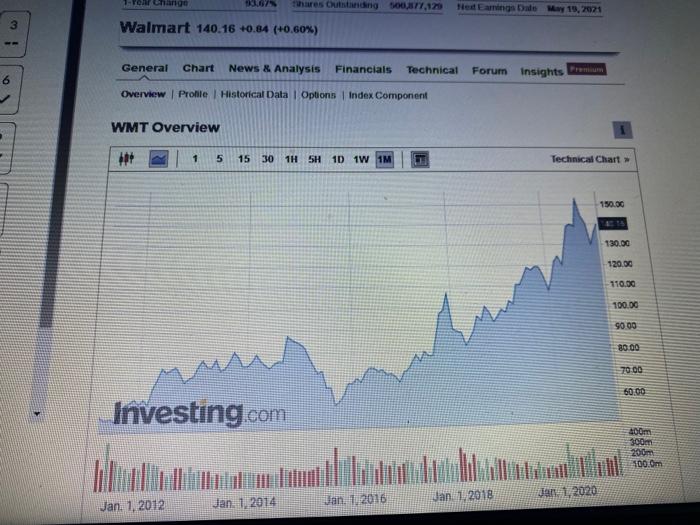

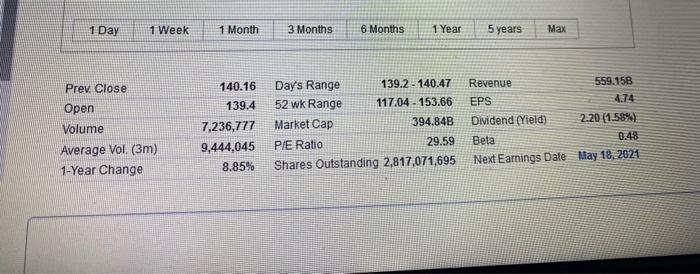

Liten You are working for a wealth management company. One of your customer requested to invest in one of the conglomerate company. Your boss is still hesitating between Target (TGT:NYSE) trading at $205.76 and Walmart (WMT: NYSE) trading at 140.16. She requested to provide her with a short report discussing which stock to invest in relying on market ratio analysis. She also added that both company had shown same growth rate in revenue and dividend of approximately 6% per year. You are requested to check the screenshots below and try to help her in the decision process by providing a short discussion comparing the two stocks using market ratios (15 MARKS) TGT Overview Technical Chart >> 1 604 5 15 30 1H5H 1D 1W 1M 205.76 ug 175.00 150.00 125.00 . 3 Apr 1 5 15 30 1510 1W Technical Chart 175.00 150.00 125.00 100.00 75.00 Investing.com 50.00 200m 150m 100.0m 500m Jan 1, 2012 Jan. 1, 2014 Jan. 1.2016 Jan. 1. 2018 Jan 1, 2020 3 Months 1 Month 1 Year 6 Months 1 Week 5 years Max 1 Day Prev, Close OF Volume Average Vol. (3m) 1-Year Change 205.76 206.02 3,370,288 3,796,657 93.67 Day's Range 203.53 - 206.21 52 wk Range 100.5 - 207.29 Market Cap 103.06B PIE Ratio 23.80 Shares Outstanding 500,877.129 Revenue 93.56B EPS 8.65 Dividend (Yield) 2.72 (1.32%) Beta 1 Next Earnings Dale May 19, 2021 Tournage SYN hares Cutting 0,877,123 Ned Earnings Date May 19, 2021 Walmart 140.16 +0.84 (40.60%) General Chart News & Analysis Financials Technical 6 Forum Insights remium Overview Profile | Historical Data Options Index Component WMT Overview . 1 5 15 30 1H 5H 1D 1W 1M Technical Chart 150.00 130.00 120.00 110.00 100.00 90.00 80.00 70 00 60.00 Investing.com 300m 300m 200 100 m Jan 1, 2020 Jan 1, 2012 Jan 1, 2014 Jan 1 2018 Jan 1, 2016 1 Day 1 Week 1 Month 3 Months 6 Months 1 Year 5 years Max 140.16 139.4 Prev Close Open Volume Average Vol. (3m) 1-Year Change 7.236,777 9,444,045 8.85% Day's Range 139.2 - 140.47 52 wk Range 117.04.153.66 Market Cap 394.84B P/E Ratio 29.59 Shares Outstanding 2,817,071,695 Revenue 559.158 EPS 4.74 Dividend (Yield) 2.20 (1.58%) Beta 0.48 Next Earnings Date May 18, 2021