Question

LITERATURE REVIEW 2.1 Introduction This chapter reviews the literature on the past studies that have been conducted on financial inclusion and the determinants of financial

LITERATURE REVIEW

2.1 Introduction

This chapter reviews the literature on the past studies that have been conducted on financial inclusion and the determinants of financial inclusion in Ghana and elsewhere. It starts with the definition of financial inclusion. It also has information such as the summary of the banking system in Ghana, the underpinnings of the theoretical and empirical concept of the research.

2.2 Theoretical Literature

Various theories could be used to explain financial inclusion and the determinants of financial inclusion in Ghana These include the theory of credit rationing, the theory of planned behavior among others. Following below, the theories are briefly discussed.

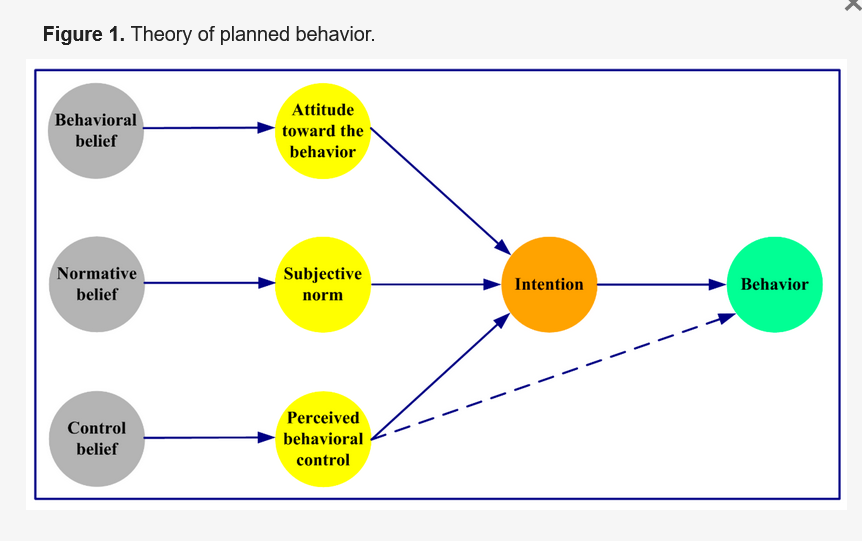

2.2.1 The Theory of Planned Behavior[AGD1]

A lot of researchers have agreed to the fact that describing individual attitude is quite demanding and a very hard one. More researchers have asserted that personal behavior and social opinion have all added to the effort to predict and clarify human behavior (Ajzen, 1983). There exist many theories that target at predicting human behavior. The well-known among these theories is the theory of planned behavior developed by Ajzen in the year 1991. This theory is found to be analytical in anticipating the multiple range of human attitudes (Saidin and Isa, 2013).

The theory of personal behavior, also known as behaviourism is the study of human behavior as it correlates to ones environment. These theories assume that humans are rational and thus, make use of the information accessible by them to make a rational decision. According to Ajzen (1991), The Theory of Planned Behavioral studys rationale behind why people engage in a behavior and detect three elements that underline individual intends to engage in a behavior. The attitude of the individual and the tailored geared toward such behavior are the first elements. Individual factors like age, gender, and individual ability all add to shaping one's attitude towards the behavior (Giluk and Postlethwaite, 2015).

According to the Theory of Perceived Behavior, the second element after the first element is the opinion of others about a behavior. Thus, the attitude and actions of an individual are been influenced by the views and opinions of other persons. According to perceived theory, perceived behavior is the third factor of people's behavior. This behavior rises when a person is more confident about him or herself that he or she has the vital skills to perform that behavior and such skills fall when the person perceived it to a challenge for the behavior to be done (Ajzen, 1991). Hence, it is compelling to probe that the Theory of Perceived Behavior will help us examine the main determinants of Financial Inclusion in Ghana after an extensive review.

Source: Adjzen (1991) and Mathieson (1991)

2.2.2 The Definition of Financial Inclusion

Although, there is no specific agreement over the meaning of financial inclusion and there exist various views on what financial inclusion means and involves as illustrated in the existing literature. According to Kunt and Klapper (2012) financial inclusion has been elucidated in many ways. Financial Inclusion can be explained as the nonexistence of price obstructions in the practice of financial service (Hannig and Jansen, 2011). Financial inclusion refers to the procedure by which the vulnerable individuals especially the low-income segments and all units of the society have easy access to appropriate financial products and services at an affordable cost in an unbiased and apparent manner by structured mainstream organized players (Chakrabarty, 2010). According to Hayton et al. (2007), Financial Inclusion can be elucidated as access for persons to appropriate and proper financial products and services. This involves having better understanding, capacity, awareness, and abilities to best make use of those financial products and services. Financial inclusion is a major challenge in developing countries, especially in Africa of which Ghana is no exception (Chikalipah, 2017). Beck and Cull (2015) revealed that there is more financial exclusion among the financial firms in the developing countries as against those in the developed countries. Financial inclusion aids in the reduction of poverty among individuals especially the vulnerable. When individuals have access to appropriate financial services at a reasonable cost, it aids reduce poverty as these individuals can meet their basic needs such as shelter, education, and health (Bruhn and Love, 2014). The world bank also concludes that financial inclusion is when individuals and business having access to useful and affordable financial products and services that meet their needs- transactions, payments, savings, credit and insuranc[AGD2] [AGD3] e delivered in a responsible and suitable way.

2.2.3 The Synopsis of Banking System in Ghana

A bank is a financial firm that accepts deposits from the public and creates a demand deposits while simultaneously making loans. Banks are intermediaries between depositors (who lend money to the banks) and borrowers (to whom the bank lends money). The banking sector of the Ghanaian economy has experienced many stages of financial deregulations all directed towards improving the industry, making it financially inclusive, and making it more competitive. The banking system in Ghana could be dated back to 1953 when the government instituted the Bank of Gold Coast in that era. Later the bank was divided into two, particularly Bank of Ghana and Ghana Commercial bank. Before the 1980s, the banking sector in Ghana has faced many government interventions. Around that period, most of the banks were owned by the government and thus, restraints were levied on international entry, and also the interest rate was regulated by the bank of Ghana. There was an influx of banks in 1989 such as CAL bank and Eco bank which were freed to operate after the enactment of the financial law. There also exist the non- banking firms seeking to operate as finance houses building of social orders which have been granted by the financial institution Law 193 (P.N.D.C Law 328). Ghanas banking industry is up of the central bank, investment banks, commercial banks, universal banks, rural banks, and microfinance. In the pursuit of improving the banking system in Ghana, there was a rise in the minimum capital requirement of universal banks in the year 2017 from GHS120 million to GHS 400 million, and all the banks were given directives to meet the requirement by the end of December 2018. After the directives from the central bank of Ghana, the total number of banks in Ghana has currently reduced from thirty four (34) to twenty three (23). 14

2.2.4 The Scope of Financial Inclusion

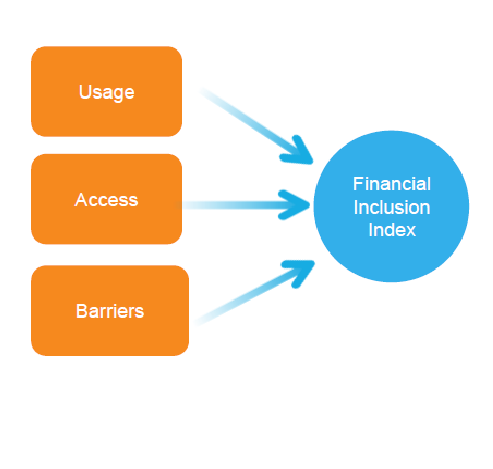

Alliance for Financial Inclusion (2012) posits financial inclusion involves many diverse issues. They considered that firms and individuals can be categorized into two, whether the institution of a person is not included or not. Sharma (2016) revealed that several states have strengthened their choice to device policies to involve anyone who wants to be financially included and thus leave no one behind due to the gain that nations get from financial inclusion. According to Sequeira and Hans (2012), financial inclusion may be assessed via four dimensions of complexity; access it also deals with the ability of banks to offer services or products that are aligned to the regulatory market space. Thus, individuals need to find out the challenges that these banks go through in delivering their service to help analyze access to financial service; quality this focus on the banks prospects that meet the desires and expectations of their clients with their service delivery. Factors such as transparency, easiness, and client safety exhibit quality of the product; usage it describes how clients employ banking operation like several trades per account and electronic transaction; impact which involve assessing deviations in the lives of users that may be ascribed to the utilization of financial service. Many factors have been employed to measure the scope of financial inclusion well-known as Index Financial Inclusion. They consist of bank account per adult, geographical and demographical ATM, cash- deposit ratio, income- deposit, loan-income ratio, and demographic loan and deposit penetration (Conrad, et al., 2008). For an individual to use banking operations, one needs to have access to it. It should be noted that allowing individuals to have access to banking services does not necessarily mean that they use it. Thus, not everyone who fails to be part of the banking operations must be named.

Figure 2: Measures of Financial Inclusion

Source: Adopted from Hannig and Jansen, (2010)

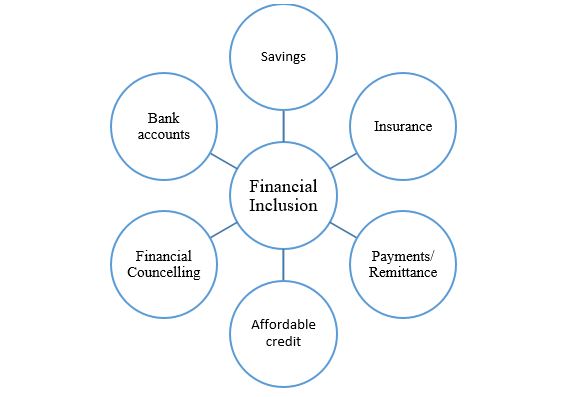

According to Thorat (2006), the scope of financial inclusion includes the delivery of economical financial services, particularly, access to remittance and payment facilities, insurance service, loans, and savings by the official financial structure to those who incline not to be included. Sahrawat (2010) scope of financial inclusion coincides with Thorats Scope of financial inclusion, however, added financial counseling and a variety of bank accounts fitting the exact needs of the clients.

Figure 3: The Scope of Financial Inclusion

Source: Sahrawat 2010 17

2.3 Reasons for Financial Exclusion

The barriers to financial inclusion are major issue faced by Ghana as far as financial Inclusion is concerned. Components such as regulation barriers, prohibitive market elements, geographical and connectivity barriers hinder many individuals from accessing banking products and services. Below are the brief explanations of the barriers stated earlier on.

2.3.1 Regulatory Barriers

A lot of researchers have held that the regulation in the banking system in one way or another tends to marginalize the bank population already banked and thus, Know Your Customer regulations by banks as ordered by the central bank in account opening has led to the limited access of some segment of clients to the service of banks in Ghana (Boateng, 2016).do not motivate further inclusion. In some instances, the regulatory structure compelled the financial officials to restrict the capacity of financial firms especially the banks to appeal to new clients.

2.3.2 Prohibition Market Barrier

There have been instances where potential clients of banks are not able to obtain the services they need because they are restrained by some elements such as lack of credit records, huge transaction fees for basics service, and precondition that require the customers to maintain minimum account balances (Boateng, 2016).

2.3.3 Geographical and Connectivity Barriers

Most individuals access financial services in geographical branches of banks they want. Nonetheless, in Ghana, some banks do not have branches especially in the remote zones in the name of cost reduction. Notwithstanding the invasion of advanced technology and innovation in the banking sector such as internet banking, these are not reliable in areas with network connectivity issues. Thus, this makes the provision of financial deliveries or services less effective and efficient.

Engaging in financial inclusion does not necessarily mean that banks will assume costs in planning which area or person to offer service to. The important interventions needed are initiatives tailored towards eliminating all kinds of barriers in having access to large financial products and services.

[AGD1]just one theory?

[AGD2]no need as well

[AGD3]no need for dedinition in this chapter

[AGD4]i am expecting to see am empirical review of financial inclusion and growth since this is part of your objectives

Required:

Please review and correct the grammar and rewrite it to be free from plagiarism

Figure 1. Theory of planned behavior. Usage Access Barriers Financial Inclusion IndexStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started