Answered step by step

Verified Expert Solution

Question

1 Approved Answer

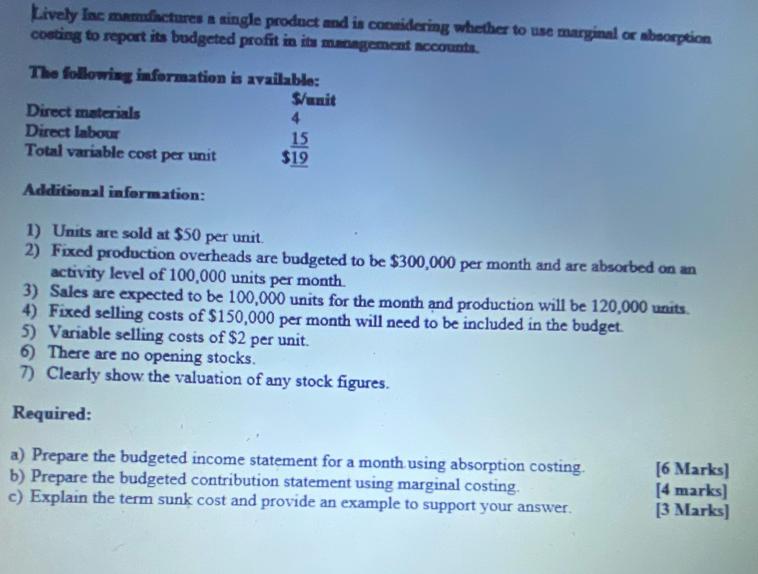

Lively Inc manufactures a single product and is considering whether to use marginal or absorption costing to report its budgeted profit in its management

Lively Inc manufactures a single product and is considering whether to use marginal or absorption costing to report its budgeted profit in its management accounts. The following information is available: S/unit Direct materials 4 Direct labour 15 Total variable cost per unit $19 Additional information: 1) Units are sold at $50 per unit. 2) Fixed production overheads are budgeted to be $300,000 per month and are absorbed on an activity level of 100,000 units per month. 3) Sales are expected to be 100,000 units for the month and production will be 120,000 units. 4) Fixed selling costs of $150,000 per month will need to be included in the budget. 5) Variable selling costs of $2 per unit. 6) There are no opening stocks. 7) Clearly show the valuation of any stock figures. Required: a) Prepare the budgeted income statement for a month using absorption costing. b) Prepare the budgeted contribution statement using marginal costing. c) Explain the term sunk cost and provide an example to support your answer. [6 Marks] [4 marks] [3 Marks]

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Budgeted Income Statement using Absorption Costing Sales Revenue Units sold 100000 Selling price per unit 50 Total Sales Revenue Units sold Selling price per unit Total Sales Revenue 100000 50 50000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started