Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Little Box Retailer reported sales of $58,000,000. In the prior year, sales were $52,000,000. What is the change in sales from the prior to the

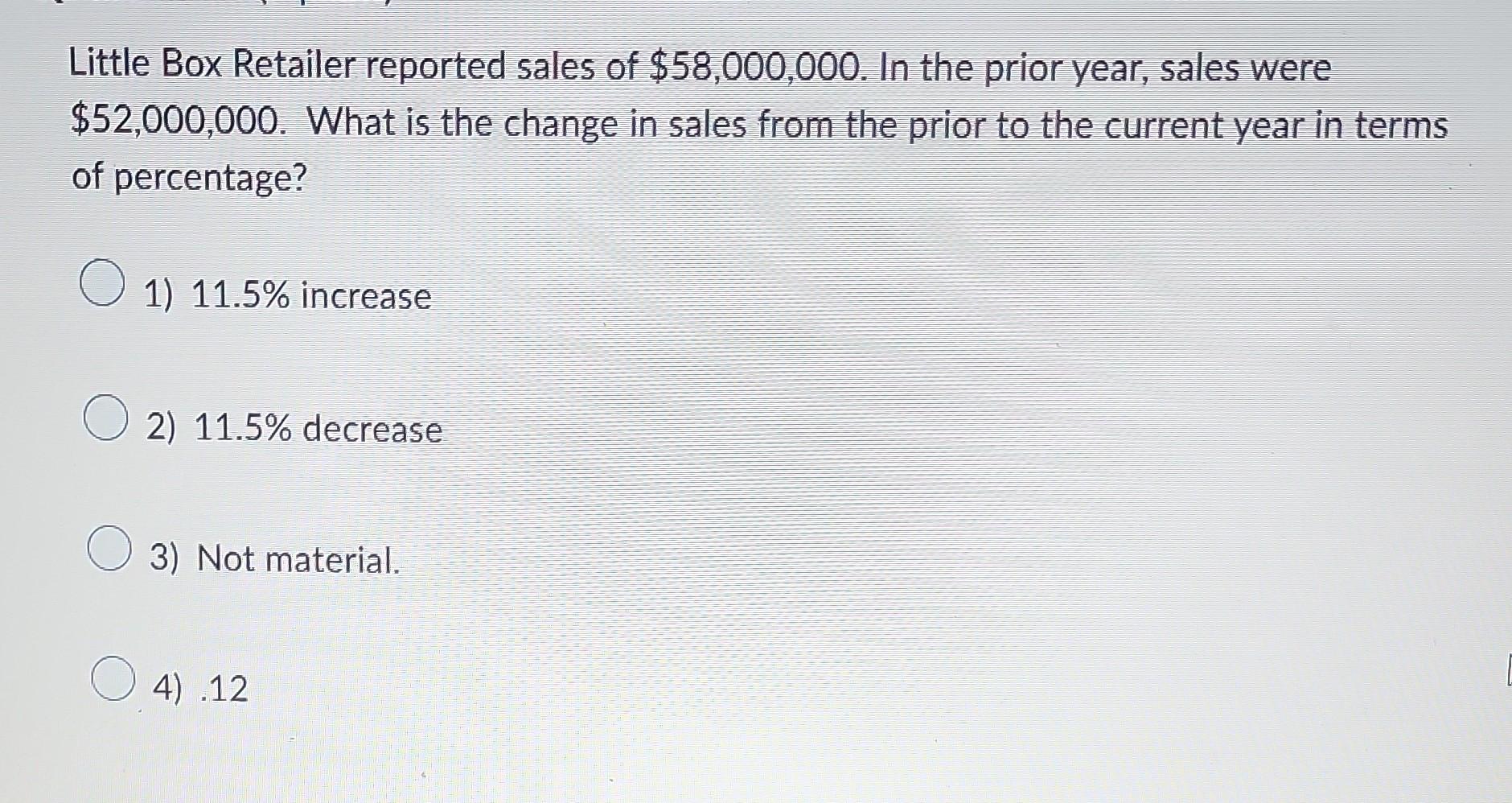

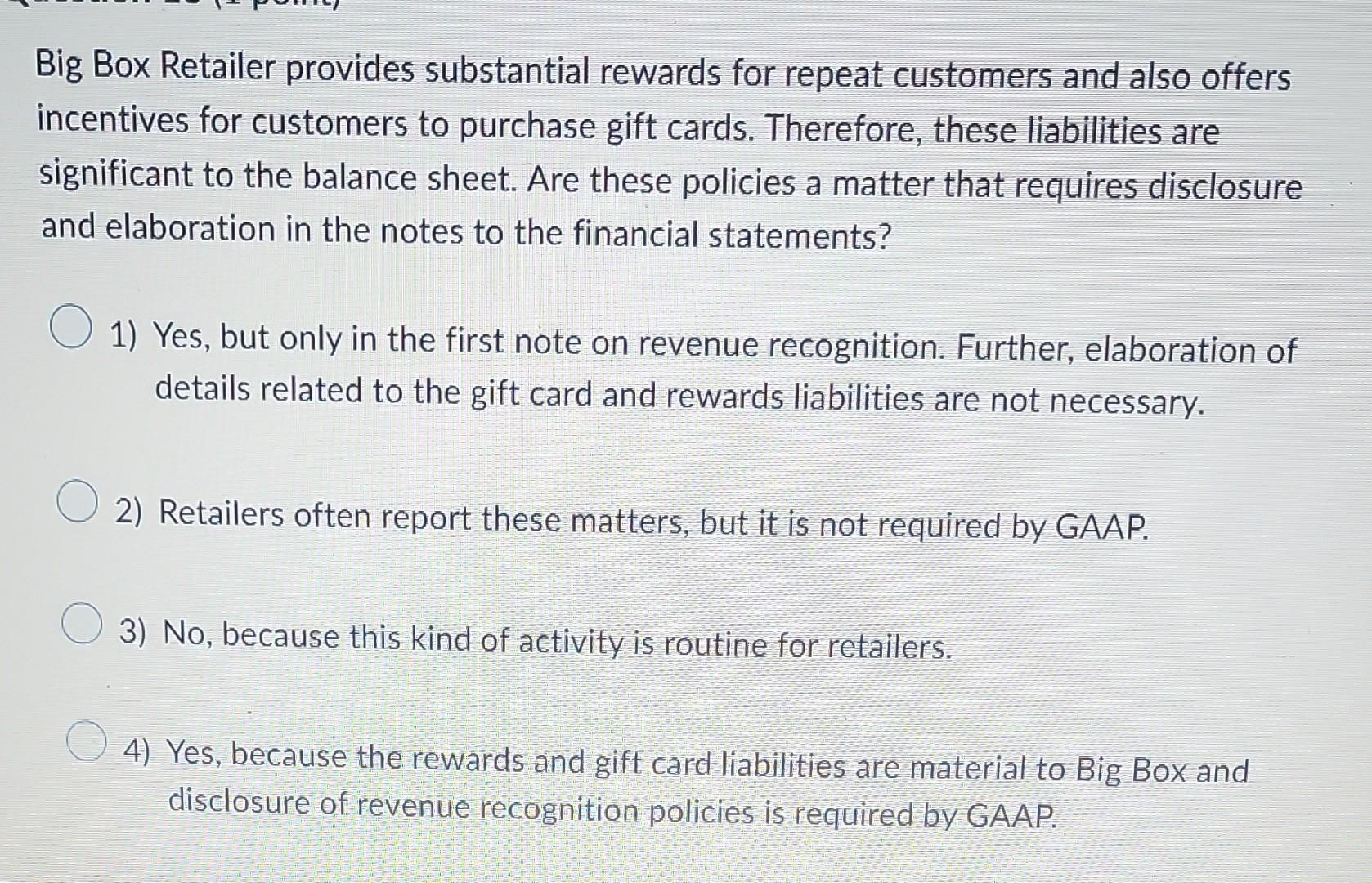

Little Box Retailer reported sales of $58,000,000. In the prior year, sales were $52,000,000. What is the change in sales from the prior to the current year in terms of percentage? 1) 11.5% increase 2) 11.5% decrease 3) Not material. 4) 12 Big Box Retailer provides substantial rewards for repeat customers and also offers incentives for customers to purchase gift cards. Therefore, these liabilities are significant to the balance sheet. Are these policies a matter that requires disclosure and elaboration in the notes to the financial statements? 1) Yes, but only in the first note on revenue recognition. Further, elaboration of details related to the gift card and rewards liabilities are not necessary. 2) Retailers often report these matters, but it is not required by GAAP. 3) No, because this kind of activity is routine for retailers. 4) Yes, because the rewards and gift card liabilities are material to Big Box and disclosure of revenue recognition policies is required by GAAP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started