Answered step by step

Verified Expert Solution

Question

1 Approved Answer

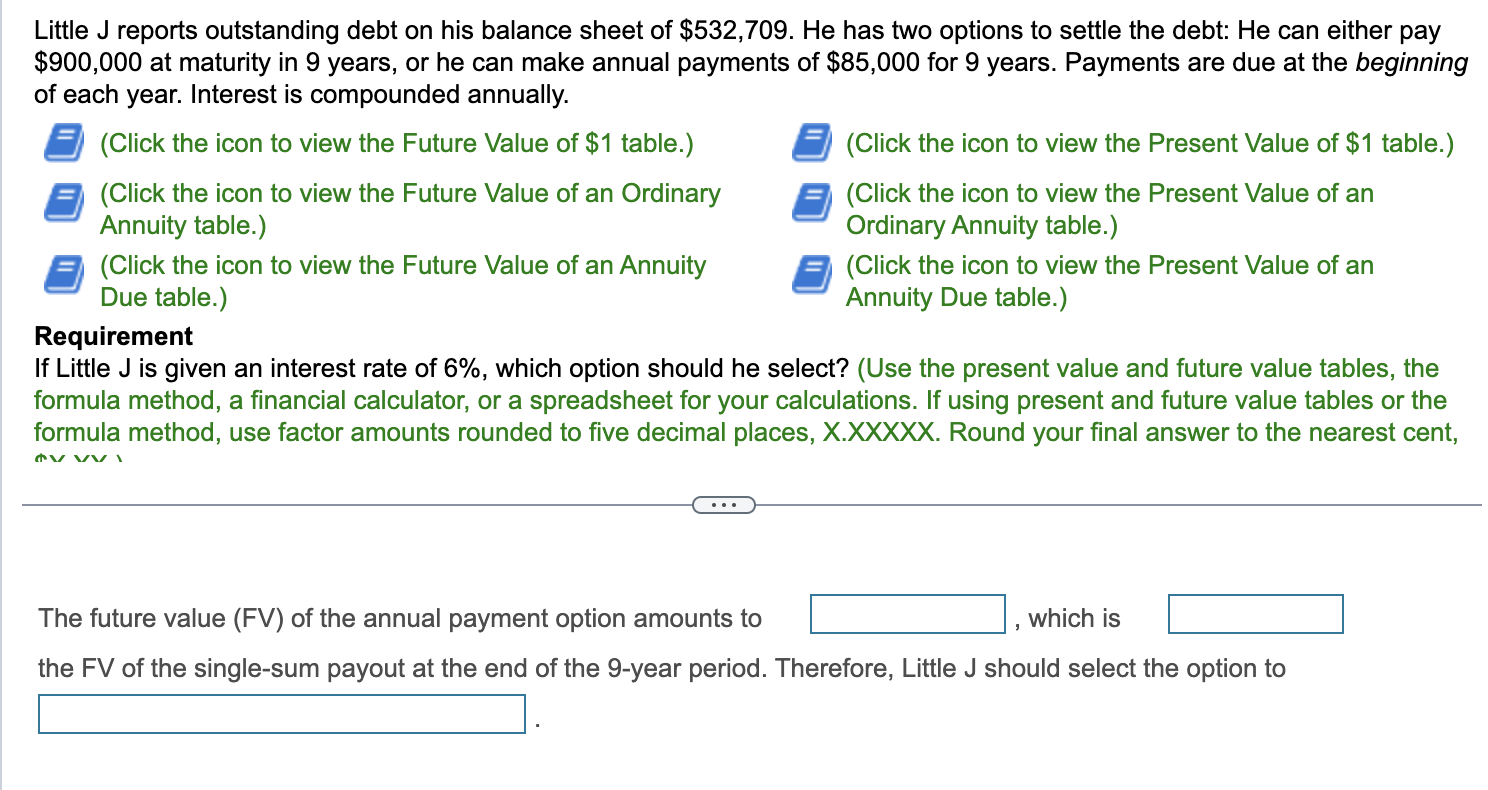

Little J reports outstanding debt on his balance sheet of $ 5 3 2 , 7 0 9 . He has two options to settle

Little J reports outstanding debt on his balance sheet of $ He has two options to settle the debt: He can either pay

$ at maturity in years, or he can make annual payments of $ for years. Payments are due at the beginning

of each year. Interest is compounded annually.

Click the icon to view the Future Value of $ table.Click the icon to view the Present Value of $ table.

Click the icon to view the Future Value of an Ordinary

Click the icon to view the Present Value of an

Annuity table.

Ordinary Annuity table.

Click the icon to view the Future Value of an Annuity

Click the icon to view the Present Value of an

Due table.

Annuity Due table.

Requirement

If Little is given an interest rate of which option should he select? Use the present value and future value tables, the

formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the

formula method, use factor amounts rounded to five decimal places, XXXXXX Round your final answer to the nearest cent,

The future value FV of the annual payment option amounts to

which is

the FV of the singlesum payout at the end of the year period. Therefore, Little should select the option to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started